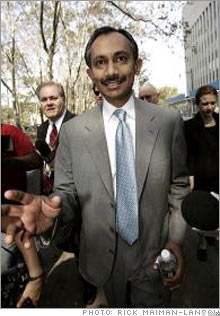

CA: America's most dysfunctional companyTwo years ago Computer Associates admitted $2.2 billion in fraud and recruited a new CEO to save the day. Has it solved its problems? Fortune's Nicholas Varchaver reports.(Fortune Magazine) -- On Nov. 2, Sanjay Kumar walked into a Brooklyn, N.Y., courtroom to receive his punishment for the $2.2 billion accounting fraud and cover-up he orchestrated at the software company formerly known as Computer Associates (Charts). The ex-CEO read a statement that expressed regret - "I take full responsibility for my actions and apologize for my conduct" - with all the remorse of a man reciting a grocery list. The judge then sentenced Kumar to 12 years in federal detention.

A few hours later, just 45 miles away on Long Island, the man hired to clean up the mess left by Kumar, CA chief executive John Swainson, read a script of his own on a conference call to announce the company's quarterly earnings. The news was gloomy, with CA's most cited metric - cash flow from operations -down 98 percent from the equivalent period a year ago. Swainson asserted that cash flow would quickly rebound. "Obviously, you guys are working through a lot of issues here," one analyst asked. "I' m just wondering: Is this next quarter the quarter we're going to see big improvement here?" After a pause, Swainson offered a curt four words: "I certainly hope so." He didn't elaborate. Two years after Swainson joined CA, the longtime IBM (Charts) executive is still struggling to turn around what may have been, simply put, the most dysfunctional big corporation in America. When he arrived, the nearly $4 billion-in-revenues company had barely avoided federal indictment for securities fraud and obstruction of justice - Swainson has called it a "near-death experience" - and had negotiated a deferred prosecution agreement, which essentially put the company on probation. Eight former senior executives, including Kumar, would eventually plead guilty to fraud, obstruction of justice or both. Since then Swainson has embarked on an energetic and comprehensive series of reforms - staking out a commitment to ethics, taking concrete steps to transform a sales culture that treated customers as adversaries and making more than a dozen strategic acquisitions. But for CA, shoddy ethics have been replaced by bumbling execution. While revenues and earnings have inched upward, cash flow - the constant that has sustained the company during its darkest moments and persuaded a coterie of investors to remain shockingly loyal to its stock - is sagging. More to the point, this year CA has endured an embarrassing run of mostly self-inflicted calamities: two accounting restatements, a late 10-K, an earnings miss, a bond downgrade, a fiasco over sales commissions and an exodus of executive talent. Most humiliating of all, in September the company had to admit that two years after agreeing to fix its accounting systems - one of many conditions of its deferred prosecution agreement - its processes are still broken. CA endorsed a 72 month extension for the court-appointed monitor who oversees its probation, which was probably a wise endorsement given that an indictment was a possible alternative. A problematic business One reason it's been so hard to fix CA's internal systems is that the company barely had any. In fact, it turns out that the business-software powerhouse - which has products ranging from database management to storage and security running inside more than 95 percent of the companies in the Fortune 500 - had never really bothered to use business software. We're not kidding. It took the threat of the deferred prosecution agreement to persuade CA to begin installing a major enterprise-software system, which it is buying from another software company, SAP (Charts). This remarkable creation - a $4 billion company run like a 20-person startup - is in large part the legacy of CA's feisty departed co-founder Charles Wang and Kumar, the brilliant charlatan who helped build - and then nearly destroyed - it. Kumar and Wang, who now spends much of his time overseeing his hockey team, the New York Islanders, created a sharp-elbowed, sales-obsessed culture, a company proud of its Long Island heritage. Indeed, Island stalwarts ranging from former Senator Alfonse D'Amato to former New York Stock Exchange chief Dick Grasso figure in the saga of CA as board members. Everyone was there, it seems, but Joey Buttafuoco. That's a lot for Swainson to overcome - and as the setbacks mount, the pressure is building. Despite his good-faith efforts to restore CA's good name, the CEO has lost support from some inside the company for the perquisites he enjoys - new offices, new helicopter pad, generous compensation - even as he asks the rank and file to sacrifice. Viewed individually, CA's challenges appear daunting but solvable. It seems plausible that - eventually, anyway - CA will be able to fix its internal systems. Over a period of years the company may be able to mend its deeply troubled relations with its customers. And it shows some signs of transforming a culture that could be described as - whatever it takes to get my commission - and replacing it with one that values collaboration and customer service. The problem is, these aren't separate issues; they make up the core of how CA has always done business, the DNA of the company. And it raises a critical question for CA and for any CEO who has ever attempted to revive a deeply troubled company: Can you change the very soul of a corporation? And can you