|

It's showtime for Encore

|

|

June 3, 1998: 3:15 p.m. ET

Liberty Media sees no need for original programming despite industry shift

|

NEW YORK (CNNfn) - Even as premium cable channel Showtime increases its dependence on original programming, competing network Encore/Starz! doesn't feel the pressure to follow suit.

Since October 1996, Viacom Inc.'s Showtime has turned to original programming in hopes of winning over television audiences and market share.

The shift underscores the dominant role industry leader HBO has played in the premium cable segment. HBO, a unit of Time Warner Inc., has been utilizing original programming since 1981.

But Encore/Starz!, whose parent company Tele-Communications Inc. (TCI) lacks production ties with any major studio, isn't concerned about the void.

"They [Showtime] haven't gone to original production by choice. They've gone because they don't have studio output," explained Robert Bennett, president and chief executive at Liberty Media, TCI's programming subsidiary.

Indeed, Bennett highlighted one of the concerns that has led many on Wall Street to speculate about the future of Showtime in Viacom's portfolio of assets.

"It's my view that Viacom is somehow trying to spin it off or sell it. With the competition from Encore/Starz! and the dominance of HBO, there just isn't that much room for it," said Arthur Rockwell, analyst at Drake Securities.

Despite this year's strong positioning of Showtime, the Viacom network faces a sharp reduction in its theatrical products as a result of shifting supply agreements in the near future.

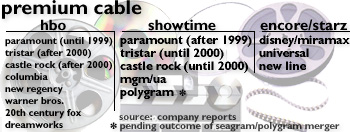

By 1999, Showtime will gain the exclusive distribution rights of new releases from Paramount Studios. But the network loses the broadcast rights for Sony's TriStar and Time Warner's Castle Rock to HBO in the year 2000.

That leaves Showtime with Polygram (pending the status of its merger into Universal Pictures) and MGM/UA, a major studio known for its high-quality, low-quantity release schedule.

Meanwhile, Encore/Starz! will retain Seagram Co.'s Universal Pictures, Time Warner's New Line and the theatrical releases of Buena Vista/Miramax, units of Walt Disney Co.

"We don't feel a need to create a lot of new product," Bennett said during a telephone interview with CNNfn.

And with the lion's share of Hollywood product going toward HBO, industry observers have renewed speculation about a possible alliance between the perennial No. 2 and No. 3 premium cable channels.

"Somewhere down the road, a closer alliance between Starz! and Showtime may make sense," said Philip Olsen, analyst at UBS Securities.

But attempts in the early part of this decade for Showtime and Encore/Starz! to join forces were stopped by federal regulators. And Liberty Media's Bennett refuted any notion that the two companies were currently interested in such a partnership.

Bennett, however, did confirm negotiations over a possible alliance with Cablevision Systems Corp. in an effort to strengthen its subscriber base, which totaled 19 million customers as of March 31.

In February, Cablevision became 33 percent owned by Liberty Media's parent, TCI. That led many to speculate about partnerships between Encore/Starz! and American Movie Classics/Bravo, two Cablevision properties.

"We're partners with them at various levels. We have held talks all the time but I don't want to comment," Bennett said.

In order to maintain its position in the face of competition from digital broadcast satellite (DBS), Encore/Starz! has relied on multiple channel broadcasting based on various themes such as action or romance.

And this strategy, known as "thematic multiplexing," has been duplicated by Showtime as well as HBO.

"If you're not thinking that way and stuck in an old [business] model, it could be bad for you," Bennett said.

Showtime

In the meantime, Showtime, which boasts 18.6 million subscribers, plans to further concentrate on original programming in its battle against HBO.

Last weekend's "Thanks of a Grateful Nation" -- a made-for-television film focusing on the debate over Gulf War Syndrome -- was watched by an estimated 966,240 American households.

In the near term, Showtime benefits from one of the industry's busiest release schedules. The network, which normally runs about 70 theatrical releases annually, will have more than 100 Hollywood films in 1998.

"In fact, Showtime suppliers will release more pictures than either HBO or Starz!" said Matthew Duda, executive vice president of program acquisitions at Showtime.

Shares of Showtime's parent company, Viacom (VIA), were down 1/2 at 54-1/4 in Wednesday trading on the American Stock Exchange.

Liberty Media's stock (LBTYA) was up 7/8 at 34-1/4 on the Nasdaq. Time Warner shares (TWX) lost 1-3/16 to 75-13/16 on the New York Stock Exchange.

-- by staff writer Robert Liu

|

|

|

|

|

|

The TCI Group

Viacom

HBO

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|