|

New home starts surge

|

|

March 17, 1998: 9:28 a.m. ET

Construction starts on new homes rise 6 percent in February, best since `87

|

NEW YORK (CNNfn) - Starts on new homes and apartments surged to their highest level in more than a decade in February, aided by warm weather that pushed up spring construction, low interest rates and a robust economy.

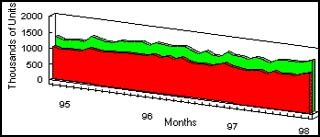

Sales of new, privately owned family homes jumped 6 percent over January to a seasonally adjusted annual rate to 1.636 million units, according to the Commerce Department. The figure far surpassed much more modest Wall Street expectations of a 2 percent rise, to a 1.56 million unit-a-year building rate.

It was also the highest rate of new homes registered since the 1.656 million construction starts recorded in November 1987.

"I'm not surprised by the direction of the numbers; I'm surprised by the magnitude," said Eileen Neely, senior economist at the Federal National Mortgage Association.

New single-family houses sold in U.S.

Housing starts are traditionally seen as a grass-roots indicator of consumer confidence in the economy. New home construction and the peripheral activities associated with it -- from realty to mortgage brokering -- may account for as much as 12 to 14 percent of the economy, Neely said.

The lower bond yields that are one by-product of Asia's crisis, have meant lower mortgages for families looking to buy a new home. That, in turn, has spurred home buying.

February single-family housing starts were 1.270 million units, 4 percent above the January figure of 1.218 million. The seasonally adjusted rate of housing units authorized by building permits rose 6 percent from Januray's level of 1.526 million, to 1.625 million.

February sales hit an annual rate of 192,000 in the Midwest, 372,000 in the South, and 348,000 in the West.

|

|

|

|

|

|

|