|

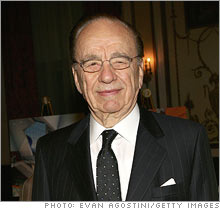

Take my satellite business - please Rupert Murdoch may dump DirecTV for John Malone's stake in News Corp. Why?, asks Fortune's Stephanie Mehta.

(Fortune Magazine) -- When reports surfaced in September that News Corp. was in talks to swap its share of satellite operator DirecTV for Liberty Media's 19% voting stake in News Corp., you could almost hear Rupert Murdoch chortling with delight. Such a deal would rid Murdoch of two big problems: the sagging U.S. satellite business and his sometime friend, sometime rival, Liberty chairman John Malone.

In 2004, cable-TV pioneer Malone surprised Murdoch by gobbling up News Corp. (Charts) shares, prompting the media conglomerate to adopt a poison-pill plan to keep Liberty from encroaching on the Murdoch family stake. Earlier Malone unloaded on Murdoch his stake in a tech company called Gemstar; it turned out to be a dud, and News Corp. had to take a major write-down on its investment. Little wonder Murdoch wants a Malone-ectomy. Murdoch also seems to have fallen out of love with the satellite business, after spending close to a decade trying to buy into DirecTV. (Charts) (News Corp. now owns 38% of the California-based company.) To understand why, just look at the new object of Rupert's affection: the social-networking juggernaut MySpace. Shortly after News Corp. acquired the site last year, Fortune detailed, in "Look Who's Online Now" (Oct. 31, 2005), Murdoch's evolving strategy. The stunning success of MySpace over the past year - it now has some 100 million registered users - is largely thanks to the growth of high-speed connections to the Internet. Users post videos, photos, songs, and other content that is best viewed or listened to via broadband services from cable or phone operators. Satellites are capable of delivering some fast Internet links - HughesNet, a service of Hughes Network Systems, offers a residential service with download speeds of 700 kilobits per second - but that's still only half the speed of a typical broadband cable connection. And users increasingly want superfast connections. Murdoch, associates say, now sees that broadband is the future, and DirecTV simply can't keep up. Indeed, DirecTV doesn't offer broadband itself, but instead points customers to alliances it has with DSL providers. Meanwhile, the pay-television business is about to get even more competitive, as phone companies Verizon (Charts) and AT&T (Charts) try to invade territory the cable and satellite guys once had to themselves. "Rupert has come to the hard conclusion that perhaps he shouldn't hold onto the dream- the dream being DirecTV," says Leo Hindery, a media investor and former Malone lieutenant. If satellite's prospects are so dim, why is Malone buying? (Neither News Corp. nor Liberty would comment on the reports.) Some analysts suggest that Malone is trying to get back into the spotlight; others say he remains a big believer in the sector. Both parties to this transaction are shrewd dealmakers, so it will be interesting to see what happens. But even if Murdoch is wrong about satellites, he'll be happy to have Malone off his back. |

|