|

Battling the big banks

|

|

April 16, 1998: 2:42 p.m. ET

Banking consolidation could mean higher fees, but you can fight back

|

NEW YORK (CNNfn) - Higher fees for banking transactions and services could be the result of the recent spate of high-profile financial industry mergers, but you need not knuckle under at the teller's window.

The stage was set by Citicorp's announcement that it plans to merge with Travelers Group Inc. in a deal worth $70 billion. The linkup was followed closely by the BankAmerica Corp. and NationsBank Corp.merger announcement and Banc One Corp.'s acquisition of First Chicago NBD Corp.

The common thread of all these deals were promises of "one-stop shopping" for consumers who would have all of their financial services needs met under a single roof.

And while the "convenience factor," to borrow a banking industry buzz phrase, could be a benefit to consumers, bigger banks don't usually mean lower banking costs for customers.

"Bank mergers take away competitors and create bigger banks," said Ed Mierzwinski of Public Interest Research Group (PIRG), a Washington-based non-profit consumer advocacy group. "The studies that we have done show that bigger banks have bigger fees."

In particular, a PIRG study of deposit account fees at 400 banks found a 15 percent gap in prices charged by large banks and small banks. Additionally, larger banks slapped more and higher ATM surcharges on non-customers.

NationsBank spokeswoman Martha Larsh said that her bank's merger with BankAmerica would actually reduce costs for customers since the two firms would merge their ATM networks and would not charge fees to each others' customers.

However, that generosity will not apply to other banks' customers. "If a Banc One customer wants to use one of our ATMs, let them become one of our customers," said Larsh.

Another acquisition by NationsBank, a $15.5 billion buyout of Barnett Banks last year, proved beneficial for customers, said Larsh. She explained that 90 percent of Barnett's banking customers were paying the same or less in deposit account fees after the merger.

The complacency factor

PIRG's Mierzwinski said the biggest advantage merged banks have going in their favor is what he called the "complacency factor."

"Banks count on a vast group of consumers who trust banks and, therefore, they can charge them more and pay them less interest," he said.

This could create further problems down the road for consumers, he believes, since one-stop shopping could become one-stop selling and banks could push customers looking for conventional checking services into more sophisticated products like brokerage services.

Banks counter that this wider array of options will give customers better ways to manage and grow their money.

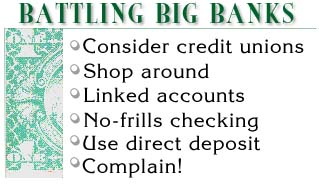

Whether larger banks have your best interests at heart or not, there are ways for you to make sure you're not getting pushed around.

One of the easiest ways to beat the big banks is to avoid them altogether. You can explore putting your money into a credit union. Credit unions are owned by their members and, therefore, are less likely to charge high fees. Your company, union or community may have its own credit union that you may be qualified to join.

You can also battle the big banks by shopping around. People often assume their own financial institution will be giving them the best deal. Unfortunately, banks give their best deals to other banks' customers in an effort to lure them in. For example, they may offer a credit card rate that you as a customer are not eligible for.

Several banking products can also cut down on the number of fees you end up paying. Look for banks that offer "linked" accounts where one balance, such as savings, can offset your checking account balance requirement.

Find the banking product that's right for your particular needs. If you write just a few checks a month, a flat-fee checking account may make more sense for you if you sometimes cannot maintain the minimum balance for free checking. Additionally, some banks offer free or low-cost checking if you use direct deposit.

If all else fails, consumer advocates say you have another option: complain! The bank will have no reason to make any changes or treat you better if you never make your displeasure known.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|