|

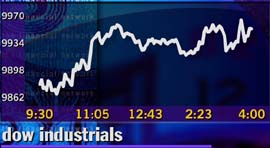

Dow just shy of 10,000

|

|

March 15, 1999: 5:47 p.m. ET

Blue chip index continues to claw its way toward historic landmark level

|

NEW YORK (CNNfn) - The Dow's trek toward 10,000 reached a new level Monday, with the blue chip index finishing just 41 points shy of the milestone.

A spurt of multibillion dollar mergers -- bringing together banks, chemical powerhouses and natural gas firms -- added to catapulting airline stocks and resurgent technology issues, to produce a broad-based rally that brought about records for the Dow and S&P 500 and the second largest one-day point gain for the Dow transports index.

The Dow Jones industrial average advanced 82.42 points to 9,958.77, ending just short of the five-figure milestone.

Market breadth on the New York Stock Exchange, which had been negative for most of the trading session, changed to positive in the last hour of trading to end the day with advances leading declines 1,523 to 1,445 on volume of 731 million shares.

The Nasdaq Composite rallied 49.91 points, or 2.1 percent, to 2,431.44. The S&P 500 index gained 12.67 points to 1,307.26 -- its first close above 1,300.

The Dow transports index outshone all other market measures, roaring 4.2 percent to 3,404.65 -- a gain of 137.14 points.

"The thing that's very, very impressive is the quality of the stocks that are driving this," said Ralph Acampora, Prudential Securities' famed chief technical analyst. "It's a very narrow list, but a very beautiful list."

Others were a bit more skeptical. Reflecting the market's caution and speculation among some investors that Dow 10,000 could turn into a sell signal, Greg Kuhn, stock market analyst at Kuhn Asset Management, said Wall Street faces a greater downside risk, especially over the longer term.

"To me, 10,000 is really inconsequential, because looking at the bigger picture, I think going over the next six months the bigger risk will be to the downside," Kuhn said.

But Joseph McAlinden, chief investment officer at Morgan Stanley Dean Witter Advisors, set his eyes on the really long-term picture, hoping the Dow would conquer 10,000 in a matter of days and wondering if the index would then proceed to double by the end of the next decade. (275K WAV) or (275K AIFF)

Acampora joined McAlinden, taking his projections even further. The feisty analyst, whose words often have halted or inspired tremendous rallies in the market, sees the Dow conquering 14,000-15,000 by the end of the year 2000, and maybe even 30,000 in 10 years. (268K WAV) or (268K AIFF)

"It's a wonderful market," Acampora said.

The bond market finished the day higher with the benchmark 30-year Treasury bond up 2/32 of a point in price for a yield of 5.52 percent.

The dollar fell against the yen as investors shifted money back into Japan ahead of the country's fiscal year end at the end of March. The dollar also moved lower against the euro, pressured by some strong German economic data.

Financials take the lead

Much of the stock market's Monday performance was driven by a heavy dose of alliances and mergers in a broad array of industries.

News that BankBoston (BKB) and Fleet Financial Group (FLT) are joining forces in a $16 billion deal sent BankBoston shares up 5/16 to 47-1/4 but the stock of Fleet fell 2-9/16 to 42-3/16. The news got mixed reception among Wall Street experts: NationsBanc Montgomery Securities upgraded both BankBoston and Fleet to "buy" from "hold," but PaineWebber downgraded BankBoston to "neutral" from "buy."

The merger, however, helped lift other banking and financial stocks, with BankAmerica (BAC) rising 1-1/2 to 73-3/4 and Dow member J.P. Morgan (JPM) advancing 3-3/8 to 125-3/8.

Meanwhile, in another niche of the financial services industry, brokerage Donaldson, Lufkin & Jenrette (DLJ) shot up 3-1/4 to 67-1/4 after the company's online arm was ranked No. 1 in a survey by Barron's this weekend. Morgan Stanley Dean Witter 's (MWD) Discover online brokerage came in second, and the company's stock rose 7/8 to 102. Salomon Smith Barney raised its 12-month stock price target for Morgan Stanley to $115 a share from $100, citing low valuation.

Merger machine churns again

Elsewhere in the day's news, shares of Dow component DuPont (DD) slipped 1-1/2 to 56-1/4 on news the chemical giant is paying $7.7 billion for seeds producer Pioneer Hi-Bred International (PHB). Pioneer's stock rallied 4-1/16, or nearly 12 percent, to 38-3/8.

Based on the news, and arguing that Pioneer's future stock price will depend on merger speculation rather that fundamentals, Merrill Lynch withdrew its "intermediate-term accumulate" and "long-term buy" ratings on the company, replacing them with a "no opinion."

In the natural-gas business, shares of El Paso Energy (EPG) fell 2-5/8 to 32-1/16 following news the company is buying Sonat (SNT) in a $6 billion stock and debt deal. Sonat's stock eased 7/16 to 29-5/8.

Meanwhile, in the high-tech sector, shares of Netscape (NSCP) surged 6-1/8 to 91 after the Justice Department cleared the way Friday for the browser-maker/Web portal to merge with online service giant America Online (AOL). AOL's stock gained 5-7/8 to 102.

And shares of CMGI (CMGI), which is itself a major player in the ongoing merger of Lycos (LCOS) and USA Networks (USAI), shot up 28-5/8, or more than 17 percent, to 192-5/8 on news the company will replace Netscape in the Nasdaq 100 index.

Transports head to higher ground

Transportation stocks powered much of the broad market's rally after UAL (UAL), the parent of the nation's largest carrier, United Airlines, said it will beat earnings expectations for both the first quarter and the full year, due partly to last month's pilot unrest at rival AMR 's (AMR) American Airlines.

UAL's shares soared 6-11/16, or almost 10 percent, to 73-3/4, the biggest net gainer on the NYSE.

Shares of AMR rose 3-3/4 to 61-3/4 and Delta Air Lines (DAL), the third-largest airline, shot up 5 to 69.

Techs join the rally

Technology stocks, which last week lagged the broader market and contributed to the Dow's interrupted climb toward 10,000, found new buyers Monday and helped the rest of Wall Street work its way toward new higher ground.

Among the sector's leaders, Dow component IBM (IBM) rose 4 to 182, and fellow Dow 30 member Hewlett Packard (HWP) advanced 2-9/16 to 71-9/16.

HP is part of a broad alliance that includes giants Microsoft (MSFT), Intel (INTC) and Canada's Nortel (NT) that was announced Monday afternoon. The group will work to create telecommunications networking equipment products in direct competition with Cisco Systems (CSCO) and other established players in the field.

Microsoft's stock rose 5-11/16 to 165-7/8, Intel eased 3/8 to 117-7/8 and Nortel's American depositary receipts rose 1-3/8 to 60-3/16.

(Click here for a look at today's CNNfn market movers.)

(Click here for a look at today's CNNfn technology stocks report.)

-- by staff writer Malina Poshtova Zang

|

|

|

|

|

|

|