|

Gullible investors targeted

|

|

March 11, 1998: 5:16 p.m. ET

Beware of brokers with big promises who pressure you to buy stocks

|

NEW YORK (CNNfn) - Your phone rings, and a fast-talking broker promises you stocks with guaranteed returns that will make you rich.

"Warren Buffett has recommended it …You'd be a fool to pass up the chance…You'll make your money back in 90 days…"

But all you're really buying is the latest investing scam -- and you risk losing big if you fall for it, securities officials warn.

"Some of these cases are really sad," said Barry Goldsmith, executive vice president for enforcement at the National Association of Securities Dealers (NASD). "There are people who have literally lost their life savings."

The Securities and Exchange Commission gets about 20,000 investor complaints a year about everything from unauthorized trades to inflated stock prices, said Nancy Smith, director of investor education at the agency.

And what concerns Smith is the sharp increase in complaints about broker "cold-calling." The number rose from 265 in 1995 to 422 in 1997, a 60 percent hike.

"Whenever you get that dramatic of an increase, it bears watching," Smith said. "It's always hard to measure the amount of fraud in the market. A lot of investors don't complain."

The SEC has issued a number of investor alerts about cold-calling and other practices.

Investment fraud is nothing new. Penny stock fraud in the 1980s led to a string of reforms. But the bull market of the 1990s has triggered new scams that are fooling even financially sophisticated professionals like doctors and lawyers, Goldsmith said.

"It's an atmosphere that enables fraudsters to take advantage of investors," Goldsmith said.

Disreputable brokers most commonly sell "microcap" stocks, which are shares of the smallest public companies that trade on the over-the-counter (OTC) market, Goldsmith said. The OTC market has fewer disclosure requirements for companies than the Nasdaq and the New York Stock Exchange.

An initial public offering of a small company presents a good opportunity for an unethical broker, Goldsmith said.

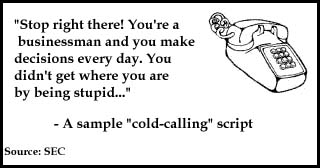

Cold-calling, a legitimate sales method used in business to find new customers, is the most common way dishonest brokers operate, Smith said. Since the sale is over the phone, it's harder to prove fraud or unethical tactics. Brokers often work from prepared scripts.

Added Goldsmith, "It's always harder to prove what somebody said when it's one person against another."

One common phone scam is the "pump and dump." Sellers will recommend a stock that their company owns, sometimes called a "house stock," according to the SEC. After they "pump" up the stock, they'll "dump" their shares at a higher price.

Another method, called "bait and switch," is when a broker offers a well-known stock to lure you in. Then the "switch:" he'll try to sell you risky stock in an unknown company.

In the "three call" technique, brokers will phone you three times: once with background information to earn your trust; a second time to tell you about a big deal that "might" happen; and a third time to rope you in, according to the SEC.

Smith said dishonest brokers will try to sell nonexistent "limited edition U.S. Treasury securities" and "Prime Bank financial instruments."

"There is no 'Prime Bank,'" Smith said. "Calling it a 'financial instrument' just makes it sound better."

Investors can protect themselves by watching out for certain warnings. A dishonest broker might say the company was featured on a show, like "60 Minutes." Phrases like, "once-in-a-lifetime opportunity," "inside information," and "guaranteed returns," should raise red flags.

The NASD has proposed changes that would raise the reporting requirements for companies in the OTC market, Goldsmith said. Another proposed rule would require more information and notification to investors.

"It won't wipe out stock fraud, but it will give investors a much better tool," Goldsmith said.

-- by staff writer Martine Costello

|

|

|

|

|

|

|