|

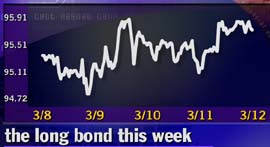

Bonds hold on to gains

|

|

March 12, 1999: 3:24 p.m. ET

Inertia, negative inflation keep Treasury yields low, but dollar turns mixed

|

NEW YORK (CNNfn) - U.S. Treasury bonds neared the close of a directionless week higher Friday, but even surprisingly inflation-free economic statistics seemed to be losing their charm as oil prices climbed in the background.

By 3:00 p.m. the benchmark 30-year Treasury bond had climbed 10/32 of a point in price to 95-24/32, sending the yield back down to 5.54 percent. Since Monday morning, the yield crept down a scant 5 basis points.

According to the Labor Department, the February producer price index showed prices declining by 0.4 percent overall, a dramatic slide compared with last month's 0.1 percent price inflation. Excluding food and energy, the index remained flat, showing 0.1 percent inflation.

Because economists had expected the overall figures to show deflation at a milder level of 0.1 percent, investors were pleasantly surprised by the decline.

"It's very encouraging to see a negative PPI," said Susan Hering, chief economist at Carr Futures. "People just aren't in the mindset to expect prices to rise sharply."

However, activity was lackluster at best, with many traders opting to watch NCAA basketball instead of their trading screens.

Michael Boss, bond futures broker at IBJ Lanston Futures, called the PPI figures "a surprise on the good side," but otherwise found little new market-moving interest in the report.

"Basically, what else is new? For the last 2, 2-1/2 years we've had very good numbers," he said. "I think traders shrugged off January's strong number. They shrugged off today's number. Pretty much more of the same of what we've seen and that of course is surprisingly strong growth, no inflation."

Furthermore, Boss said that the bond market has now almost completely discounted the threat of higher interest rates in the near term.

"Mr. Greenspan dropped some subtle hints that he's okay with the inflationary picture," he said. "A week ago . . . 60, 70 percent of traders thought the Fed would adopt a tightening bias in their next meeting, which is March 30. That is down to about 13 percent right now. That is good for the bond market."

Higher interest rates would render Treasury bonds and other fixed-income securities comparatively unattractive investments by reducing real returns on capital. Recent speculation that the Federal Open Market Committee might be moving toward a rate-tightening policy depressed demand for bonds, driving yields up to seven-month highs.

Although the rate fears now seem subdued, Boss noted that the now-reactive bond market will require a strong outside push in order to move in either direction outside its current directionless trend.

"I think the treasury market is trying to do better," he said. "We just need a little bit more oomph to get this thing going out here."

Oil: the oomph?

Such "oomph," albeit toward the downside, could even now be materializing in the form of higher oil prices. Oil cartel OPEC cut petroleum production by 2 million barrels a day Friday in an attempt to stem the world petroleum glut, causing crude prices to immediately surge above $13 per barrel.

Continued low oil prices have been a major factor in keeping U.S. price inflation low in recent months, but economists already are warning that an oil resurgence could throw open the doors of the economy to let inflationary pressures in.

"No doubt, it's been on traders' radar screens," said Boss. "But until we see more evidence of inflation coming down the pipeline, I think things are still looking pretty good for the time being."

Dollar back in play

The dollar reasserted itself against other global currencies, knocking the euro off Thursday's two-week high as elation over Oskar Lafontaine's resignation as German finance minister gave way to worries that the departure would not be enough to save Europe from interest rate cuts ahead.

Lafontaine resigned from his post Thursday, sparking rejoicing throughout the European investment community. The euro soared more than 2 cents off its intraday lows, its largest single-day push ever.

However, Friday brought the sobering realization that the European Central Bank (ECB) is now even more likely to lower interest rates in Lafontaine's absence. The German minister was a strident advocate of lower rates, leading the ECB to behave in a contrary manner in order to avoid looking like a tool of German fiscal policy.

With Lafontaine gone, pan-European monetary authorities now may see their way clear to cut rates anyway, artificially curbing the euro's official value and thereby depressing speculative demand.

By 9:00 a.m. ET, the euro had stumbled back to $1.0902 from its previous close of $1.1043.

However, the dollar retreated from the yen as the urge to lock in tentative profits kicked in late in the afternoon.

While the greenback had earlier gotten a boost from data showing that Japan remains in a state of economic recession, the gains proved transitory and by 3:00 p.m. the dollar was down to 118.80 yen from its uninspired Thursday close of 119.12.

|

|

|

|

|

|

|