|

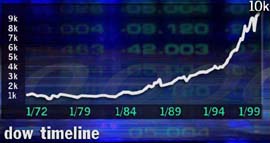

Dow 10,000 at last

|

|

March 29, 1999: 7:20 p.m. ET

Euphoria over oil and techs, drugs and banks pushes the Dow to record close

|

NEW YORK (CNNfn) - Wall Street marched into history Monday, with the Dow industrials closing above 10,000 for the first time, reflecting renewed confidence in the high-tech sector, oil merger mania and a strong dollar.

With traders cheering as the blue chip index closed in on the 10,000 milestone, a sense of relief seemed to descend on the floor of the New York Stock Exchange.

On three previous occasions, the Dow climbed above 10,000 -- only to retreat before the sound of the closing bell -- amid concerns about corporate profits at such blue chip companies like International Business Machines Corp.

So, it was fitting on Monday to see IBM leading the charge toward 10,000. Among the 30 companies that make up the Dow Jones industrial average, 24 stocks closed higher Monday, with IBM surging 5-1/2 to 177-7/8.

Some market watchers predicted the Dow's rally would continue in the coming weeks as investors look to put their tax refund money back into the market.

"I'm trying to tell people now that 10,000 is no longer the ceiling," long-time bull and Prudential Securities technical analyst Ralph Acampora told CNNfn. "I think it's the floor for the market over the next 5 to 10 years." (136K WAV) or (136K AIFF)

Traders greet Dow 10K with cheers

The Dow Jones industrial average closed up 184.54 points, nearly 1.9 percent, at 10,006.78, its seventh largest point gain of the year and its 16th largest of all time. (Click here for a 17.1M Quicktime movie of the close.)

Advances broadly outpaced declines on the New York Stock Exchange by a margin of 1,841 to 1,143, while trading volume was a robust 742 million shares.

In the last three and a half years, the blue-chip index has doubled in value, crossing five 1,000-point milestones.

All cylinders firing

Dow landmarks aside, the technology-rich Nasdaq Composite remained Monday's unsung trailblazer, climbing 73.67 points, more than 3 percent, to 2,492.84. The climb was the technology-rich index's fifth-largest gain ever.

The S&P 500 index rose 27.37 points, a gain of more than 2 percent and its ninth largest advance of all time, to 1,310.17.

Traders shrugged off an unexpectedly weak housing report, instead remaining confident that U.S. economic growth remains robust despite fluctuations. New-home sales fell to an annual rate of 881,000 in February from a rate of 899,000 in the previous month.

In addition, analysts said many investors were buying into the market ahead of Tuesday's meeting of the Federal Open Market Committee.

Few economists now expect any surprises from the committee, which sets U.S. interest-rate policy, but some traders were banking that confirmation of the forecasts will send stocks even higher in a relief rally.

Meanwhile, Wall Street got an additional charge from a strong dollar. Worries about the extent of armed conflict in Kosovo pushed the euro to new record lows against the greenback, while the yen made only minimal headway.

Bonds retreated from the stock market's triumph, while traders remained profoundly nervous ahead of the FOMC meeting and fearful of rising oil prices. The benchmark 30-year Treasury bond fell 22/32 of a point in price, driving the yield up to 5.64 percent.

Technology back in front

In stocks, the high-tech sector picked up right where it left off after Friday's rally, reasserting its leadership to push the broader market higher.

In particular, investors seemed to have mostly banished their worries surrounding the growth outlook for the computer industry, sending shares of most big PC manufacturers into positive territory.

Daniel Kunstler, technology analyst at J.P. Morgan Securities, said he was "not particularly concerned" by the computer sector's growth prospects, although he noted that the battle for market share could increase the pricing pressure on PC makers, causing stocks to become overvalued. (694K WAV) or (694K AIFF)

Dell (DELL) led the way, climbing 1-9/16 to 39-7/16, while Gateway (GTW) gained 2-13/16 to 68-7/16 and Compaq (CPQ) added 5/16 to 31-1/2. On the Dow, IBM (IBM) gained 5-1/2 to 177-7/8 and Hewlett Packard (HWP) climbed 15/16 to 69-5/8.

The market found shares of software giant Microsoft (MSFT) looking cheap after the company's two-for-one stock split went into effect, pushing shares up 3-5/16 to 92-3/8.

Shares of software rival Platinum Technology (PLAT) soared 14-3/16, nearly 150 percent, to 24-1/16 after the company agreed to a $3.5 billion buyout offer from Computer Associates (CA). Computer Associates shares reversed early losses, climbing 3-9/16 to 37-1/2.

Other technology bellwethers were also sharply higher, gathering speed late in the session. Cisco (CSCO) leapt 4-13/16 to 110 and Intel (INTC) surged 4-7/8 to 121-9/16, while Lucent (LU) climbed 7-7/8 to 109-15/16 on news that it had signed a $1 billion supply contract with AT&T (T).

Wall Street's technological exuberance even extended to Dow member Kodak (EK), sending shares in the photography and imaging giant up 3/8 to 65-5/8 despite the company's confession of disappointing corporate profits ahead.

Oil and other mixtures

The lifeblood of commerce helped grease the rally's wheels, as global oil stocks surged in the wake of talks regarding a possible $25 billion merger between Atlantic Richfield (ARC) and seemingly insatiable BP Amoco (BPA). Atlantic Richfield soared 8-11/16, more than 13 percent, to 74-1/16 and BP Amoco leapt 4-9/16 to 105.

Elsewhere in the sector, Texaco (TX) soared 2-3/16 to 57-3/4 on hopes that it might find a partner of its own soon. Dow component Exxon (XON) gained 1-7/16 to 73 and fellow blue-chip Chevron (CHV) added 3-1/8 to 89-15/16. Total (TOT) climbed 1-3/8 to 61-7/16 and Royal Dutch Shell (RD) gained 1-3/8 to 53-7/8.

In other merger news, the game of musical mergers continued in the pharmaceutical sector, with British giant Glaxo Wellcome (GLX) reportedly calling off merger talks with Bristol Myers Squibb (BMY).

Investors applauded the reported decision, pushing American depositary receipts of Glaxo up 2-7/16 to 64-1/4, while Bristol Myers gained 2-11/16 to 62-3/16. ADRs of perennial Glaxo merger hopeful SmithKline Beecham (SBH) climbed 2-3/4 to 69-3/8.

Finance firms up

Portfolio managers adjusted their assets ahead of the end of the first quarter, picking up shares of finance companies as well as the high-tech leaders in order to round out their accounts.

As a result, shares in large banks were almost uniformly higher, led by blue-chips J.P. Morgan (JPM), up 2-15/16 at 125-13/16, and Citigroup (C), up 3/4 at 64-1/8. Dow member American Express (AXP) climbed 2-9/16 to 123-5/16, while outside the Dow 30, Republic New York (RNB) surged 1-15/16 to 46-11/16.

Among the big Wall Street firms, Hambrecht & Quist (HQ) was a clear winner, soaring 2-3/16 to 35-3/16. Leading discount broker Charles Schwab (SCH) climbed 2-7/8 to 95-7/8 and Donaldson, Lufkin & Jenrette (DLJ) gained 1-11/16 to 65-1/2.

(Click here for a look at today's list of CNNfn market movers.)

(Click here for a look at today's CNNfn technology stocks report.)

-- by staff writer Robert Scott Martin

|

|

|

|

|

|

|