2011 revenue: $88.3 billion

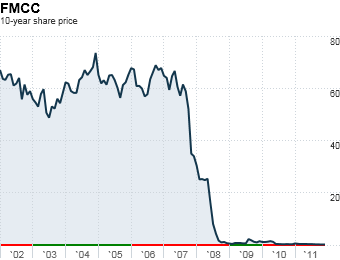

10-year annualized return: -42.7%

A similar story is playing out at Fannie Mae rival Freddie Mac, the McLean, VA-based mortgage giant. Freddie has struggled since 2008, when it saw losses pile up following bust of the housing market. Neither company has shown real signs of a turnaround since the government seized them at the height of the financial crisis.

Early in 2011, Freddie Mac surprised investors when it posted a $676 million first-quarter profit. But the optimism was short-lived, since the company later asked the government for more aid partly to offset dividend payments it is required to pay to the Treasury Department. Freddie ended the year with a $5.3 billion net loss -- its fifth consecutive year of losses.

NEXT: 4. AMR

By Nin-Hai Tseng, writer and Shelley DuBois, writer-reporter

@FortuneMagazine

- Last updated May 07 2012: 10:56 AM ET