|

Retailers post solid month

|

|

March 4, 1999: 11:57 a.m. ET

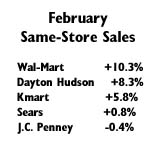

Discounters, big apparel stores lead February advance; J.C. Penney slips

|

NEW YORK (CNNfn) - The national shopping spree continued in February, with most of the major department and specialty store chains posting improved comparable- store sales.

"The consumer's been out in force for several months," Richard Church, Salomon Smith Barney's retail analyst, told CNNfn Thursday. He cited consumer confidence levels, high employment and a still vibrant stock market as reason for the consumer spurt, adding "all of these factors have contributed to very robust sales at retail."

Leading the way were two of the big discount chains: Wal-Mart (WMT) and Dayton Hudson (DH), which operates Target stores. While Wal-Mart's total corporate same-store sales -- which include Sam's Club warehouse outlets -- were up 10.3 percent in the month, Wal-Mart stores themselves posted a 10.8 percent gain in stores open a year or more.

"There's a lot going right with Wal-Mart," said Church, singling out the retailer's push into grocery sales as one reason for its success. "They've also done a lot of good things in terms of improving the presentation and the content of the merchandise in their general stores."

The discount end also helped Dayton Hudson. While the overall company same-store sales -- which include Mervy'n and the company's department stores -- were up 8.3 percent, Target stores posted a gain of 9.7 percent.

Kmart (KM), the other major national discount retailer, posted a 5.8 percent gain in same-store sales on Wednesday.

Also posting strong sales in February were big apparel retailers. Gap (GPS) same-store sales were up 12 percent, while stores affiliated with the Limited (LTD) had a same-store sales increase of 13 percent. And the Ann Taylor (ANN) chain of women's clothing stores came in with a 21.4 percent increase in same-store sales.

Among department stores, Sears (S) posted a 0.8 percent same-store increase and Federated (FD) sales were up 1 percent. But J.C. Penney (JCP) said sales at its department stores open a year or more were down 0.4 percent.

Some targeted retailers of clothing had a tough month. Children's clothing specialist Gymboree (GYMB) saw sales decline 10 percent, teen clothes purveyor Gadzooks (GADZ) had a 10.6 percent sales decline, and upscale women's clothier Talbots (TLB) saw sales drop 7.1 percent.

Salomon Smith Barney's Church said he sees the impulse to hit the malls and discounters continuing throughout the year.

"I don't expect it to be as strong in 1999 as what we saw in 1998, which was an extraordinarily good year," Church said. "But we do see still further growth from the consumer throughout the course of 1999, particularly in the first half of the year, and February was a good example of that, so we're off to a good start."

|

|

|

|

|

|

Wal - Mart

Target

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|