|

Fund stocks flounder

|

|

March 19, 1999: 7:11 p.m. ET

Public fund companies struggle on Wall St.; average stock fund returns are flat

|

NEW YORK (CNNfn) - Some of the leading names in mutual funds are falling flat on Wall Street -- in more ways than one.

Stocks in several publicly-traded fund companies have been stuck in the red this year, while the average annual returns of their domestic and international stock funds are also hitting a wall, according to Morningstar, a Chicago fund-tracker.

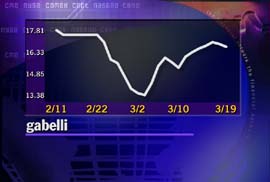

But despite a lackluster initial public offering in February at one of the companies, Gabelli Asset Management, some analysts remain bullish about the long-term prospects for fund company stocks.

"It's really an excellent industry, and once you cover fixed costs, it's very profitable," said Alex Paris Jr., an analyst at Barrington Research in Chicago.

Bearish numbers

Among the few publicly-traded mutual fund companies, only T. Rowe Price (TROW) is beating the S&P 500 year to date. T. Rowe Price is up about 8 percent year to date at 37-1/4 as of the market close Thursday. The S&P 500 has risen less than 6 percent so far this year.

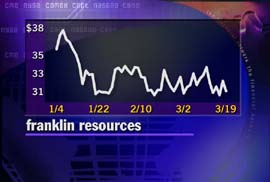

Franklin Resources (BEN) is up 1.5 percent at 32-1/2, while Gabelli (GBL) is hovering near the break-even mark at 16-7/8 from its Feb. 11 IPO price of 17-1/2. Federated Investors (FII) is down about 7 percent at 17-3/16.

The average annual return for T. Rowe Price domestic stock funds as of Feb. 28 year to date is down 3.06 percent, while international funds are off 1.61 percent, according to an analysis by Morningstar.

Franklin's domestic funds are down 3.65 percent in the same time, while International equity funds are off 2.91 percent. (The fund family includes Franklin Funds, Franklin Mutual Series, and Franklin Templeton Funds).

Federated's domestic funds are off 2.59 percent, while International funds are up 0.74 percent.

Gabelli delivered slightly better returns compared with other funds in the same category, the data shows. Domestic stock funds were up 0.60 percent and ranked in the 36th percentile for the category, while international stock funds were down 1.19 percent but in the 29th percentile, Morningstar said.

Is there a fund-stock link?

Scott Cooley, an analyst at Morningstar, said there is a connection between fund performance and stock price in the long term.

"Over time, the fund families that acquire assets, are growing and have good performance are going to do better," Cooley said. "There has to be a link."

At the same time, Cooley said some of the fund groups invest in parts of the market that have not been doing well. For example, Franklin Mutual Series is value-oriented, and value stocks have been beaten down. Yet Franklin's funds perform well compared with peers, he said.

"In general, it's a pretty well-run company," Cooley said about Franklin Resources. "But it's just an extremely tough environment for them. Until market sentiment changes quite a bit, they're going to have a tough time."

Franklin Resources declined comment on the stock's performance.

George Roache, president of T. Rowe Price, argued that you cannot compare the company's stock with its diversified stock portfolios. You also cannot correlate average annual fund returns with the performance of the company's stock.

"There will be points in time when T. Rowe Price the stock will substantially outperform the funds, and there will be times when it will substantially underperform the funds," Roache said.

Chris Donahue, CEO of Federated Investors, said fund performance doesn't have a "direct and immediate link."

"But the overall performance of our funds has a lot to do with our ability to sell funds and maintain our clients," Donahue continued. "Therefore fund performance is critical to the long-term health of Federated stock."

Donahue said 90 percent of Federated funds are rated 3, 4, or 5 out of 5 stars for risk-adjusted returns at Morningstar. Half of the funds are 4 or 5 stars.

Mutual-fund company stocks, like other financial services, were hit hard by the market correction in the 3rd quarter of 1998, Donahue and Roache said. For example, T. Rowe Price's stock sunk into the 20s and shot up to the high 30s in a two-week period at that time, Roache said.

"In the long run, this is a good industry and the companies should do well," Roache said.

Gabelli would not comment on the issue of its stock.

The Street yawns at IPOs

Gabelli sold 6 million shares at its IPO, raising about $105 million that represented about 20 percent of the company. Insiders at the company own the other 80 percent. About two weeks later, Gabelli staff members, on their own, purchased $2.9 million worth of stock -- probably about 150,000 shares -- in an apparent show of faith in the company.

"I think it's a good company with a very strong management and it's priced very attractively relative to the market and its peers like T. Rowe Price and Franklin Resources," Paris of Barrington Research said.

Salomon Smith Barney recently started covering Gabelli and rated it as a "buy."

But not all fund companies have been as bold as Gabelli and some have postponed or even canceled plans to go public in recent months.

Neuberger Berman Management Inc. scrapped plans for an IPO last summer as the market corrected, Paris said.

Larry Zicklin, managing director at Neuberger, said the company has no plans to try an IPO again -- but not because of a lack of interest.

"There are certain things that are more critical to us that we want to take care of," he said, without elaborating. But he did say those priorities are internal.

The upside of IPOs

Roache, who engineered T. Rowe Price's public offering in 1986, saw it as an opportunity to invest more money in the business.

"It allowed us to grow more effectively," Roache said.

T. Rowe Price uses the capital to invest in its funds and update its buildings and technology. It also keeps higher cash reserves on hand in case investment opportunities come up, he said.

Federated Investors considered going public so important the company did it twice.

Donahue's father, John, started the company in 1955 with a business partner by selling mutual funds door-to-door. They took the company public from 1960 until they sold it to Aetna, the former insurance giant, in 1982.

Federated had hoped to combine its funds and distribution capabilities with Aetna's computer power and huge client list that included Boeing (BA) and Ford (F). The company also wanted to develop and market a new series of Aetna funds. But Aetna did not want to get into the mutual-fund business, the younger Donahue said. (The father, now chairman, does not do media interviews).

Management bought Federated back in 1989, and they went public once again on May 14, 1998.

What's so great about being public? The Donahue-son says it gives Federated stronger name recognition.

"And because we sell through intermediaries, an IPO helps us strengthen our relationship with the people who sell our funds," Donahue said.

Donahue is optimistic for the future because he said fund companies will be able to capture more business from aging baby boomers and growing populations in Europe and emerging markets that will be planning for retirement.

"The culture that got created by two fellas selling mutual funds door to door is a sales and distribution culture," Donahue said. "We think by being public it puts us in the best position to take advantage of all these opportunities."

-- by staff writer Martine Costello

|

|

|

|

|

|

|