|

UAW vows to stand firm

|

|

June 22, 1998: 8:45 p.m. ET

UAW adopts defiant tone and warns of more GM strikes this summer

|

NEW YORK (CNNfn) - Striking a defiant tone, officials with the United Auto Workers union vowed Monday to unleash a torrent of labor strikes against General Motors Corp. this summer if the auto giant continues to try to shift jobs to other countries.

"We're going to continue this fight till we beat them," UAW President Stephen Yokich told thousands of local leaders gathered in Las Vegas for the union's annual convention Monday.

"We will last one day longer," Yokich shouted to thunderous applause.

Richard Shoemaker, vice president of the UAW's General Motors department, said he is not optimistic the strikes will be settled before the end of July, because GM' two-week summer shutdown starts the weekend of June 27.

He said the Flint walkouts could be followed by strikes at a GM stamping plant in Indianapolis, and two brake plants in Dayton, Ohio, where similar disputes are brewing. Workers at the Dayton plants struck for 17 days in March 1996, shutting down 26 GM assembly plants and costing the auto giant $900 million.

But Shoemaker said the UAW would not strike at those plants before the Flint walkouts are settled because "it wouldn't put any additional pressure on them."

Strike could drag on until September

Duane Zuckschwerdt, president of the striking UAW Local 659 at the Flint Metal Center, said he is preparing his 3,400 members for the worst.

"We've told them it could go into August or September," Zuckschwerdt said, adding that negotiators again made no progress Monday.

The strikes at GM's metal stamping plant and another parts plant in Flint have brought most of GM's North American production to a halt, idling about 131,600 workers, including the 9,200 strikers.

Analysts reckon a total shutdown will cost GM some $75 million a day, and cumulative losses could exceed $1 billion by the Fourth of July weekend.

"This local strike is about whipsawing plant against plant," Yokich said. "This local strike is about not living up to the agreements that they made with the local memberships across the bargaining table."

Yokich said GM wants concessions in previous agreements, and has threatened to move work to other plants unless it gets them.

Union officials at Flint Metal say GM has reneged on promises to invest $300 million in new equipment at the plant, while those at Delphi East say the automaker wants to contract out work that would mean the loss of 2,500 jobs at the plant.

GM officials have blamed the Metal Center walkout on UAW Local 659's refusal to change inefficient work rules that result in annual losses of $50 million at the plant.

Fallout from strike spreading

As Yokich addressed the UAW members in Las Vegas, the fallout from strike continued to spread throughout the vast network suppliers that provide parts to GM factories across the country.

ITT Industries Inc. (IIN), a supplier of brake systems and electrical components, has idled 1,100 workers. Lear Corp. (LEA), whose seats go into Chevy Luminas and Buick Regals, has temporarily laid off 2,000 workers. And Cooper Industries Inc. (CBE), the supplier of lighting fixtures for Corvettes and Firebirds, said its second quarter earnings expectations will fall below expectations partly due to the strike.

Industry analysts attribute the fallout to just-in-time manufacturing systems that allow suppliers to ship key parts to assembly plants on a tight deadline.

"The ripple effect on GM supplies is profound," said John Casesa, auto analyst at Schroder. "GM represents anywhere between 15 and 20 percent of the sales of most big supplies, so these are lost sales and lost profits. And you'll see it in their second quarter results."

Indeed, since the pickets went up almost three weeks ago, stocks of auto parts companies have skidded 5 to 15 percent.

GM workers on the picket line

About 3,400 workers at the Flint Metal Center went on strike June 5, while 5,800 workers at the Delphi East parts plant, which makes spark plugs, instrument clusters and other parts, walked off the job June 11.

GM sent more workers home Monday as it ran short of parts from the two plants, including 1,253 people from its Ste. Therese, Quebec, assembly plant where the company builds the Chevrolet Camaro and Pontiac Firebird sport coupes.

GM now has 24 of its 29 light vehicle assembly plants in the United States, Canada and Mexico idled by the strike.

The picket line dividing the two sides in the current strike is a familiar one to many veteran industry observers. But it is a gaping chasm to striking workers who view GM's efforts to cut or transfer jobs out of the country as the epitome of corporate callousness.

GM, for its part, argues that unless it streamlines operations, it will continue to lose market share to rivals Ford Motor Co. (F) and Chrysler Corp. (C) in the hyper-competitive auto market.

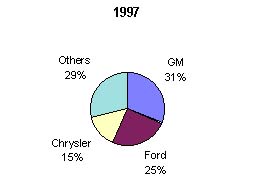

Share of the U.S. Vehicle Market

Source: Autodata Corp.

Since the 1970s, GM has lost nearly 16 points of market share to its rivals. Faced with a glut of excess capacity, GM has been forced to slash its hourly payroll nearly in half to 218,000 employees. But analysts say the company must eliminate 30,000 more blue-collar jobs if it hopes to transform itself into a lean corporate player fit for 21st century competition.

Because GM manufacturers most of its parts in-house, using high-priced union workers with years of seniority, its costs are much higher.

In 1997, for example, the average hourly employee at the Flint Metal plant received $98,000 in salary and benefits, $14,000 more than the average GM assembly plant worker.

GM contends it must be able to transfer more work to other plants, including those outside the United States, in order to remain competitive.

For the UAW, however, GM's drive for efficiency comes as the union is trying to stop its own slide. Over the last two decades, the UAW has lost more than half a million members, putting pressure on the current union leadership to take action.

At the same time, the UAW is also trying to prove it can win a high profile labor dispute.

Earlier this year, the UAW ended a bitter dispute with Caterpillar Inc. but the contract included major union concessions and barely won ratification.

Shares of GM (GM) rose 9/16 to 68-1/16 Monday.

-- from staff and wire reports

|

|

|

|

|

|

|