|

'Portal' or 'destination'?

|

|

July 8, 1998: 4:31 p.m. ET

Should Internet stocks be valued based on differing functions of Web sites?

|

NEW YORK (CNNfn) - Smoking or non-smoking? Paper or plastic?

Perhaps the next big question facing investors of Internet stocks is: "Portal or destination?"

Investors now don't really see a difference. As a group, Internet stocks have climbed to astronomical levels. But the functionality of the products and services offered by these companies are as diverse as the consumers they serve.

"That's why the stocks trade so strangely. There are all these Internet indices with just big groups of Internet stocks," said Gretchen Teagarden, analyst at Stephens Inc.

Feeding off the frenzy created by interest from strategic participants (media companies like Walt Disney Co. and communications giants like AT&T Corp.), financial investors have hopped on the chance to ride the wave of upbeat sentiment. And the resulting speculation has sent the sector to unsustainable levels, analysts said.

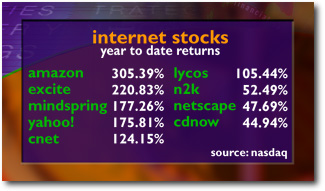

With triple-digit percentage gains so far this year, it's no wonder that some analysts such as Steve Horen of NationsBanc Montgomery Securities on Wednesday took Amazon.com off his "buy" list.

To be sure, analysts have attributed much of the stock's price gains in May and June to a technical factor known as a "short squeeze." The amount of short interest -- borrowed shares which are sold in hopes to book profits when bought back at lower prices -- increased 27 percent throughout May. And bullish investors have tried to force out so-called "short-sellers" by propping up prices.

Still, based on fundamental outlooks, investors still should run away from the lofty stock prices. Like other electronic commerce Web sites, the online book retailer Amazon.com (AMZN) isn't expected to turn profitable until 2000. According to First Call, the company is expected to earn 8 cents a share in the spring quarter that year.

"You would have to grow revenue at close to 90 percent for the next five years ... in order to justify these valuations," Horen said.

A Door or Window

Yet these destinations like Amazon and CDnow.com (CDNW), an online music retailer, represent longer-term opportunities compared to the so-called "portal" Web sites such as Excite and Yahoo!

"These companies are early-stage investments and they have to be invested in for what they are," said Stephens' Teagarden who is the author of "The Consumer Economy: How Internet Commerce Turned the Supply Chain Upside-Down."

"This is a private equity investment that the public market is making," she said.

Because the multifunctionality of the portals, strategic players like Disney (DIS), which purchased a 43-percent stake in Infoseek Corp., view the sites as logical home pages for their burgeoning Internet operations.

That was the rationale behind the $26-million investment into CNET's Snap! portal site by General Electric Co.'s NBC broadcasting subisidiary, Horen said.

"I think that the large media companies and large communication companies realize that they would ultimately have the opportunity to have relationships with end-users if they were involved in them when they log on," the NationsBanc analyst said.

Predicting the Future

But with only an estimated $906,000 in first-quarter revenue, Snap! and other start-ups still lag the more established brand names. And as the World Wide Web continues to develop, some argue that the paradigm will shift power toward the destination sites.

"It will be Amazon's brand name that will be more important than the Infoseek brand name as it relates to selling books," Horen said.

Still other industry observers believe that portal sites will become increasingly more valuable due to the nature of the medium.

"The Internet is not a brand-building medium. It's a direct marketing medium," Teagarden said.

Utilizing various tracking software developed by companies like DoubleClick Inc., Yahoo! and other sites already have started providing personal services based on the user's demographics.

And Teagarden foresees a transformation of the large portals into smaller so-called "genre" sites, which will more closely target products and services based on the end-user's personal preferences.

-- by staff writer Robert Liu

|

|

|

|

|

|

|