|

Net sex: No investors wanted

|

|

December 4, 1998: 9:23 a.m. ET

Online adult sites have Net pizzazz and traffic, but share sales unlikely

|

NEW YORK (CNNfn) - Sex sells, except maybe on Wall Street.

That's the current lesson of the high-flying Internet sector. Stocks in online companies are market wonders this year. But online adult entertainment sites, arguably one of the more traveled areas of cyber space, aren't part of the rocket ride.

"You'd think it'd be a great idea for a (public) company," said Scott Bleier, an investment strategist at Prime Charter Ltd. "After all, the big areas of the Internet are basically stock trading, e-shopping and pornography. But you can't really invest in it. And you know, maybe that's the way it should be, quite frankly."

Sex in general is not a major player in U.S. markets. Companies that operate in adult entertainment businesses are often closely held, like Larry Flynt Publishing (Hustler) and General Media International (Penthouse).

Still, there are some publicly traded players, the best-known being Playboy Enterprises (PLA). Others include Princeton Media Group Inc. (PMGIF), publisher of Oui and Adult Cinema Review, and Spice Entertainment Companies (SPZE), the adult pay-per-view programmer. But with less than half-a-billion dollars in market capitalization, adult entertainment makes up a small portion of the overall business world.

The cyber world is another story. Electronic mail, anonymity and search engines have made adult Web sites far more prominent.

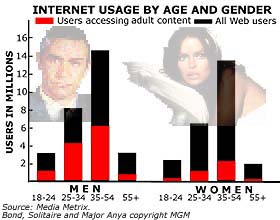

"The search engines tell us about 50 to 60 percent of their traffic is going to adult sites," said Mark Tiarra, president of United Adult Sites, a non-profit trade association representing over 500 adult entertainment web sites.

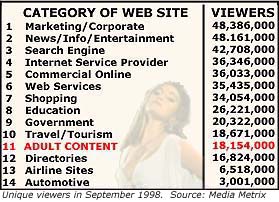

The dominance of porn on the web may be somewhat over-rated. Recent figures from Media Metrix indicate that adult sites, while a significant Internet presence, are far from the ultimate traffic champion. Nevertheless, they still account for a large chunk of traffic.

But with all that traffic, why haven't any adult entertainment cyber companies come out to rival the eBays and Yahoo!s? Part of the answer seems to lie in the structure of the industry itself.

The mainstream adult entertainment companies with a presence on the web are usually magazines or adult video companies that have started Web sites. They are geared more for selling their goods over the Web, rather than providing entertainment. As a result, they are minor players in the Web-sex universe, according to Tiarra.

"The only people going into the Internet with a good corporate structure are the 900-number operators, and they really just transferred their business from the phone to the Web," Tiarra said.

Mom-and-pops

For the most part, adult Web sites are small operations with little more than a scanner and some rented server time.

"The primary reason that you don't see may IPOs or that type of thing is that 95 percent of the market is made up of mom-and-pop type of operations," said Tiarra. "The few that have adopted a corporate structure were primarily reacting to the sudden amount of money they were making. ...and in this market you don't need a lot of money to get off the ground."

Indeed, those sites that do need seed money for server access and technological support can generally get it through "angel capital" -- cash from individuals willing to invest in return for a share of the profits.

Will online adult entertainment investment ever migrate out of the angel realm to within reach of the common investor?

Tiarra thinks there's a chance. "A lot of this depends on where the Internet goes," he observed. Adult entertainment sites have been at the cutting edge of Internet technology as purveyors work harder and harder to provide full motion video and other media enhancements over modem lines to lure those willing to give up a credit card number.

But as the various combinations of television, telephone and audio meld on the Web, technology may become more sophisticated and expensive.

"Static pictures-only on a site can't compete with that kind of media, so a lot of mom-and- pops may be out. Or they may start doing things to raise capital," Tiarra predicted.

Others don't think it will be so easy.

"I don't doubt that some (adult Web site operators) would like to get some money, but Wall Street has a natural sort of reluctance to get involved in adult entertainment," noted Adam Schoenfeld, a vice president of Jupiter Communications, a consulting firm specializing in the Internet.

From deceptive advertising and unwanted e-mail (spam) to outright misuse of credit card numbers, some adult Web site operators have cast a negative shadow over an already morally debatable industry, Schoenfeld noted.

"It's a shady sort of area. And while they are on the cutting edge of a lot of technology, they are also on the cutting edge of a lot of dubious practices, in some cases outrageous fraud and really bad fraud," he added.

And that, Schoenfeld suggested, will continue to keep staid and cautious underwriters and investors away from online adult entertainment as a ripe investment sector.

-- by staff writer Allen Wastler

|

|

|

|

|

|

United Adult Sites

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|