|

Tilting odds in your favor

|

|

April 29, 1998: 11:49 a.m. ET

Breed of mutual fund tries to use a tilt to stay ahead of the S&P 500 index

|

NEW YORK (CNNfn) - The stock market is supposed to be a level playing field but you can tilt the odds in your favor using a mutual fund with a different slant.

Tilt funds, also known as enhanced index funds, are an attempt by stock pickers to combine the overall safety of the general market with the high payoffs of certain breakaway stocks.

To accomplish this, a fund manager chooses an index, usually the S&P 500, as the benchmark against which all progress of the fund will be measured. The Fund Manager then creates a core portfolio out of stocks of large companies within the S&P 500, giving him or her the ability to, in general, keep pace with the direction of the overall market.

The "tilt" comes with the remaining stocks. Portfolio managers try to pick companies they believe will outperform the core stocks, tilting the fund's favor above the overall stock market.

Managers use several methods to pick these tilt stocks. Some look for a sector, such as financial stocks, that tends to rise faster than the blue chips.

Others may be drawn to a stock with a low price-to-earnings ratio -- the measure of share prices against the amount they have been earning. And some managers try to squeeze out a better performance by taking a "short" position -- buying a stock and making a profit if it goes down.

Regardless of which method is used, the fundamental idea behind enhanced index funds is theoretically sound, said Ed Noonan, president of Triad Mutual Fund Investors.

"Whether you make the right bet or the wrong bet, you're going to be around the [benchmark] index," said Noonan.

Because of their strategy of less risky investment, tilt funds have historically been popular with pension funds such as the Illinois Teachers' Retirement System, which has allocated money into the Pimco StocksPlus Fund.

Within the past few years, however, more financial firms have started offering enhanced index funds to the rank and file investor.

But while the lure of a fund which could mimic the trend of the overall market is tempting to some investors, others may be frustrated by the generally conservative position staked out by tilt fund managers.

The enhanced index fund, by definition, has a limited range from the benchmark. Managers aren't able to chase possible good investments too far, since the bulk of the fund must remain in the benchmark stocks.

The reverse, however, is also true. Poor stock decisions aren't as devastating, because of the fund's constraints.

An eye toward value

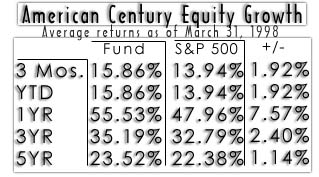

One of the most successful tilt funds has been the American Century Equity Growth Fund, co-managed by Jeff Tyler and Bill Martin of American Century Investments.

The Equity Growth fund, which requires a minimum investment of $2,500, has consistently beaten the S&P 500 and in the last year has topped the index by 7.57 percent with an average annual return over that period of 55.53 percent. (The fund's five-year return is 23.52 percent.)

While manager Martin said his core holdings go outside of S&P 500 stocks, he continues to use that index as his rule, hoping to stray no lower than 3 percent below it. So far, that hasn't been a problem.

Martin explained he looks for both growth and value issues but his fund is weighted slightly toward value stocks, which are shares he believes to be undervalued but close to rising again.

"We try to buy value stocks that are turning around," said Martin, who admits it's an inexact science. "Sometimes you buy a value stock and it just sits there."

To increase the chances they'll stay near the S&P index, Martin and his predecessors use a sophisticated computer model to help them analyze the massive amounts of stock data available to them.

Other tilt funds have not been quite so adept at besting the broader market. The AARP U.S. Stock Index Fund has in the past year underperformed the S&P 500 by nearly 0.75 percent with an annual return of 47.25 percent.

The differing results of the two funds underscore that, as with any other mutual fund, you are simply trying to find the person who is most adept at guessing correctly on stocks.

Additionally, some funds may buy S&P 500 stocks with futures contracts or use leveraging to acquire those equities, said Kevin McDevitt, mutual fund analyst at Morningstar, Inc. While these methods are not necessarily wrong, they do add another element of risk to your investment.

Therefore, the best thing you can do as an investor is to do your research before you invest in any fund. Most funds have information and prospectuses online.

Although tilt funds may not be the answer for someone looking for aggressive growth, they are an option for conservative investors who want a chance to distance themselves from the herd.

As for portfolio manager Bill Martin, he doesn't think playing it safe is necessarily a bad thing.

"If you look at how everyone has done against the S&P 500, it's beaten about 85 percent of the fund managers. We're happy to be in that upper 15 percent. We're not trying to be a 'shoot the lights out' fund at all."

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|