|

Bart Simpson goes public

|

|

June 29, 1998: 6:39 p.m. ET

Murdoch's News Corp. plans to sell 20 percent stake in new Fox Group

|

NEW YORK (CNNfn) - Don't have a cow, man, but Bart Simpson and his fellow Fox-mates are going public.

Harkening to the call of glum investors, Rupert Murdoch's News Corp. burst onto Wall Street Monday with plans to fuse his multi-billion-dollar entertainment and athletic empire in the United States under a single canopy -- and then spin off 20 percent of the new entity in an initial public offering.

Based on standard valuation formulas, the new company could be valued at $15 billion or more, analysts said Monday -- making the IPO worth at least $3 billion.

News Corp. said it hopes that selling stock in the new company, to be called the Fox Group, will boost News Corp.'s share value by allowing investors to focus solely on the conglomerate's fast-growing entertainment businesses. The strategy, said industry observers, appears to make perfect sense.

"They're being responsive because this is something the equity market has been looking for as a way to target some of (News Corp.'s) pure entertainment assets," said Philip Olsen, an analyst at UBS Securities.

"This is a U.S. entity that is 100 percent pure play entertainment," he added. "You will get a better transparency of numbers, a better chance to really target your investment."

Murdoch signaled his determination to boost his conglomerate's lackluster share price earlier this month. In May, News Corp. unveiled plans to sell TV Guide, once a sacred cow of its publishing business, to United Video Satellite, a company controlled by Tele-Communications Inc, for $2 billion. A day before the TV Guide announcement, News Corp. stock was trading at 20-1/4.

In search of higher share value

Monday's IPO announcement capped weeks of in-house hand-wringing at News Corp., which had come under pressure from financial quarters to bolster its share value. As late as last week, Olsen said, one of Murdoch's top aides told him News Corp. was mulling whether to issue tracking stock, special shares that allow investors to track the financial performance of part of a company but that don't confer voting status.

News of the IPO sent Australian-based News Corp.'s American Depositary Receipts skyrocketing Monday. News Corp. (NWS) ADRs ended up 3-9/16 at 33-1/16, a 12.08 percent rise.

The Fox Group will account for more than half of News Corp.'s $13 billion in annual revenues from a lucrative array of global assets that include newspapers in Australia, the Times of London and the HarperCollins publishing house.

It will pool together all of News Corp.'s U.S.-based filmed entertainment, television programming and sports team assets. Tucked into the fold will be some of the crown jewels of Murdoch's global media portfolio: the Fox Television network -- producer of such Nielsen ratings juggernauts as "The X-Files" and "Ally McBeal" -- the 20th Century Fox movie studio and the Los Angeles Dodgers.

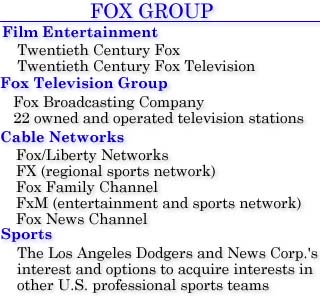

The group will consist of three business segments: the Fox Filmed Entertainment Group, including 20th Century Fox and its video and film affiliates; the Fox Television Group, with its Fox Broadcasting Co. and 22 other television stations; and Cable Networks, which include interests in five pay cable television networks.

The cable networks are Fox/Liberty Networks, a regional sports network in which News Corp. owns a 50 percent interest; FX, a general entertainment and sports programming network in which News Corp. also has a 50 percent stake; The Fox Family Channel, 49.5-percent controlled by Murdoch; FxM: Movies from Fox, a 24-hour wholly owned movie network; and the wholly owned Fox News Group.

In addition to the Los Angeles Dodgers, the Fox Group owns interests in New York's Knicks and Rangers, along with options to buy minority stakes of the Los Angeles Lakers and Los Angeles Kings.

Doing more with assets you have

With total assets of $33.2 billion, Murdoch, in the view of some analysts, may feel he has reached a saturation level and wants to do more with what he has -- in more creative combinations.

"My impression is that Mr. Murdoch has been in a phase of building assets for most of his career, 25 years or so, and he has reached the point where most of the key pieces are in place," said Harold Vogel, a media analyst at Cowen & Co.

"Now," Vogel continued, "instead of sacrificing to build assets, he is in effect trying to raise shareholder value and he was under pressure to do so because News Corp. stock was selling below the average of the other major entertainment and media companies."

As Olsen at UBS Securities put it, Murdoch likely looked at his far-flung portfolio and deemed it to be less than the sum of its parts. As things stand now, News Corp. issues two classes of stock. Holders of either type, then, technically have an interest in such diverse assets as the Papua New Guinea Post Courier and Brazil's Net Sat, a satellite cable television channel.

The company derives nearly three quarters of its sales from its U.S. businesses, analysts say. Among these, News Corp.'s television assets have proven cash cows for the company, generating profit margins in the 50 percent range, Olsen said. The film segments, by contrast, have struggled more to increase profitability, despite the record-breaking blockbuster success of "Titanic," for which Fox ponied up most of the investment.

News Corp. has trod on similar terrain in the past, most recently in 1995 when it established BSkyB as a stand-alone British satellite company and sold a stake to the public.

This time around, Murdoch plans to use proceeds from the IPO to relieve its debt burden and perhaps buy back stock.

|

|

|

|

|

|

News Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|