Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

Small emerging markets like Nigeria and Egypt have delivered stellar stock market performances this year.

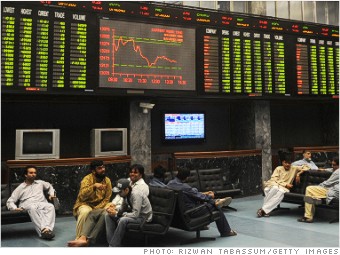

Karachi's benchmark index has soared to historic highs this year on healthy volume, largely due to the State Bank of Pakistan's easing monetary policy.

Through a series of moves, Pakistan's central bank has been able to cut its key interest rate to 10% from 12% at the start of the year, thanks to lower-than-expected inflation figures, said Naveed Vakil, director of research at AKD Securities.

As inflation keeps trending lower, analysts expect that Pakistan's central bank will continue cutting rates and eventually push its benchmark interest rate into the single digits. And that should help spur further gains in the country's stock market.

A jump in consumer spending has also been a big driver of the stock market rally, said Vakil.

Rural income has grown significantly thanks to larger remittances and stable prices for so-called soft commodities, such as cotton. In fact, overseas Pakistani workers sent home a record $1.4 billion in remittances last month, up more than 30% from a year earlier.

The rise in spending has particularly helped companies like Bestway Cement, which benefits from a rise in homebuilding, and Engro Foods Limited, which gets a lift as people spend more money on food.