|

Alternative auto financing

|

|

April 21, 1998: 4:19 p.m. ET

You may have other options in financing your upcoming auto purchase

|

NEW YORK (CNNfn) - While it may be alluring to finance and purchase your next car at the same place, you could be selling yourself short if you don't explore other ways of raising the money.

The temptation for most car buyers to finance through the dealer is the convenience of the process. In many cases, buyers are approved within 30 minutes thanks to computerized credit systems.

However, consumers often give up options by taking the path of least resistance. Other means of alternative financing often give purchasers chances of lower rates or more flexible payment options.

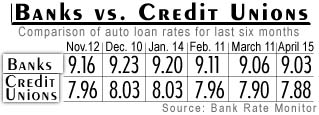

The first stop for alternative financing is a rather conventional one. Credit unions often offer loan rates which are, on average, more than 1 percentage point lower than banks.

Credit unions are able to offer the lower rates because they don't have the tax burden that banks are pushed to pass on to their customers. Additionally, they are chartered for the purpose of giving low cost loans to their members.

Joining a credit union is often a lot easier than you might think. While you typically need to be part of a company, union or other organization, membership criteria has been gradually liberalized in many areas.

Use your home to buy a car

Home equity loans are becoming increasingly popular as a way to obtain financing for purchases such as automobiles, but they're not without risk.

As a homeowner pays off her mortgage, she builds up equity in the home. For example, if you borrow $175,000 to buy a home, and have a balance of $100,000, you have $75,000 in equity.

"People generally have more equity in their home than they're aware of," said Jack Nerad, author of "The Complete Idiot's Guide to Buying or Leasing a Car."

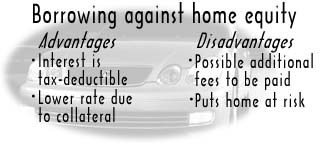

Nerad explained that the rates for such loans "are generally lower than a dealer-financed loan because you're backing it up with collateral." Typically, you can expect to pay 0.5 to 1 percentage point over prime. This means that if prime is currently 8.25 percent, you'll pay about 8.75 to 9.25 percent in interest on your loan.

However, the real advantage of a home equity loan kicks in with your taxes. The interest on such loans is tax deductible up to a limit of $100,000. That deduction, in effect, lowers the interest rate you pay.

For example, assume you are in the 31 percent income tax bracket and you take out a home equity loan for your vehicle with a 10 percent interest rate. After the deduction from your taxes is taken out, your effective interest rate is about 7 percent. Over the course of a four year loan on $20,000, this will save you about $1,350.

Hidden costs can make home equity loans less of a bargain, though. Nerad said if you haven't already established a home equity line, you may have to pay for a property appraisal and a title search.

In addition, you may have to pay an origination fee and lender points (essentially cash due at the start of the loan. All of these extra charges could negate any advantages of home equity loans.

There's also a more fundamental issue to consider, according to Linda Lee Goldberg, executive director of the National Association of Buyers' Agents.

"Mixing emotional needs with where our roots are is not a good idea," said Goldberg, noting that you are putting your home at risk with such loans. "These cars are toys. These are not the essentials of life."

Borrowing on your insurance

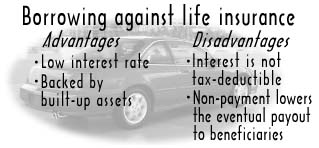

Home equity is not the only asset that consumers can turn to for an auto loan. Purchasers can also borrow against their life insurance.

Usually, you can only take out money against whole life insurance, which builds up assets as you pay your premiums.

A policyholder often receives about a 4.5 to 5 percent crediting rate, the interest rate offered on an investment type of insurance policy. A loan against such a policy would charge usually about 2 percentage points above that, for a total rate of about 7 percent.

The interest on insurance loans is not tax deductible, unlike home equity loans.

Perhaps the most tempting aspect of this type of loan is that the pressure is not on you to pay. If you do not make your payments, the amount is taken out of your accumulated policy assets.

However, Steve Goldstein, senior vice president at the Insurance Information Institute, cautioned about borrowing against something which could be vital to your family's future well-being. "You're not buying life insurance as an investment. You're buying it in case you die."

A word from the dealer

Dealer financing authorities say that getting a loan from the same place you buy the car is not necessarily a bad deal.

Randall McCathren, executive vice president of Bank Lease Consultants, said dealers can actually have a more competitive rate than bank branches do.

"Direct lenders have to charge you for overhead, staff and advertising so rates can be 1 to 1.75 points higher than a dealer," said McCathren. "The dealer has some of the same overhead and is going to mark it up some but they do a much higher volume of business," enabling them to offer a lower rate.

Additionally, many dealers often tout financing at a rate of 3 percent or below. Such rates are usually available for specific models that the dealer wants to move but obviously offer a way of saving money.

As with any deal, make sure the rate does not apply to an extremely short-term loan, such as 12 months, or that it does not require a larger down payment. Also, don't be lured into buying car options you didn't initially want because you are getting such a low rate.

The most important thing to keep in mind with any of the various means of financing your car purchase is that none is right for every situation. Fortunately for the buyer, picking the best one is just a matter of doing the math and choosing the one which comes out the lowest in the end.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|