|

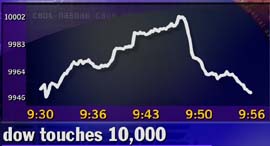

Dow goes to 10,000 and back

|

|

March 16, 1999: 10:24 a.m. ET

Blue-chip index crosses five-figure mark, then quickly turns around

|

NEW YORK (CNNfn) - After four days of cautious advances and quick retreats, the Dow Jones industrial average made history in the first half hour of trading Tuesday, crossing 10,000 for the first time in its 114- year history.

But the euphoria was short-lived, and minutes after the index crossed the five-figure threshold, sellers came in, wiping out the Dow's gains and sending the index below Monday's closing level.

Shortly after 10 a.m. ET the Dow Jones industrial average was 25.53 points lower at 9,933.24, retreating after climbing as high as 10,001.78.

On the New York Stock Exchange declines outnumbered advances 1,261 to 1,036 on trading volume of 114 million shares.

The Nasdaq Composite eased 7.63 to 2,423.81. The S&P 500 fell 4.63 to 1,302.63, trading in uncharted territory.

Bonds were higher, helped a bit by a small recovery in the dollar and keeping their gains after the release of February industrial production data that came above estimates. The bellwether 30-year Treasury bond rose 7/32 of a point in price, for a yield of 5.50 percent.

The dollar recovered small ground against the yen, but remained stuck in a narrow trading range. The dollar also inched up against the euro.

Caution near the peak

As had been the case over the past three trading session, the proximity to 10,000 seemed to cause caution among investors.

Still, an announcement by chemical giant and Dow component Union Carbide (UK) that first-quarter earnings will come in at the high end of forecasts, helped lift that stock 1-3/4 to 45-1/4 and push the Dow toward the five-figure landmark.

The Dow also got some help from Merck (MRK), which rose 3/4 to 85 on news the Food and Drug Administration has approved broader use of the company's drug Mevacor, a cholesterol lowering treatment.

However, the Dow came under pressure from losses in its technology and financial components. IBM (IBM) sank 1-9/16 to 180-7/16, American Express (AXP) fell 1-3/16 to 124-9/16 and J.P. Morgan (JPM) lost 3/16 to 125-3/16.

The rest of the market appeared satisfied to remain within a limited trading range, with few stocks making large strides in either direction.

Webs on a roll

Among the few outstanding issues, shares of Go2Net (GNET) soared 18-7/16 to 131-13/16, a gain of more than 16 percent coming on top of strong gains from Monday when Microsoft co-founder and billionaire investor Paul Allen said he would buy a $300 million stake in the company which operates a network of community Web sites and the MetaCrawler search engine.

Other Web-related issues shared the excitement, with Cyberian Outpost (COOL) surging 6-3/4, or more than 36 percent, to 25-1/4 and CyberCash (CYCH) rallying 1-1/2, or more than 10 percent, to 15-3/4.

More established Internet players showed a cooler attitude, with America Online (AOL) rising 2 to 104, Amazon.com (AMZN) slipping 2-3/8 to 136-9/16 and Yahoo! (YHOO) easing 2-13/16 to 176-5/8.

|

|

|

|

|

|

|