|

Net tax filings on the rise

|

|

March 2, 1999: 9:59 a.m. ET

Everybody -- including the IRS -- is making it easier for you to file online

|

NEW YORK (CNNfn) - A trip to the tax preparers' office will become a thing of the past if Lewis Weinstein gets his way.

Weinstein, founder of TaxLogic in Needham, Mass., thinks preparing your taxes over the Internet may soon become the norm.

He's not alone. The U.S. Internal Revenue Service said more than 25 million people filed their Federal returns electronically last year. And the IRS hopes to see more than 80 percent of all returns "e-filed" by 2007.

E-filing is not new. Software products like TurboTax and Kiplinger TaxCut have been around for years, but now there's a new kid on H&R's block. Web-based services such as TaxLogic and SecureTax are becoming increasingly prevalent.

"We basically give you a professionally prepared return and you don't even have to leave home," said Weinstein.

Web-based tax services work much like their software counterparts. You access the site through your regular browser and answer a questionnaire regarding basic information such as your address, Social Security number, etc.

Next, you're queried about the number of dependents you have and, of course, the financial information contained in such forms as your W-2s, interest records and statements from your brokerages.

These services then give you the option of filing the return electronically or printing it out and sending it in via regular mail.

Tax fees vary. SecureTax charges nothing for the most common federal and state returns -- although it does charge for premium services. Tax Logic charges a minimum of $75 because it offers CPA consultation.

Weinstein said he expects Web-based outfits like his will eventually get even cheaper through economies of scale.

"We can handle more returns than the average office-based tax preparer," said Weinstein. "When you have clients come in, you shoot the breeze for 20 minutes, take 20 minutes to interview them and print up the return.

While it may seem easier to do your taxes online, there's no inherent advantage to it, according to Professor Greg Geisler of Georgia State University's School of Accountancy.

"It's just like going out to buy TurboTax software," said Geisler. "The only difference is you're basically paying for the cost of the software after your return has been prepared."

Before you turn over sensitive information about your own finances, though, make sure the preparer's Web site forms are encrypted, which makes the transmission of your data more secure.

In addition, ensure that the company will not use your financial information for any other purposes. Most guarantee this, but make sure you get it in writing from the company.

Software's limits

Tax software has been embraced warmly by a nation of computer enthusiasts. Helping things along have been changes which began allowing people to file e-returns directly from their home's personal computers.

This year, the IRS began an experiment which may make it even easier to e-file. On the first of the year, the agency sent out approximately 12 million e-file customer numbers (ECN) to U.S. taxpayers.

Taxpayers put the ECN onto their returns and the ECN acts as a "signature" for the IRS, verifying the identity of those who file electronically.

In addition, the IRS is also allowing people to pay their taxes electronically for the first time, either with a credit card or by directly debiting a savings or checking account.

The ECN is a limited test for this year. Taxpayers who don't receive the number will have to go through the seemingly old-fashioned method of signing and sending form 8453-OL to the IRS via regular mail.

Geisler said tax software packages can be beneficial as long as people don't expect too much out of them.

"Just because you use the tax software does not mean your return is right," he said. "If you didn't put in the information it needs, it doesn't know that."

Because of the confusion of the average taxpayer, software companies have worked hard to make the programs foolproof.

The taxpayer is guided through the application with a series of questions, each of which leads to another series depending on the answers.

In addition, the software tries to be diagnostic when you're done. It may ask about some information that appears to be missing or tell you if there are inconsistencies between two numbers.

Aside from acting as a software guide, the real benefit of tax software may be less complicated.

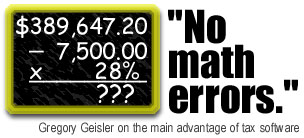

"No math errors," said Geisler. "The fact that so many figures get carried between forms makes it easy to make a mistake entering numbers."

Also, the numbers of phase-ins and phase-outs in tax computation are quite high nowadays. For instance, as your income goes up, you get tagged for more Social Security taxes. Tax software can be better about keeping an eye on these shifts.

Geisler warned that the ease of the software could be misleading for some taxpayers, though.

If you had a CPA prepare your taxes last year, don't necessarily think that a software package can be a cheap alternative to detailed financial advice. Software isn't a replacement for a qualified tax professional.

However, for many people it will be the first step in keeping taxpayers home rather than having them trudge off to the preparer's office.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|