|

CNNfn market movers

|

|

March 12, 1999: 2:44 p.m. ET

Drillers and e-commerce pull ahead, but National Semi, Safeskin see the downside

|

NEW YORK (CNNfn) - Wall Street found itself torn between black gold and red ink Friday, leaving the blue chips dazed and demoralized and the tech sector in even worse shape.

Among the day's scattered standout advances, shares of seed supplier Pioneer Hi-Bred (PHB) soared 7-7/16 to 31-15/16 after Dow component DuPont (DD) said the two companies were talking about a possible combination. DuPont currently holds a 20 percent stake in Pioneer and has indicated an increasing appetite for acquisitions.

DuPont shares edged up 1/4 to 58-3/8 on the news, but fellow blue chip Disney (DIS) left the chemical firm in the dust with its own 1-3/8-point advance to 36-1/16. Both BT Alex. Brown and Deutsche Bank expressed confidence in the media giant, rating it a "buy."

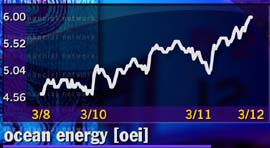

OPEC deal good for drillers

The oil-field sector once again bubbled to the surface of the market, dominating lists of gainers on all three major U.S. stock exchanges after OPEC and non-OPEC members agreed to cut petroleum output by 2 million barrels a day.

Nuevo Energy (NEV) extended Thursday's climb, edging up 1-3/8 to 10-5/8, while B.J. Services (BJS) was right behind on a net basis, up 13/16 at 18-3/16. Among other oil service firms climbing 10 percent or more, KCS Energy (KCS) added 5/16 to 2-5/8 and Seagull Energy (SGO) surged 3/4 to 6-1/16.

Western Gas (WGR) wasn't left out, jumping 15/16 to 7, while Canadian Occidental Petroleum (CXY) added 7/16 to 11. UTI Energy (UTI) gained 1-1/8 to 9 and Halter Marine Group (HLX) edged up 3/8 to 14-13/16.

Blood in the techs

The technology sector waded deep into the red after several key tech players reported disappointing profits and profit warnings overnight, unnerving investors.

Chipmaker National Semiconductor (NSM) sagged 5/8 to 10-1/16 despite third-quarter losses coming in narrower than Wall Street had expected. The company warned that it is "going into the fourth quarter more cautiously" due to "competitive uncertainties in the personal computer markets."

The market also saw CMGI 's (CMGI) glass of earnings as half-empty, knocking shares down 18 to 164-1/8. Although the Internet venture capital firm reported a profit for its fiscal second quarter, the results include a one-time gain of $44 million relating to its sale of Lycos (LCOS) shares. Not counting the sale, the company's losses were much wider than Wall Street had been looking for.

The CMGI downturn came amid a general retreat in the Internet sector, with tumbling CMGI shares meeting such Web bellwethers as Yahoo!, Amazon.com, CNET and Inktomi on the way down. Yahoo! (YHOO) fell 4-5/16 to 174-11/16 and Amazon.com (AMZN) dropped 3-1/2 to 131-3/8. CNET (CNET) plunged 7-13/16 to 88 and auctioneer eBay (EBAY) shed 7-1/2 to 142-1/2.

One bright spot online was providers of e-commerce software. Elcom International (ELCO) firmed 21/32 to 3-7/16, Finet Holdings (FNHC) added 11/32 to 2-3/8 and Bottomline Technologies (EPAY), in a transitional stage to becoming an e-commerce provider, gained 14-3/4 to 52-3/8.

Cassandras offline

Despite the computing woes, the morning's biggest losses came from non-technology companies predicting profit gloom ahead.

Latex glove maker Safeskin (SFSK) led the early declines, plunging 5-7/16 to 9-13/16 after warning of slightly disappointing current-quarter profits, while organizer firm Day Runner (DAYR) slid 2-1/2 to 10-3/4 on its own forecast of widening losses ahead.

Drug store operator Rite Aid (RAD) plunged 13-1/2 to 23, becoming the New York Stock Exchange's biggest net loser after it said fourth-quarter earnings will miss the mark by as much as 40 percent. Competitor Duane Reade (DRD) also suffered, falling 2-3/16 to 27-11/16, while Walgreen (WAG) slipped 9/16 to 30-3/8 and CVS (CVS) slid 1/4 to 51-15/16.

Among other companies knocked into the red by ominous forward-looking statements, STM Wireless (STMI) fell 3/4 to 2-1/2. The communications device maker said per-share losses could touch $1.63 in the current quarter, leaving investors unimpressed by the company's accompanying vow to cut expenses and payrolls.

United Stationers (USTR) lost 2 to 15 after warning of a narrower disappointment ahead. The office supply company said its first quarter will bring in between 48 and 50 cents per share, while Wall Street had expected a figure of 51 cents.

Outside the whirl of earnings reports, shares of MedPartners (MDM) plunged 1-1/8 to 4-11/16 after California state officials took over the health care provider's operations and filed for Chapter 11 bankruptcy protection.

The company said it believes the action was "unwarranted" and "completely unexpected."

Hospital real estate owner Ventas (VTR) slipped 1-1/4 to 5-1/16, but had no comment on rumors that its property-operations arm Vencor (VC) is facing financial problems. J.C. Bradford downrated the stock to "hold" from "buy."

|

|

|

|

|

|

|