do it when the company's business is being squeezed from every direction? The barnacle of corporate America On the mostly empty wall across from John Swainson's desk in CA's Manhattan satellite office is a framed charter. It's the CEO's statement of principles, a manifesto that trumpets virtues such as serving the customer. The charter is covered with signatures from many CA executives (more than a few of whom have already departed). Swainson has even distributed little cards, which can be attached to a key ring, to the company's 15,000 employees. The cards list "core values" such as "innovation," "excellence," "teamwork," and "integrity." "We're in the middle of a cultural transformation," says Swainson, an earnest 52-year-old Canadian. He concedes that, on the earnings conference call a few days before, he probably should have given the analyst a fuller explanation of his reasons for optimism. "It was a bit of an emotional and stressful event.... I should've said, 'Look, I believe in this company. I think it has all the ingredients for success. It has good people. It has good products. And it has an improving set of customer relationships.' That was the original promise that brought me here in the first place. And that continues to be the promise that keeps me here and keeps me believing in it." Swainson candidly admits his stumbles and chalks them up to the enormity of the challenge and the fact that he needed to attack on multiple fronts at the same time. "We were just doing an awful lot of things at once," he says. "And a couple of the balls dropped in the process. And we picked them up and kept running." He acknowledges that at the outset, "I sort of perceived, perhaps a little bit naively, that I would spend a small amount of time cleaning up the problems and a large amount of time focused on growth and strategy. What I didn't anticipate at the time was that we hadn't yet fully done the first part of the job, which is clean up from the past." The CEO says CA is two years into a five-year transformation. To grasp why Swainson thinks he needs five years, consider the old Computer Associates. For all its ubiquity inside the tech departments of corporate America, CA had a horrendous reputation. Where Microsoft (Charts) has long been the most feared software company, the old CA claimed the title of most despised - not by competitors but by its own customers. The reason was baked into its business model. The company has long specialized in unglamorous but highly lucrative software, often for giant mainframe computers. One of CA's signature products, Unicenter, allows IT managers to monitor, diagnose and manage other systems and software. For example, it can detect if a server is about to crash and help an IT person redirect data to stave off the problem. These products made it the barnacle of corporate America: Once you had CA software onboard, it was so onerous and expensive to pull it out that few customers ever did. That led to a lot of steady cash flow - and to arrogance on the part of CA's management. The do-nothing corporate culture CA's acquisition binge - it snapped up some 85 companies in the 80s and 90s - merely compounded the problems. Its method was simple: inhale each new operation, toss much of the acquired staff overboard, and then flip the newly purchased products into "maintenance mode." That's software jargon for abandoning any attempts to invest in or update the products. Incensed customers would find themselves stuck with millions of dollars worth of software that was slowly becoming obsolete. But hey, that was their problem, right? CA was gushing profits, and as far as the company was concerned, the best policy was to ignore the customer. Certain exceptions were made, of course: at contract renewal time, when the hard sell kicked in; or if CA thought the customer was violating the terms of its license, in which case there were threats or even a lawsuit. The man most responsible for this culture was Wang, CA's combative co-founder. A Chinese immigrant who was raised in Queens, he didn't surround himself with Silicon Valley code writers or white-shirted Ivy League middle managers. Rather, his people were salesmen, pure and proud, who embraced their blue-collar roots in Brooklyn, Queens and Long Island, and had the accents to prove it. As Sanjay Kumar told Fortune in 1997, "It helps if you grew up on the wrong side of the tracks." Kumar himself had risen from poverty as a Sri Lankan immigrant in South Carolina. He kept his job when the company he worked for was acquired by CA in 1987 and then enjoyed a meteoric rise that would make him president in 1994, CEO in 2000, and finally chairman and CEO in 2002. But even as the company grew into a multibillion-dollar enterprise with thousands of employees, it remained small in mindset. It was run like a startup - largely out of the brain of Wang and later Kumar. Notoriously frugal in the early years, Wang saw no pressing need to, say, invest in software systems for his own company. Greed and arrogance Success and arrogance, familiar partners, were in ascendance at CA. They were soon joined by an equally familiar third colleague: hubris. Those qualities coalesced memorably in 1998, when word got out that Wang, co-founder Russell Artzt (a quiet programmer type who still works at CA), and Kumar would split $1.1 billion in stock - a figure nearly as great as the company's entire profits for the year. As it happens, one of the members of CA's compensation committee was Grasso, who would later encounter his own legal problems over the $100 million-plus