|

Net IPOs keep coming

|

|

December 7, 1998: 12:11 p.m. ET

Xoom.com, InfoSpace.com going public; CBS' Infinity to draw attention

|

NEW YORK (CNNfn) - Investors scrambling to get in on the next Web offering will have another chance this week. Nine initial public offerings are in the pipeline, expected to raise nearly $3 billion. Of that group, four are Internet deals.

This week's new issues come on the heels of one of the best first-week performances for new offerings. Last week's six IPOs surged nearly 95 percent on average and only two were Internet-related. Never mind that the broader market contracted as the Dow Jones industrial average fell nearly 3-1/2 percent and the Russell 2000 lost almost 1 percent -- the IPO rally wasn't to be undone.

But give it another week or two and the law of gravity likely will assert itself. EarthWeb and theglobe.com, two recent darlings of the Net world that both were credited for the IPO revival, hit their all-time lows Friday.

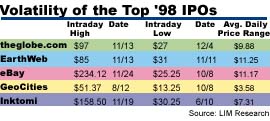

Net Sector Volatility

It was only three weeks ago that some investors paid as much as $97 and $85 for shares of theglobe.com and EarthWeb, respectively. And investors who rode the rocky decline also found themselves holding some of the most erratic stock. Since going public last month, both IPOs have, on average, swung within a $10 trading-band every day.

theglobe.com's rival Xoom.com goes public this week with a 3 million share offering between $9 and $11. As a community site, it offers the standard services such as home pages, e-mail, chat rooms and online greeting cards.

Xoom.com doesn't charge membership fees. Instead, the company makes most of its money through electronic commerce; it uses a membership profile to target certain products and will use e-mail to alert members about product offerings. At the same time, its collective membership base attracts advertising dollars. Of its $5.1 million in revenue for the first nine months of this year, 31 percent came from advertising.

Xoom.com was the second-fastest-growing site on the Web as measured by online reach in the first half of this year and the 12th-most-trafficked site in October, according to Media Metrix. According to its prospectus, the company had about 4.5 million members as of mid-November and has added almost 20,000 new members per day for the last 30 days.

After the offering, Xoom.com will have a market capitalization of $120 million. On a conservative estimate of $6.8 million for this year's sales, that gives the company a revenue multiple of 17. It wasn't long ago that this ratio seemed excessive, but now it almost can be viewed as a bargain.

Web future: advertising or e-commerce?

For investors who feel Net advertising holds more money-making promise than e-commerce, InfoSpace.com is one to consider. The company aggregates content but uses its "internally developed" technology to integrate its own value-added services that make searching information more flexible and customizable.

It then syndicates its content for a broad network of affiliates, including Internet portals. Xoom.com generates its ad-sales through these Internet "points-of-entry" sites.

InfoSpace.com's flagship product is a nationwide yellow and white pages directory called "The Ultimate Guide." It's a tool to find the name and address of new customers and get directions to their offices. It may even help find a nearby restaurant.

Hambrecht & Quist plans to raise approximately $40 million for InfoSpace.com. The 4 million shares are expected to price between $9 and $11. It has $6.1 million in revenue.

Hot Software

If past is prologue, then the IPO of Exchange Applications may be one to consider. Competitor Siebel Systems went public last June and is up 512 percent since then. BT Alex. Brown is the underwriter for Exchange Applications' $40 million offering, slated to price between $8 and $10 a share.

Exchange Applications is the maker of software popular with the banking and financial services industry. The software gives marketers the technology to plan, build, execute, analyze and refine marketing campaigns.

This week's biggest offering is the $2.7 billion offering from Infinity Broadcasting, the CBS spin-off of its radio network. This deal is Renaissance Capital's pick of the week. In its weekly report, Renaissance says that with its "ownership of premier properties, the leadership of Mel Karmazin and its well-known parent, this company is sure to draw lots of attention as it becomes the first company in the history of the NYSE to go public three times."

And finally, for those wondering how many more Internet IPOs are in the pipeline, don't worry -- they're still spilling in. Twenty-one are scheduled for the next few months, raising $838 million, and most of them are slated to go public early next year.

-- by Bambi Francisco

|

|

|

|

|

|

|