|

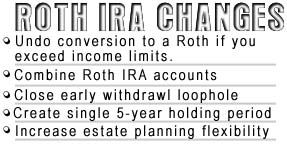

Fixing the Roth IRA

|

|

July 20, 1998: 2:20 p.m. ET

Clinton set to sign legislation which will affect your Roth IRA investments

|

NEW YORK (CNNfn) - U.S. President Bill Clinton is set to receive on Tuesday legislation that will correct some of the foibles of the original legislation which created the Roth Individual Retirement Account (IRA).

The technical corrections legislation, which Clinton promised to sign after it was approved by the U.S. Senate, fine-tunes the Taxpayer Relief Act of 1997 -- but these changes can be important if you've converted to a Roth IRA or are considering doing so.

One of the most important parts of the legislation are stipulations which allow for honest mistakes by someone who has converted from a traditional IRA to a Roth IRA.

In order to convert to a Roth IRA, you must have a gross income of under $100,000. Currently, individuals or couples near that income level must make a leap of faith that they won't top out over that figure. If they do, they'll face stiff penalties.

"If I found out that I got capital gains [from the sale of stocks] which pushed me over the $100,000 limit, I had no recourse," said John Coscia, director of marketing for retirement planning at Merrill Lynch.

This uncertainty, said Coscia, kept many people who would have otherwise been eligible from taking advantage of the Roth IRAs. "It was holding up or making harder the decision to convert," he said.

Once the corrections take effect, taxpayers who find themselves over the $100,000 limit can at anytime on or before April 15th transfer their money back into a traditional IRA, avoiding those penalties.

Additionally, the new legislation will save you some time and money. Previously, many investors were often advised to keep separate accounts for their converted Roth IRAs and the ones they would be making contributions toward.

Corrections to the legislation will make it easier to combine Roth IRA assets into one, eliminating many of the fees you would pay on multiple accounts as well as cutting down on the paperwork you have to maintain.

Coscia advises almost every Roth IRA investor to combine their assets into one Roth after the legislation takes effect. "I can't think of a logical reason to have multiple accounts," he said.

Roth loopholes exposed quickly

The Taxpayer Relief Act of 1997, signed into law by Clinton last August, was one of the most dramatic changes to tax law in recent years.

It also created the Roth IRA, named after Senate Finance Chairman William V. Roth. Unlike traditional IRAs, the money you put into a Roth is not taxed when you withdraw it from the account, provided you're older than 59-1/2.

The income limit to contribute $2,000 to an account in 1998 is $95,000 for a single person, phased out at $110,000. For couples who want to contribute $2,000 each, the cutoff is $150,000, phased out at $160,000.

As the new Roth IRA became available in January, loopholes and other questions came up about the legislation.

One of the most costly loopholes centered on conversions made during 1998 from a traditional IRA to a Roth IRA.

Basically, a person could take money from a conventional IRA and put it into a Roth. The transferred money would be taxed but, as the law stood, the taxes would be spread out over four years in an effort to lessen the tax blow on individuals.

However, due to a loophole, the 10 percent tax penalty on early withdrawals did not apply to these conversions. Therefore, an individual could convert, take the money out right away and not have to pay a penalty. They'd also get the benefit of having the resulting tax divided up over the next four years.

"In effect, you got away with withdrawing money without any penalties," said Rick Grafmeyer, national director for tax legislation at Ernst & Young.

This error didn't escape the notice of the government the second time around. To crack down on the chance investors will take advantage of this, the 10 percent withdrawal penalty for these conversions will apply.

While the legislation takes away that loophole, it seeks to open up the Roth IRA to new possibilities.

Most notably, you'll be able to get your hands on your money sooner with the changes. Previously, there was a five-year waiting period after you opened up each Roth before you could start withdrawing your money.

Usually you would run into this waiting period after you reached 59-1/2 years and needed your retirement funds or looked to spend it on an approved exception, such as paying for your first home or financing college education.

This meant a Roth opened in 1998 couldn't be touched until 2003, and additional assets from a Roth opened in 1999 wouldn't be available until 2004. This broke up your available money into small pieces.

With the corrections, you'll only have a single five-year waiting period. So, after your first Roth IRA is five years old, you can use any of your Roth's assets, provided you meet the required age and distribution criteria.

Older Americans can use converting to a Roth IRA as a way to provide an income tax-free inheritance for their beneficiaries.

The new technical corrections afford older investors more flexibility to transfer their IRA assets while still taking advantage of the taxes being spread out over four years.

As you might expect with most tax law, the technical corrections legislation is complex. To find out how to get the greatest benefit out of the changes, you'll want to sit down with your investment professional and have him or her reevaluate your Roth IRA plans.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|