|

IPOs walking wired again

|

|

November 16, 1998: 9:58 a.m. ET

Internet companies dominate the buzz as the 1998 debut season draws to a close

|

NEW YORK (CNNfn) - The surf was up last week for initial public offerings as investors tried once again to ride a ground swell of Web debuts, and more waves have been sighted on the horizon.

Between now and January, 19 companies are scheduled to go public in the online sector, raising an aggregate of $826.94 million.

"The next best opportunities are still in front of us," said Roger McNamee, partner at Integral Capital Partners. "We'll see a huge volume of tech IPOs in January."

None of the Internet offerings is slated to hit shore this week. Instead, the 10 IPOs ahead are in the finance industry, headlined by Banco Santander Puerto's $140 million debut and Scottish Annuity & Life Holdings' $251 million offering.

Exchange Applications tests waters

Among the upcoming Internet IPOs, McNamee said, Exchange Applications warrants another look.

"This deal was yanked because of market reasons, but it is a real company," he said, referring to an abortive attempt to go public in August.

Exchange Applications provides direct marketing software and consulting services to firms seeking to target marketing campaigns with greater accuracy. The company began as a marketing consulting firm and incorporated as a software supplier in 1995.

As in the August attempt, Goldman Sachs hopes to raise $45 million by offering 3 million shares, but no new date has been set.

Elsewhere in electronics

Other Internet IPOs to watch for include Web-based news provider Marketwatch.com and ticket clearinghouse and directory service Ticketmaster Online/Citysearch.

Marketwatch.com expects to raise $34.5 million, while Ticketmaster Online hopes to bring in $63 million in its December debut.

Another Goldman deal -- although not exactly an Internet company -- is fiber optic supplier E-tek Dynamics, which surprised the market by shrinking both its initial offering and opening price last week. The company said it will offer 4 million shares at $9, down from 6 million shares at $10, raising the question of whether the company hopes scarcity will create value.

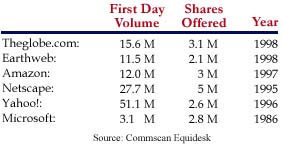

That theory seemed to hold last week with theglobe.com's offering. The company traded 15.6 million shares (TGLO) on its first day, five times its 3.1 million-share flotation. A few days earlier, the volume on EarthWeb's debut (EWBX) hit nearly 12 million, nearly six times the number of its shares offered.

Two years earlier, Yahoo!'s offering, the grandfather of Internet IPOs, saw shares volley between buyers and sellers at lightning speed. With volume of 51 million on the day, every single Yahoo! share (YHOO) traded about once an hour.

"People think nothing of owning a stock for minutes at a time," said Integral Capital Partners' McNamee. "The velocity of trading is staggering and completely unprecedented."

Web still the hot pick

Excluding last week's offerings from theglobe.com and EarthWeb, the 1998 Internet IPOs are up nearly 62 percent so far this year, a dramatic exception to the broader market's fall of 1.94 percent.

Much of that growth has come in the last few weeks. At the end of September, the same stocks were up only 10.7 percent.

-- by staff writer Bambi Francisco

|

|

|

|

|

|

|