|

401(k) plans go online

|

|

January 22, 1999: 10:15 a.m. ET

U.S. workers embrace the growing availability of benefits on Web sites

|

NEW YORK (CNNfn) - More and more companies are allowing their employees online access to their benefits, changing the way workers handle their finances.

Intranets -- which look and act like the Internet but restrict access of company information to selected individuals -- are the method of choice for tech-savvy firms to get employees more involved in their benefits.

While online access to benefits is still in its nascency, there is evidence that companies are beginning to go along.

According to a 1998 survey by Merrill Lynch, 12 percent of companies currently use a website for employees' retirement plan communications, up from 8 percent in 1997.

The survey also found that as companies get larger, they become more enthusiastic about using Internet-type services for benefits.

Indeed, a 1998 Forrester Research study found 16 percent of the Fortune 1000 companies have Intranet systems and the number appears to be growing.

And there are those, like Dallas Salisbury, president of Employee Benefit Research Institute, who think it will encourage more people to take advantage of company savings plans.

"I think it will (lead to greater participation)," said Salisbury. "The component that will make that happen will be the ability to enroll in the plan online and make changes in enrollment status."

Benefiting from variety

Employees at companies with such Intranet access can often have available to them virtually all of their benefits plans.

Ronni Blasz, vice president of Merrill Lynch's electronic media, said 401(k) plans, profit-sharing, employee stock ownership, stock options and purchasing along with health benefits, such as flex spending accounts, are all available at various online services.

Blasz explained online benefits have been a boon to employees for whom it is difficult to stroll up to the human resources office during normal business hours.

"We can offer this at home or at work," she said. "Even if you're not at a desk, you can get to it at night. It's really been great for international participants."

Despite enthusiasm for these features, employee financial education remains the main goal for most company benefits intranets.

A visitor to most benefits sites can expect all kinds of background information, ranging from 401(k) retirement strategies to saving for college, along with general information on managing personal finances.

Such education becomes key, especially since being knowledgeable about navigating online doesn't necessarily translate into being knowledgeable about financial planning.

"We've got millions of workers that don't have high school educations," said EBRI's Salisbury. "These are the type of people who would gain a great deal from interaction with an employee benefit specialist, a 401(k) specialist or a human resources professional."

The personal touch

Merrill Lynch's Blasz agrees. Her company's service, Bene Online, allows for users to submit general questions via e-mail, but the site won't give advice through these measures.

Instead, she feels it's important for users with financial planning questions to sit down with someone and receive a longer, more personalized, evaluation of their needs.

In the near future, most companies aren't planning on getting rid of their human resources departments anyway and intranet administrators see the online community as a way to get more information in the hands of employees.

"People don't always open the mail HR sends them about new investment options or new medical plans," said Blasz.

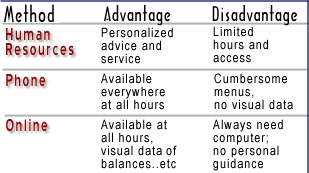

Human resources' first attempt at benefits technology for the masses was phone-based services, a method used by many corporations today.

Telephone-access does have its advantages. Workers can get to one almost everywhere.

However, using the phone for your benefits can still be cumbersome. Employees must choose from a range of options on the phone's keypad, which leads to yet another list of options.

In addition, backing up a few steps can often be difficult and you'll need to have your information in front of you or write it down quickly.

Conversely, those who use online systems can have information such as retirement account balances, investment allocation choices and other relevant data on the screen in front of them and print it out if they desire.

While there will be various options available to people, proponents believe that as getting online becomes more universal, the intranet method of accessing benefits will become the main way people manage their workplace finances.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|