|

Netscape has growing pains

|

|

January 5, 1998: 4:48 p.m. ET

Internet software firm to report first quarterly loss since initial public offer

|

NEW YORK (CNNfn) - Netscape Communications Corp., which is currently in the midst of a bruising browser war with Microsoft Corp., shocked Wall Street Monday by projecting its first quarterly loss since going public in 1995.

Netscape, best-known for its Navigator and Communicator Web browsing software, also said it plans to lay off an undetermined number of its employees -- a first in the 3-year-old company's history -- and take a $35 million restructuring charge.

The loss underscores Netscape's problems stemming from its year-long transition from a software product company into an Internet solution services provider -- a problem that many growth-oriented technology companies have experienced.

In a statement, the Mountain View, Calif.-based company said it will report a net loss for the fourth quarter of 1997 in the range of $85 million to $89 million, or 88 to 92 cents a share. Since its initial public offer, Netscape has never missed Wall Street's profit estimates, which were 14 cents a share for the latest quarter.

Netscape (NSCP) stock tumbled 4-13/16 or 20 percent, to 18-9/16 in Nasdaq trading of 13.8 million shares, making it the second-most active issue on U.S. markets and one of the biggest percentage losers on Nasdaq. Earlier, the stock traded at an all-time low of 17-3/4.

Industry analysts said Netscape's battle with Microsoft has clearly taken its toll.

"Microsoft giving away its browser is a huge, huge problem, one that is extremely difficult for Netscape to overcome," said Bruce Smith, analyst at Merrill Lynch & Co. Inc. "I think the stock is overvalued, even at these prices."

Revenue from the enterprise business (which includes servicing revenue such as subscription, support and consulting) has dropped in part because of competitive pricing pressure but also because it now takes longer for its sales force to book a sale, said Peter Currie, chief financial officer.

As opposed to individuals, Netscape's client-base now principally consists of small- to mid-sized corporations. "Longer sales cycles were what caused the shortfall," Currie told analysts on a conference call.

Solutions services revenue fell to $91 million in the latest quarter from $95 million in the third quarter. Revenue totaled $54 million in the 1996 fourth quarter.

"Over the last nine to 12 months, they've been growing into an enterprise software company. Today, we're seeing some growing pains," said Jamie Kiggen, analyst at Cowen & Co. "They are going to grow their top line but there is low visibility as to how rapidly they are going to grow it," Kiggen said.

Although Netscape retains over 60 percent of the browser market, revenue plunged to $17 million in the 1997 fourth quarter from $52 million a year earlier.

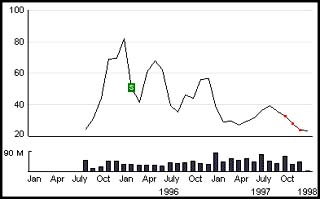

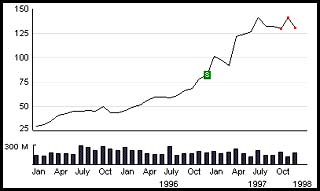

Since going public in 1995, Netscape has faced a withering assault from Microsoft, pushing its stock price lower. Meanwhile, Microsoft's stock price has continued to climb.

Netscape's stock price since going public

Microsoft's price over the same period

Analysts said Netscape is losing sales directly because of the shrinking popularity of its browsers, which cost about $50 for a single copy. Microsoft is snagging potential customers because it gives its browsers away.

Browsers, the key tool for viewing information stored on computer networks, leads to sales of higher-margin, higher-priced software products.

Netscape's decision to make its browser free in response is "imminent," said David Smith, vice president of Internet strategy at Gartner Group Inc., a technology consulting firm.

"In the long term, Netscape's businesses are highly reliant on the company maintaining a majority of the browser market share," Smith said.

According to market researcher Dataquest Inc., Netscape's browser market share fell in the third quarter to 57.6 percent, its lowest point ever, while Microsoft's rose to 39.4 percent in the same period.

"This is a material shortfall. It's a sign of some structural problems at Netscape," said David Readerman, analyst at NationsBank Montgomery Securities.

Netscape said it plans to take steps to immediately address its financial issues including closing certain facilities, outsourcing and eliminating some administrative costs. The company will take a restructuring charge of $35 million and approximately $52 million in merger-related charges to absorb its the purchases of Actra Corp. and Kiva Software.

Excluding the charges, the net loss for the period is expected to be in the range of $14 million to $18 million, or 15 to 19 cents a share, based on a preliminary analysis of its operating results. Revenue is expected to range from $125 million to $130 million, representing growth of about 9 percent to 13 percent. The company reported revenue of $115 million in the fourth quarter of 1996.

For the year, Netscape expects to report a net loss in the range of $113 million to $117 million, or $1.20 to $1.24 per share, including approximately $105 million of merger-related charges and $35 million of restructuring costs.

The company also estimated revenue will grow 54 percent to 56 percent to $534 million to $539 million, from $346 million in 1996.

Excluding the non-recurring charges, 1997 net income is expected to be in the range of $7 million to $10 million, or 8 to 11 cents a share.

The company expects to report its actual results Jan. 27.

-- from staff writer Robert Liu and wire reports.

|

|

|

|

|

|

|