he received at the NYSE. (We'll say this much for Grasso: He was consistent in his philosophical commitment to full pecuniary recognition for top executives.) In an instant, a company that had been little known outside its own industry gained widespread notoriety for outlandish corporate greed. Worse, CA managed to make enemies of what had been a very contented group, its own shareholders. Some filed suit, and the top dogs agreed to return $250 million. Investors weren't worried, though: The company was in the hands of a reformer. At least that's how Sanjay Kumar billed himself. By 2002, Wang had left to focus on running the Islanders (where he's earned an eccentric reputation: Just this summer, he fired the team's general manager six weeks after he hired him and replaced him with the backup goalie). And Kumar, fully in charge, repeatedly proclaimed himself committed to the "gold standard" of governance. Kumar even appeared to be backing up his rhetoric with action. He made CA's revenue-recognition policies dramatically more conservative; announced initiatives to repair customer relations; and in 2002 brought respected independent directors such as former chief SEC accountant Walter Schuetze to CA's board. But Kumar was a liar, of course, and an astonishingly convincing one at that. And for a long time even an astute accountant like Schuetze was hornswoggled. As the director puts it, "Kumar could sell sand to Saddam Hussein." Eventually, though, the dimensions of the $2.2 billion accounting scandal emerged. For at least three years the company had kept its books open after the end of each quarter (the so-called 35-day month) so that it could grab enough revenues from the succeeding quarter to make its numbers and keep its stock price up. Kumar conspired with the CFO, head of sales, general counsel and others not only to backdate hundreds of contracts and alter documents, but to lie about it, first to internal investigators, and then to the SEC and FBI. By the spring of 2004, Kumar had stepped down, and it had become clear that the malfeasance was so grave that CA faced possible indictment. For months, two independent directors - Lewis Ranieri and Schuetze - and the company's lawyer negotiated with federal prosecutors and the SEC. Finally in September 2004 came the deferred prosecution agreement: CA acknowledged that its former executives had committed fraud and obstructed justice and agreed to pay $225 million in restitution to shareholders as well as undertake dozens of corrective actions. The latter included detailed steps to overhaul CA's accounting and financial control systems. In addition, the agreement provided for the appointment of an independent examiner to monitor CA's compliance with the agreement. If CA fulfilled all of its obligations within 18 months, an "information" (the equivalent of an indictment) that had been put on hold would be dismissed permanently. CA had survived. Now the real work could begin. The sheriff and the software guy In selecting John Swainson two years ago, says CA's current chairman, Lewis Ranieri, the board wasn't looking for a celebrity CEO or even a corporate sheriff. "What we needed was a software guy," he says. "We could've hired people who had more glitz, but we wanted substance." Ranieri is the former Salomon Brothers banker and real estate investor made legendary in Michael Lewis's book "Liar's Poker" as the outsized - in every sense of the word - creator of the $6.2 trillion mortgage-backed securities market. Gruff and frank, Ranieri is nobody's idea of a polished diplomat. In his mouth, the word "fiscal" comes out sounding like "physical." He's the sort of character who seems to call for the description "cigar-chomping" even though a stogie is nowhere in evidence during our interview. Ranieri might not have seemed an obvious choice to lead a cleanup. But lead it he did, and there are those who credit him (and Schuetze) with saving CA. Through much of 2004 and into early 2005, Ranieri actually ran CA on a daily basis alongside an interim CEO. The directors had ousted more than a dozen senior executives - "Sometimes I felt like Robespierre, sending a never-ending stream of aristocrats to the guillotine," says Ranieri - and begun hiring replacements, bringing on a new general counsel and CFO before Swainson. As far as Ranieri was concerned, he and his general counsel and compliance team could be the sheriffs while his new CEO could focus on software and strategy. Ranieri got exactly what he was looking for. Swainson is truly a software guy - he can write code. Other than a couple of years as a mining engineer in his native British Columbia, Swainson had spent his entire 26-year career at IBM and had risen to vice president of worldwide sales for its software group at the time he was tapped for the CA job. From where Ranieri sat, Swainson - low-key, bordering on phlegmatic - had just the right qualities: He knew software, he was credible, he was smart and he was honest. But at least one CA executive wondered whether intelligence and decency would be enough. "Who do you get after Richard Nixon?" asks the executive, who has since left CA. "Well, you bring in Jimmy Carter." Would good intentions add up to effective leadership? Big changes at the new CA Swainson's candor was certainly refreshing. At his first meeting with industry analysts, his honesty floored the attendees. "He admitted everything," recalls Steve Duplessie, founder and analyst at the Enterprise Strategy Group, "and took it all right on the chin. And I'd never seen anyone from CA do anything