|

CNNfn market movers

|

|

March 16, 1999: 2:35 p.m. ET

The chips are up, but the unending flow of profit warnings hurts MicroTouch

|

NEW YORK (CNNfn) - Fresh worries over valuations took the blue-chip shine out of Wall Street's eyes Tuesday, although encouraging words for the chip-equipment makers managed to lend the technology sector some welcome breadth.

Morgan Stanley analyst Jay Deahna upgraded several stocks tied into the semiconductor industry to "strong buy" from "outperform," citing generally higher demand in the wake of Monday's news that chip sales are back on the boom cycle.

One such "strong buy" was ASM Lithography (ASML), which climbed 2-13/16 to 45-1/4. Etec Systems (ETEC) jumped 3-1/8 to 48-1/8, rallying not only to Deahna's rating but to his new higher 1999 price target of $60.

Deahna also raised his price target on Cymer (CYMI) to $37 from $35 and said he saw the company trimming its operating losses, driving shares up 1-3/8 to 25.

Other chip-equippers, while not singled out by Deahna, fed into the rally. Xilinx (XLNX) surged 2-11/16 to 40-1/4 and Applied Materials (AMAT) leapt 3-3/16 to 63-3/4.

Meanwhile, the chipmakers themselves, the core of the semiconductor industry, posted strong gains of their own. Texas Instruments (TXN) climbed 5-3/4 to 105-3/16 and Micron Technology (MU) added 2-7/8 to 51-7/8, while sector leader Intel (INTC) gained 3-3/8 to 121-1/4.

Disappointing bottom lines

Chip companies aside, Wall Street remained merciless in punishing stocks for missing the earnings mark.

MicroTouch (MTSI) shares fell 2-7/8 to 13-1/4 after the maker of computer touch-access screens said an unfavorable verdict in an employee-hiring suit would cost it more than $2.6 million, causing current-quarter profits to fall short of forecasts. The company noted that the case remains under appeal.

Likewise, Homestead Village (HSD) slid 7/16 to 3-1/4 after the company blamed lower-than-expected residency rates at its Texas and Raleigh, N.C., properties for projections of disappointing earnings ahead.

Even AMR (AMR), holding company for major air carrier American Airlines, suffered thanks to its confirmation that last month's labor dispute hurt the company's bottom line. Shares slid 13/16 to 60-15/16.

Machinist Atchison Casting (FDY) lost 3/4 to 7-7/8 on the back of its own warning, this one due to customer ordering delays and "continued weakness which has been evident in the agriculture, energy, mining, and steel sectors since last summer."

Not even estimate-meeting profits were safe from Wall Street's punishing hand, as electronics firm Solectron (SLR) learned. Shares slid 1-1/16 to 44-15/16 even though the company overnight reported earnings exactly in line with what analysts had expected.

Looking to the bright side

Despite the shadows cast by gathering downward profit expectations, the prophecy game cut both ways, as some stocks were rewarded for boasting that current-quarter performance will be even better than the Street had predicted.

Investors found car lessor Ugly Duckling (UGLY) living up to its fairy-tale heritage, with shares climbing 1/4 to 6-7/16 after the company displayed surprising appeal by saying it will break even when analysts had looked forward to a substantial loss.

Medical-equipment maker Sabratek (SBTK) actually gained 1-11/16 to 17-1/16 despite the company's seemingly disappointing fourth quarter, which fell short of estimates by 2 cents per share.

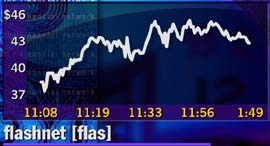

Beyond the bottom line, Internet IPO Flashnet Communications (FLAS) leapt 26-3/4 from its starting price of $17 to trade at 43-3/4. The Internet service provider had originally planned to price at between $12 and $14, but raised its prospective upper range to $15 Monday.

High-tech entrepreneurial firm Safeguard Scientific (SFE) also soared on the seemingly endless allure of Internet IPOs, climbing 6-13/16 to 55 after closely-aligned Internet Capital Group (ICG) said it is increasing its Net investment strategy. Analysts expect ICG to go public in late 1999, at which time Safeguard, which owns 26 percent of the company, could go through the roof.

Among older Internet firms, computer e-retailer Cyberian Outpost (COOL) surged 4-13/16 to 23-5/16 after getting into the electronic auction game, nudging closer to Wall Street darlings eBay (EBAY)and uBid (UBID).

|

|

|

|

|

|

|