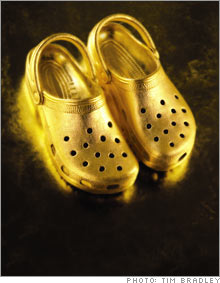

Can small caps still shine?Small stocks such as cobbler Crocs are doing great this year, but is the party soon to end? Top pros offer a surprising answer.(FSB Magazine) -- Big-cap stocks are on the move. Headlines declare the resurgence. Money managers queue up to buy. Most market indicators suggest the big beast's hour has returned at last: In the final three quarters of 2006, the big-cap Standard & Poor's 500 index beat the small-cap Russell 2000 index by about seven percentage points, 11.12 percent vs. 3.95 percent. Persuasive, to be sure. But don't count out small caps just yet. Journalists (FSB included), money managers and market tea leaves have called the end of small-cap market leadership several times before, and they (we) have been wrong. With that in mind, here are some smart ways to play these stocks. First, recognize that the game in small-cap stocks has changed. At the start of the small-cap run, back in 2001, the entire sector represented an amazing bargain. Shares of companies in the Russell 2000 sold at an average price-to-sales multiple that was 60 percent below the multiple on big caps - that's twice the normal discount, according to the Small Cap Research department at Merrill Lynch (ml.com). Today those attractive discounts are all but gone, whether the measure is sales, book value, cash flow or earnings. That means it's probably time to rebalance your portfolio and shift some of your gains in small stocks to the big-cap sector. John McCraw, managing director of Nicholas Applegate U.S. Micro Cap (nacm.com), a small-cap fund based in San Diego that has handily beaten both the market and its Morningstar fund category over the past three years, even embraces this logic. "I've recently shifted some of my personal money into large caps," he says. But McCraw isn't abandoning small caps, personally or professionally, nor should you. Small caps may be performance stars of recent years, but they are not dangerously overvalued relative to big caps: On a price-to-sales basis, for example, the Russell 2000 sells 27 percent below the S&P 500, close to the historical average discount of 33 percent. There's another reason small caps may keep sizzling: Big-cap stocks may disappoint on profits. Notes Satya Pradhuman, chief small-cap strategist at Merrill Lynch: "The earnings growth estimates for the biggest companies are now in double-digit territory - 12 percent as of early January for the 50 biggest-cap stocks in the S&P 500 index. But these estimates are way too high," given the size of these companies, their lack of new investment opportunities (evidenced by bulging cash balances and major stock buybacks), and low bond yields (suggesting mild inflation and tame economic growth ahead). Pradhuman thinks that as big-cap growth rates ease, attention will return to zippy small caps. Among Merrill's favorite stock groups: business staffing companies, such as AMN Healthcare Services (Charts) (amnhealthcare.com) of San Diego, which are cashing in on the demand for temporary help as businesses seek to contain labor costs. A good place to find value today is in small-cap growth stocks, which look like a bargain. Within the Russell 2000 index, those stocks with the best growth rates and the highest price-to-book value typically sell at a huge premium over value stocks. Over the past ten years the Russell 2000 growth-stock P/E has lofted 22 points higher on average than the P/E on value stocks. At the end of 2006, however, the P/E on growth stocks was just eight points above the value P/E. One reason for this anomaly is the bursting of the technology stock bubble in 2001, which made investors more cautious. "They've pretty much shied away from growth stocks ever since," says McCraw. Now, he says, even value managers are buying growth stocks because they're so cheap. One of McCraw's favorites is Crocs (Charts) (crocs.com) , the Boulder footwear maker that has been tearing up the tracks, growing earnings at an 85 percent or better annual rate over the past few quarters, as demand for its colorful resin shoes continues to explode. While that growth will surely slow, McCraw believes that Crocs can attain a 45 percent boost in earnings over the next year. "This company has hit it right. It has a fashionable product that fits the correct price point," he says. While any fashion trend can fade, Crocs is expanding into new demographic groups (toddlers, for example) as well as internationally. Mutual funds offer a diversified - and thus safer - play on the small-cap promise. But with more tepid gains likely in the years ahead, it pays to keep fund expenses to a minimum. Vanguard offers two low-cost ways to invest in this slice of the market: the Vanguard (vanguard.com) Small-Cap Growth Index (Charts) fund, which tracks the broad MSCI Small Cap Growth index and sports a miserly 0.23 percent expense ratio, compared with an average of 1.56 percent for all small-cap mutual funds. Or consider the Vanguard Small-Cap Growth ETF (Charts) (exchange-traded fund), which sports a microscopic expense ratio of 0.12 percent and tracks the same MSCI index. ETFs offer tax advantages over index funds - you don't receive any taxable gains until you sell - but you will pay a trading commission coming and going. Some savvy investors now feel it's also a good time to be looking beyond U.S. borders, especially given the improving prospects for developing economies. Franklin Templeton (franklintempleton.com) just launched a new fund - the only one of its kind that's actively managed - that will focus on small companies in emerging economies across Africa, Asia and Latin America, where many consumers are achieving middle-class lifestyles and governments are finally getting serious about infrastructure improvements. The fund, Templeton Emerging Markets Small Cap (it hasn't yet reached the $25 million in assets needed to be assigned a ticker symbol), is sold with a sales charge, so it is intended for investors who buy through financial advisors. It carries a high 2.3 percent expense ratio, common for its category. While Templeton's portfolio of stocks may sound like a double dose of dicey fare, it may actually represent good value. Until recently the smaller stocks in emerging markets were left largely untouched - and undervalued - by international investors because the trading volume was too low and the companies lacked proper corporate governance. That's been changing recently, notes Mark Mobius, the global investment veteran who will be leading the fund's management team: "There are [now] more countries where we can invest in companies, all types of companies," he says. Mobius is also looking to take advantage of some pretty steep discounts: The P/E on the small-cap stocks in emerging markets is about half the P/E on U.S. small caps. That leaves a lot of upside. Please send feedback or column ideas to: fsb_mail@timeinc.com Are you an entrepreneur who started your own company and now has a parent (or two) working for you? For a future article in Fortune, we'd like to hear from you! Please e-mail (afisher@fortunemail.com) and tell us about your situation - what kind of company you have, how your mom or dad came to be your employee and how we can contact you for more information (phone or e-mail) during business hours. Many thanks! ___________________ Small stock focus: It looks like bon temps for Bon-Ton Small stock focus: Benihana stock sizzles |

Sponsors

|