|

CNNfn market movers

|

|

February 18, 1999: 2:33 p.m. ET

Aegon merger drives insurance sector up; caution sinks Sipex, Travel Services

|

NEW YORK (CNNfn) - Between hesitant signs of recovery in the technology sector and a raft of encouraging deals and profit reports, winners managed to outpace losers on Wall Street Thursday.

Prime Bancorp (PBNK) shares climbed 6-15/16 to 24-15/16 after reports it has agreed to merge with regional bank Summit Bancorp (SUB) for $292 million. Summit stock slid 11/16 to 38-11/16.

Disk maker Western Digital (WDC) gained 1/2 to 10-5/8 on the strength of the divestiture of its disk media business to rival Komag, which will pay $80 million in stock for the unit. Komag (KMAG) shares gained 13/16 to 7-7/16 on the combination of the deal buzz and an upgrade to "buy" from Hambrecht & Quist.

Healthy profits led B.F. Goodrich (GR) up 1-1/16 to 32-9/16, while a similarly positive profit notice from Office Depot (ODP) lifted its shares 3-3/16 to 34-1/16.

Widely-held software company PeopleSoft (PSFT) climbed 1/4 to 17-9/16 as shareholders rallied to news that the company won't have to restate its earnings as had previously been feared.

A delayed response to profits from waste-disposal firm Superior Services (SUPR) drove Morgan Stanley to rate the stock "outperform" and pushed shares up 1-3/4 to 19-1/2. The company had surprised Wall Street Tuesday by reporting fourth-quarter earnings of 26 cents per share exclusive of costs related to its acquisition of GeoWaste Inc.

On the losing end of the rating game, industrial supplier MSC Industrial Direct (MSM) slid 2-1/8 to 21-15/16 after Prudential lowered its "strong buy" recommendation on the stock to "accumulate."

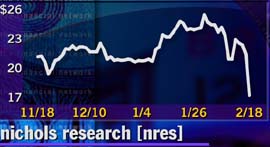

Information services firm Nichols Research (NRES) fell 4 to 17-1/2 after warning that sliding revenues would cause fiscal second-quarter profits to fall short of forecasts, while Coyote Network Systems (CYOE) lost 1-7/16 to 5 after reporting an unsatisfying operating loss that included deferred profits from a $7.2 million equipment sale.

Earnings beat Street; stocks fall

One stock suffering a less straightforward earnings-related decline was Skytel Communications (SKYT), which slid 4-1/2 to 19-3/8 despite reporting a sharply narrower fourth-quarter loss.

Chip-equipment maker Sipex (SIPX) stumbled on apparently encouraging earnings, plunging 10-7/8 to 12-15/16 after reporting estimate-beating profits but warning of a "cautious" outlook ahead.

Travel Services (TRVL) also beat estimates, this time by a penny per share, but shares still fell 7-7/8 to 14-1/8 after the CEO used cautionary language regarding the quarter ahead. Nationsbank Montgomery maintained the company's "buy" rating but cut its first-quarter estimates to 14 cents from 22 cents.

Drug stocks welcome Glaxo profits

Encouraging second-half profits boosted New York shares of British pharmaceutical firm Glaxo Wellcome (GLX) up 1-9/16 to 66-1/16 and gave a lift to the broader drug sector. Fellow U.K. drugmaker Zeneca Group (ZEN) climbed 1/2 to 42-5/16 in New York, celebrating both Glaxo's good news and its own encroaching merger with Sweden's Astra (A).

Elsewhere in the sector, Amgen (AMGN) climbed 1-1/2 to 124, Immunex (IMNX) leapt 3-1/4 to 140, and Eli Lilly (LLY) added 3-5/16 to 91-13/16, while American depositary receipts (ADRs) of Israeli drug firm Teva (TEVIY) climbed 1 to 40-15/16.

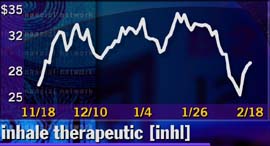

Biogen (BGEN) struggled up 1/2 to 90-7/8 after saying it will pay up to $25 million to biotech firm Inhale Therapeutic Systems (INHL) for an inhalable form of the Avonex multiple sclerosis drug. Inhale shares climbed 11/16 to 29-5/16.

Insurers bank on merger

Major insurance companies also were broadly higher Thursday, climbing on the news of a blockbuster $10.8 billion industry merger between Transamerica (TA) and Aegon (AEG), as well as hopes of further consolidation to come.

Providian Financial (PVN) surged 6-13/16 to 100-3/8, Jefferson Pilot (JP) gained 3-1/2 to 69-5/9 and Lincoln National (LNC) added 2-13/16 to 87-3/16. American General (AGC) gained 3-3/8 to 69-9/16, while Cigna (CI) climbed 9/16 to 75-5/8.

Nationwide Financial Services (NFS) was one of the few decliners to stand apart from the general enthusiasm, sliding 11/16 to 43-3/4.

|

|

|

|

|

|

|