but flagrantly lie to me before." Swainson and his team began moving fast. As part of the deferred prosecution agreement, they made employees attend ethics courses (with consequences for their paychecks if they didn't show up) and created an ethics hotline. Meanwhile, the CEO was soothing customers. He listened to their concerns, renegotiated existing deals with longtime buyers, and reduced prices to win loyalty. Operationally, Swainson was equally busy. He reorganized the company along product lines and began altering the sales organization so that each customer would have a designated CA sales rep - a far cry from the previous geographic organization, which allowed a huge number of salespeople to vie for any piece of business. And he reworked the commission structure to reward behavior that would help customers. Meanwhile, to address yet another pressing need - new products to round out CA's platter of software offerings - Swainson scooped up 16 small companies for a total of $1.6 billion. The deals were widely viewed as smart pickups. And unlike in the past, CA beseeched the acquired companies' staff to stay on and committed itself to supporting their products. As the end of 2005 neared, CA had made impressive progress. Yes, there had been another restatement, but it was one more buried sin from the Kumar era; Swainson couldn't be blamed for that. Signaling that the company's troubles were relegated to history, the CEO also announced that Computer Associates was officially changing its name to CA. In a blog posting to CA employees on Nov. 23, 2005 - a year and a day after his arrival - the CEO called 2005 a "year of progress." Looking toward 2006, he noted that "completing our obligations under the deferred prosecution agreement is an important goal," and added, "Hopefully, we won't have many distractions to contend with." Before concluding with best wishes for a happy Thanksgiving, Swainson told his employees, "It's going to be an exciting year." The helipad and the perks gap Swainson had entered CA on a wave of relief and good feelings. But trying to change a culture, he would learn, is treacherous terrain. Most employees supported him, says Ted Williams, who was a senior vice president in CA's worldwide sales division from summer 2005 until spring 2006, when he left to become CEO of Canadian software-maker Activplant. But not everybody was galvanized. "There were two camps," he says. "One was the new camp, which got a lot of visibility under Mr. Swainson, in that they were very, very devoted to turning the company around and willing to do it at almost any cost with as much energy as it took. And then you had the larger mass of people, who had a culture of - it didn't have that much urgency." Indeed, some veteran employees were irked at what had happened to CA, but preferred to blame the problems on prosecutors, the SEC, or the press. One former executive argues that the old regime's approach - micromanaging and hoarding all the crucial decisions - had fostered what he calls a "culture of corruption." In his view, employees were so used to blindly doing what they were told that some didn't know how to respond when Swainson tried to diffuse power among different levels. In the past you could just call Kumar for a decision. Now there was a whole hierarchy. This change - intended to bring a mature, big-company culture to what had been a free-for-all - met with resistance. What Swainson considered processes, others saw as artery-clogging IBM-style bureaucracy. People groused that you needed 12 layers of approvals to order a ream of paper for the copier. That extended even to introducing new products, says Chris Broderick, a former senior vice president who spent eight years at CA before becoming CEO of CoreStreet, a provider of software solutions for large identity programs, earlier this year: "The period of time it would take to go from idea to innovation to delivery was much shorter [in the past] than it is today." Though he doesn't condone the sins of the previous regime, Broderick asserts that "the leadership at that time was far stronger." Some of this may simply have been a longing for happier times and thus hard to blame on Swainson - but then there was the helicopter. Swainson didn't want to move to Long Island from his Connecticut home. Instead he choppered in once a week in the company helicopter. In September, CA even commandeered an unused part of the employee parking lot to build a new helipad. (Swainson explains that he moved the helipad because CA had previously been in the habit of landing its helicopters on a children's playing field for CA's day-care center, which turns out to be a pretty good example of the old CA's unique combination of executive grandiosity, luxury - and family benefits.) Meanwhile, the company opened a second office in New York City for Swainson and some of the other top executives. As this was happening, CA employees were being hit by three consecutive rounds of layoffs (one of which began before Swainson's tenure) that would end up costing 3,200 people their jobs. And CA was slowly squeezing those workers who kept their posts: It ended 401(k) bonus payments it had traditionally paid and leaned on employees for larger contributions to their health insurance. CA killed its free breakfasts for staff and put the kibosh on the free towel service in the company gym; it even canceled the Rolexes that employees had always received on their 10th anniversary at the company. Many of these, it is true, were not critical benefits. But the contrast between the treatment of