|

Relief for 'innocent' taxpayers

|

|

March 26, 1999: 10:59 a.m. ET

You may be absolved from your spouse's taxes, even if you filed a joint return

|

NEW YORK (CNNfn) - Discovering you owe taxes, under any circumstances, is not exactly a joy. But finding out you owe someone else's taxes can be downright depressing.

Luckily, recent changes in the tax code have made it easier for taxpayers to distance themselves from the liabilities of their spouses, or ex-spouses, even if a joint return was filed.

Generally, the IRS holds both parties fully accountable for taxes, interest or penalties due on a joint return, even in the event of a divorce. In fact, both spouses remain responsible even if one absolves the other of tax liability as part of a divorce agreement.

"People think if a divorce document relieves them, they're free and clear," said Ilene Leopald Persoff, a certified public accountant. "But they are not. The IRS will still come after you." The divorce document simply gives you the right to sue your former spouse for funds owed the IRS.

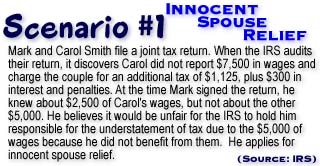

There may still be a way out, however. If your spouse was less than honest on your joint return and you didn't know about it, you can apply for "innocent spouse relief." (Form 8857)

To qualify, you must be able to prove you did not know that your husband or wife underreported income or claimed incorrect deductions or credits at the time the return was filed.

The IRS will require you to sign a document, under the penalty of perjury, stating you did not know of your spouse's misrepresentations.

In addition to the individual facts and circumstances of your situation, tax collectors will consider whether you benefited from the understatement of tax and whether you were later divorced from or deserted by your spouse.

To prove you did not benefit, you will have to provide some basic information, such as your bank statements, says Cindy Frailing, information coordinator for the National Association of Tax Practitioners.

"Innocent spouses basically need to show that they didn't change their lifestyle or live a frivolous lifestyle," Frailing said. That includes expensive purchases, such as cars, jewelry, and furniture, or elaborate vacations.

Benefits can be both direct and indirect. Even money your spouse gives you years after he or she received it due to erroneous reporting can count as a benefit.

If you knew or had reason to know there was an understatement of tax due to your spouse's erroneous items, but did not know how large the understatement was, you may still qualify for partial relief.

Whether you get partial or full relief, you remain jointly liable for any tax, interest and penalties that do not qualify for relief.

The IRS will inform your spouse or former spouse of your request and allow him or her to participate in the determination of the amount of relief of liability. If your spouse believes you should not qualify for relief, you will have to take your case to tax court, where a judge will determine your eligibility.

Exploring other options

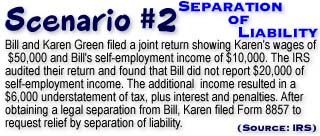

If you do not qualify for innocent spouse relief, there are other ways to disengage yourself from your spouse's tax bill.

For one, you can ask the IRS to separate your liability. If granted, the IRS will compute your taxes as if you and your spouse had filed separate returns. Under this option, the couple will allocate the understatement of tax between the two of them.

To apply for separation of liability, you must be legally separated, divorced or widowed. You also should not have been a member of the same household as your (former) spouse at any time during the 12-month period ending on the date you filed your Form 8857.

The burden of proof is on you to establish a reason for separating your liability.

Some tax attorneys now recommend filing for separation of liability in all divorce cases as a precaution against a spouse's possible erroneous reporting. Others say it's best not to file jointly at all if a divorce is imminent, since the lower-earning spouse may eventually be held equally liable for taxes on the higher-earning spouse's income.

If all else fails, you may want to consider filing for "equitable relief." Equitable relief exempts you from an understatement or underpayment of tax if you can establish that it would be unfair to hold you liable.

For example: if you take out a loan to pay for your $10,000 tax bill, but your husband spends that loan on himself, you may be able to claim equitable relief on the amount he squandered.

However, if you or your spouse transferred assets to one another to avoid tax, you are not eligible for separation of liability.

If you are denied innocent spouse relief, the IRS automatically will consider whether separation of liability or equitable relief apply.

Injured spouse relief

A different form of relief is available to those spouses who do not want their tax refunds applied to their partner's federal debts.

Because the government holds both spouses accountable in joint returns, one spouse's past-due federal tax, child support, or federal non-tax debt, such as a student loan, may be automatically paid with your joint tax return.

To avoid that, file for "injured spouse relief," which ensures your share of the overpayment won't be applied against your spouse's debt. (Form 8379)

In any of the spouse relief cases, you should seriously consider consulting a tax professional, as the calculations involved in figuring who owes what can get quite complex.

-- by staff writer Nicole Jacoby

|

|

|

|

|

|

|