Search News

We're no longer maintaining this page.

For the latest business news and markets data, please visit CNN Business

Should the Supreme Court strike down the Defense of Marriage Act, which defines marriage as solely between a man and a woman, same-sex couples will see big changes to their finances -- for better and for worse.

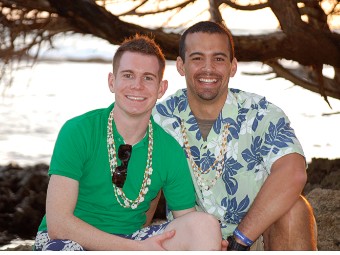

Mikey and Earl got hitched in Connecticut in September 2010. While it was a cause for celebration -- Connecticut was only the third state to legalize gay marriage -- the federal government still doesn't recognize their marriage, leaving them with a slew of extra costs that heterosexual couples don't have to pay.

Mikey, who is self-employed, gets his health benefits through Earl's employer-sponsored insurance plan. But since they aren't married in the eyes of the government, they're required to pay taxes on Mikey's benefits -- amounting to roughly $2,500 a year.

This cost would disappear if the Supreme Court votes to strike down the Defense of Marriage Act, a 1996 law that defines marriage as solely between a man and a woman.

They would also be able to boost their income tax refund by nearly $2,000 by filing jointly.

"I know what our relationship means to us ... so [striking down DOMA is] not as important to me symbolically as it is financially," said Earl.