average employees and top executives and board members (who voted themselves a $25,000 pay increase in 2005) was jarring. The perks gap darkened the mood inside CA. One employee even screwed up the courage to raise the issue in a message posted on Swainson's internal blog this past spring: "How does it contribute to employee morale to address the bad numbers caused by what you acknowledge to be upper-management errors by doing away with the discretionary 401(k) contribution while the upper managers who made these boo-boos continue to receive bonuses and other bennies of that sort? I can assure you that where I worked it has not been well received." Perhaps not, but CA's board is unmoved. "I think Swainson should be in the helicopter," says CA director Schuetze. "I want him spending his time looking after CA. I don't want him in a traffic jam on the Long Island Expressway." Another self-inflicted wound A lot of things have gone wrong for CA in 2006, but if there is one example that embodies the company's travails, it is the debacle over sales commissions. Because Swainson had reorganized the sales staff to improve customer relations, it was necessary to adjust the commissions. So the CEO assigned his top sales executive to redesign the plan. Two problems quickly emerged, says former CA executive Williams, who was brought in to try to keep the plan from spinning out of control. First, he says, "the actual commissions plan - the documen - was very, very confusing, almost impossible to interpret." Worse, perhaps, was the second impediment: implementing it on CA's sclerotic internal computer systems. CA, Williams says, had a brigade of 15 spreadsheet jockeys in the finance department who were assigned the unenviable task of individually calculating each commission for the company's 4,000 salespeople. As Williams puts it, "A lot of the internal systems were internally developed and had not been updated, had not been integrated together. So it was a very much a spaghetti code of an application. And no one could believe any of the data." The 15 finance staffers had to "verify the data that no one believed and then ultimately to certify it and put it back into the system." Somehow the finance team had managed to keep things together under the old commission system. But adding the complex new plan and combining that with the logistical hassle of adjusting for the commissions earned by sales staff at the companies newly acquired by CA was more than they could handle. Finally, this spring, CA realized quarterly commissions costs would be $75 million larger than expected. That was enough to make CA miss its earnings estimate for the quarter ending March 31. The reaction inside CA's finance department, it appears, was panic. Word leaked that the company was considering paying salespeople only 40 cents on the dollar for their commissions during the quarter. The result, says Williams, "was like a revolution in the field." CA's lawyers then weighed in and concluded that paying only a portion would be illegal in most jurisdictions. (Swainson says the company also didn't want to alienate its best salespeople.) So CA distributed full commissions for the salespeople, while sales managers got only 50 cents on the dollar. Soon after the commission disaster, CA's head of sales and its CFO departed. For Swainson, the mess was an educational experience. "One of the learnings that I had," he says, "was that you can't simply stand on top of the mountain and say, 'Fix anything.' You have to be very much involved in the process... When you come out of any organization that's working well, whether it's IBM or GE or wherever, when the CEO says something it happens, because the systems all work. And in a company that's going through a crisis, the systems don't all work. So you can't just stand on top of the mountain and issue pronouncements." He calls the commission plan "a good idea that wasn't properly implemented... And it bit us in the ass and it bit us hard. We didn't, in retrospect, understand what it was going to do. And when it did it, we didn't have any way of mediating. It's a good example of what happens when your IT systems really can't support your business processes." More 'ghosts of Christmas past' In theory, such a disaster can't happen again. The company has simplified the commission plan. And as part of its agreement with the government, CA is in the midst of a multiyear installation of so-called enterprise resource planning software (the product it's buying from SAP). The ERP software should provide the backbone for all of CA's internal systems, feeding data for everything from forecasting to commissions to the company's SEC reports. The commissions meltdown forced CA into yet another re-statement, and it forced the company to disclose a "material weakness" in its internal controls. As Swainson conceded in his blog in early June, "We don't have good communications inside the business to make sure that insights in one department are shared with others quickly, so that action can be taken before it's too late." Swainson continued, "We cannot afford any more self-inflicted wounds." Meanwhile, CA came across another "ghost of Christmas past," as Ranieri puts it. Like countless software companies, it had backdated stock options in the late 90s. Once again CA had trouble gathering and processing its own information. The result: CA had to release its annual 10-K report late. Inside CA, stomachs were churning. "I am very aware of the rumors and concerns that employees have about the future of the company," Swainson blogged