(Fortune Magazine) -- As his plane smacked down belly-first into Bowline Pond and began to sink, Ilan Reich was oddly calm. Then 50, he didn't see flashes of glowing light or fast-forward through the highs and lows of his life. He had been in bad spots before, terrible spots, in fact, and he'd always managed - through what he terms his "maniacal pursuit of the unattainable" - to pull out of them. At first, on that hazy June day in 2005, it seemed he'd done it this time too, when he pulled his plane's parachute and maneuvered the aircraft out of the way of a group of fuel tanks and into the Haverstraw, N.Y., inlet. But now, as the water seeped into the cockpit of his Cirrus SR22, it was hard to see how all that effort was going to do him much good.

"So this is how it ends," he said aloud. It was, it seemed, a sad but fittingly dramatic end to an equally dramatic life.

|

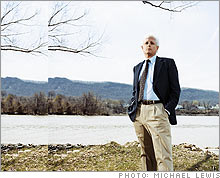

| Reich beside the Hudson River inlet where he crashed his plane in 2005. |

|

| Reich's self-imposed rehibilitation included hitting thousands of golf balls. |

And then the plane came back up.

The door was jammed, but Reich, an experienced pilot, grabbed a life jacket and a hammer and bashed a hole in the side window large enough to force his body through. Although he had fractured his spine and cut his hands on the shards of glass, he eased himself onto the wing and then began to swim toward shore, untangling his leg from the plane's parachute lines just before it sank - for good this time - in 30 feet of water.

So this wasn't going to be how it ended. Or was it? Reich was rushed to Nyack Hospital, where he submitted to a series of X-rays. "The ER doctor comes in and says, 'There's the crack in your back. It's no big deal - we'll give you a brace,'" Reich remembers. "And he comes back a second later and says, 'Oh, by the way, did you know you have a brain tumor?'"

'Death of a career'

Ilan was a remarkable lawyer. He will no longer be able to practice his profession. For Ilan, disbarment is a profound and devastating punishment. Even if there is a possibility of reinstatement after a period of years, the disbarment is lifelong in effect because his legal career is destroyed. Many of his former partners shun him and probably always will. For him, the punishment is capital in nature. -Letter from Lawrence Lederman, partner at Wachtell Lipton Rosen & Katz, to Judge Robert Sweet, Dec. 15, 1986, pleading for leniency in the sentencing of Ilan Reich (pronounced "ee-lon ry-sh").

The last time Ilan Reich almost died, it was a metaphorical passing. A 1986 cover story on him in The American Lawyer was titled "Death of a Career," but it was really much more than that; it was the very painful and equally public crumbling of an identity. One moment Reich was a brilliant young partner at one of Wall Street's most elite M&A law firms and the doting father of two (soon to be three) boys. The next moment his multiple dimensions flattened to just one: criminal. On Oct. 9, 1986, Reich pleaded guilty to securities and mail fraud for tipping Drexel Burnham Lambert banker Dennis Levine off to several deals that Wachtell was working on.

Had his story ended there, he would have been little more than the answer to a trivia question, a cautionary tale about a 25-year-old lawyer who lost himself in the huge insider-trading ring that ultimately ensnared Michael Milken and Ivan Boesky and cast a decade-long shadow over Wall Street.

But Reich's story is much more complicated than that. Driven by insecurity more than greed, he never collected any of the illegal profits he'd "earned." He publicly admitted guilt, went to jail and launched a seemingly quixotic quest to rehabilitate himself by being reinstated to the bar and - ultimately - running a public company.

"I wanted to get back what I had," he says, repeating a phrase he uses several times in our interviews. Reich did, indeed, get it back. But years later, in the course of a few seconds at the controls of a plane, he lost it again. He'd have to use all of his survival skills to face a different kind of rehabilitation - recovery from complex brain surgery and partial paralysis.

Thin and hyperkinetic, with large, deep-set eyes and a corona of hair that began to turn white in college, Reich projected competence and confidence from his first days at Wachtell. A Stone Scholar and member of the Law Review at Columbia, he impressed everyone around him with his creative solutions to knotty legal problems, his intense work ethic and his seemingly solid moral code.

But Reich had demons. The second of three children raised in an upstanding Orthodox Jewish family in Midwood, Brooklyn, he had always felt inadequate beside his 17-month-older brother, Yaron, who preceded him at the same high school, college, and law school. Ilan had rejected his family's faith and had a difficult relationship with his parents. He had never made friends easily, had trouble communicating with his wife, and was perceived by many of the Wachtell partners as arrogant.

So when Dennis Levine, then a young banker at Smith Barney, spotted him across the room in a deal meeting and invited him to lunch, Reich believed he'd found a new friend. He hadn't. Levine wanted a blabbermouth, not a buddy, and he told him about a virtually risk-free scheme that could net both of them millions if Reich gave him the heads-up on pending deals.

Reich knew in every cell of his body that it was wrong, wrong, wrong. But for reasons he still struggles to explain, he did it anyway. "In my arrogant and naive way," he says, "I didn't appreciate that (a) there were con artists and (b) my own arrogance was going to be a source of tremendous downfall." He tipped Levine on one deal, then another, and another, leaking a total of 12 in just over two years, before he decided to stop in late 1982.

But he stayed friendly with Levine - who had cultivated several other sources at other firms and banks - and in April 1984, when his interpersonal issues had made partnership less than certain and the survival of his marriage equally so, he started again, tipping Levine on deals involving companies like G.D. Searle.

In August 1984 - just three months before he learned that he was in fact going to make partner at Wachtell - Reich again backed out of the scheme, telling Levine to "go f*ck himself." He never collected one cent of the $300,000 that Levine said he had set aside in a secret account and in fact never asked for or received proof that the money was even there, which helped assuage his guilt.

When Levine was arrested on May 12, 1986 (and began naming names, including titans like Ivan Boesky as well as young behind-the-scenes types like Reich), the young attorney denied everything, certain that his actions were untraceable. But in July, when the lawyers at his firm ushered him into a conference room and hammered away at him, it was clear that he was caught.

Convulsing with sobs, he confessed and begged forgiveness. Afraid Reich might kill himself, his lawyer Robert Morvillo asked that someone stay with him that night. "His life was clearly passing in front of his eyes," Morvillo says. "It was one of the really low, low spots I've ever seen a client in to this day."

In October 1986, Reich pleaded guilty to one count each of securities and mail fraud and paid a fine of $485,000, leaving his family nearly broke. He was disbarred. "I am saddened by the pain that my acts have caused to my family and friends," he said at his Jan. 23, 1987, sentencing hearing. "I am ashamed for having betrayed the trust placed in me by my former colleagues and clients. I feel shattered every time I think about these things...."

Despite the letters of support, Judge Robert Sweet sentenced him to jail for a year and a day as Reich's pregnant wife looked on (his third son was born four days later). "However, in imposing this sentence," the judge wrote, "I want to make it clear that if ever reinstatement to the bar is appropriate ... this is such a case."

Sweet had tossed Reich a tiny grain of hope. It was enough to make him believe he might one day be able to redeem himself.