on July 14. "Let me state strongly and clearly that CA is not for sale." Swainson acknowledged that more layoffs were likely and concluded by telling employees that "we are moving fast to fix problems when we find them." But CA kept taking a pounding. In July, S&P announced that it was reducing CA's bonds to junk because the company was planning to borrow $1 billion to fund a share buyback. August brought still more gloomy tidings. This time it was the quarterly earnings announcement. Cash flow from operations, CA's preferred metric, came in at negative $46 million. It was the first time in at least seven years, says Bear Stearns analyst John Di Fucci, that the quarterly figure had turned red. That same month, Swainson sat down with his senior leadership team. "I told them that I didn't need anyone on the [team] who was not as committed as I was to the multiyear journey we were on," Swainson reported on his blog. "I told them to go home and think about it, and if they could not in good conscience make the commitment, that they should leave." Sure enough, as summer turned into fall, the executive exodus intensified. By early November only a handful of the group that Swainson had hailed the year before as a "world-class management team" remained at CA. Cash cow no longer? Two years into Swainson's tenure, CA still hasn't finished cleaning up the old mess. And there's certainly no guarantee that the company will have solved its accounting problems by May, when the court-appointed monitor's term is scheduled to end. But the bigger issues for CA have nothing to do with prosecutors and regulators: It's the clients, stupid. Interviews with CA customers suggest that Swainson's charm offensive has improved relations a bit. However, the company is digging out from a very deep hole. "There's been no measurable change in satisfaction" among CA software users, says Richard Sneider of consultancy InterUnity, which tracks customer opinions. As Gartner analyst Donna Scott puts it, "I think this whole image perception is going to take years to get by." The fundamental outlook for CA's business, meanwhile, is equally unclear. The company still derives more than half its revenue from mainframe software. And despite endless predictions of its demise, the mainframe soldiers on. But mainframe revenues for CA contracted 1 percent last year, and nobody expects any significant growth there. That means that CA has to find all its growth from less than half its business. The bullish case for CA rests precisely on the notion of holding mainframe revenues steady while finding many small growth opportunities in areas such as security. Moreover, the stock's proponents note that there is a lag in the positive effect of CA's acquisitions because of the unusual - but conservative - way in which CA recognizes revenue. (CA typically leases software, with payments spread on average over three years. Most companies, including the ones CA acquired, recognize the entire value of the contract at the beginning. CA spreads it over the length of the contract. So the full impact of the acquired companies won't be felt until they've been inside CA for three years.) Revenues and earnings have been rising steadily under Swainson, including during the most recent quarter. But that figure, as discussed, reflects money generated over the past three years. Cash flow, the most current indicator - the one that gets a boost when the company lands new accounts and falls when it doesn't - is headed in the opposite direction. That could raise a red flag among CA's big stockholders. "As value investors, we love the cash cow aspect of CA," says Manoj Tandon, portfolio manager for Pzena Investment Management, one of CA's five largest shareholders. Indeed, the company has churned out $1 billion or more in annual operating cash flow for nine straight years - a streak that kept key institutional investors loyal through some terrible times. (If you'd invested $10,000 in CA's stock nine years ago, you'd have $4,419 today.) But that billion-dollar streak appears to be on the verge of ending. On the earnings conference call in early November, Swainson gave a lowered forecast of between $900 million and $1 billion in cash flow for its current fiscal year, down 27 to 35 percent from his previous estimate. Bear Stearns's DiFucci headlined his note the next day ANOTHER DISMAL QUARTER, and the stock fell 9 percent (all told, under Swainson, the shares have swooned by 17 percent). Currently, not one of the 17 analysts who cover the stock rate it a buy. And patience is indeed running very low among certain big investors. As a portfolio manager for another of CA's largest shareholders says of Swainson, "You've been here for two years and the time's up for making excuses." For now, CA's directors remain solidly behind its CEO and say they recognize how much progress he has made in unusually difficult circumstances. "I think John Swainson is doing a very good job," says director Schuetze. That sentiment is not likely to endure, however, if CA continues to stumble. Of course, there could be an exit plan that would serve everybody. Swainson denies that CA is for sale, but an underperforming company with a billion in cash flow sounds like precisely the sort of target that would entice one or more private-equity funds on the prowl for a place to invest their bulging war chests. And even two years past the worst of its scandals, CA could use a dose of barbarian-style discipline. Reporter associates Susan Kaufman and Doris Burke __________________ From the November 27, 2006 issue

|

|