|

Old World plays catch-up

|

|

April 5, 1999: 3:28 p.m. ET

E-commerce lags the U.S., but 'fear and greed' are driving growth in Europe

|

LONDON (CNNfn) - Europe, a continent fragmented by different languages, cultures and corporate attitudes, has a long way to go before it has an online shopper in every home.

But "a combination of fear and greed" is driving the development of e-commerce in Europe, says Paul Mullis, a partner at Ernst & Young.

And the prospects are attractive. Consumer spending over the Internet will grow spectacularly from $1 billion last year to $20 billion by 2002, Ernst & Young estimates.

That's small potatoes, however, when compared with an expected rise in U.S. online spending from $9 billion in 1998 to $55 billion in three years.

Cyber barriers

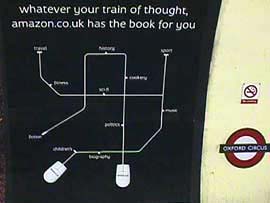

There are numerous reasons for the difference, not least the fact that the United States leads the way in most technology advances. Witness the trail-blazing by Amazon.com in Europe, which most experts hold up as the continent's leading e-commerce retailer.

"Don't get amazoned" is the advice Andreas Schmidt, president and chief executive officer of AOL Europe, has for European business leaders. He says "the U.S. is eating our lunch right now," when it comes to e-commerce.

A primary barrier to European e-commerce is the lack of overall Internet penetration.

U.S.-based consultant Jupiter Communications estimates the number of connected households in Europe grew to 10.2 million last year, will be 15.3 million by the end of 1999, and will cover 37.5 million residences by 2002. In contrast, the U.S. should have some 61.3 million households with an Internet connection by that time, despite having a smaller overall population.

"On top of Internet penetration, other issues affecting Europe include language and technology," said Mullis of Ernst & Young. "Around 80 percent of what you can purchase on the Internet is in English," he points out.

People like shopping

Attitudes in Europe also could slow the take-up of e-commerce. "People like shopping; it has a social side. In the U.S., a large part of the population lives in remote areas and are used to TV shopping, whereas in Europe most people live within easy reach of a sizable town," said Dr. David Grimshaw, a senior lecturer in information systems at Cranfield School of Management in the United Kingdom.

A lack of awareness of the realities of e-commerce is in sharp contrast to attitudes in the United States. One of the United Kingdom's leading employers' organizations, the Institute of Directors, made some revealing findings in a survey of European and U.S. business leaders published in early March.

Fourteen percent of U.S. companies thought other companies using the Internet were a competitive threat. But only 2 percent in the United Kingdom thought likewise. Almost none in France thought so. This compared with 10 percent in Sweden.

Indeed, the Swedes lead the way in Europe in terms of online spending. The average amount spent per transaction in Sweden is around $18 per head, according to Mullis, which compares with the U.S. figure of $20-$25, and is some way ahead of the U.K.'s $12 per head spending level.

Internet inroads

U.K. companies are making some online progress, however.

For instance, U.K. financial institutions are generally regarded as leading the way in online banking offers. FirstDirect, a unit of banking giant HSBC Holdings (HSBA), developed its Internet presence after pioneering telephone banking.

Others have followed suit, including the consumer financing unit of the U.K.'s largest insurer, Prudential (PRU). Launched last year, the service was given the somewhat unusual name of Egg.

Egg has been extremely successful in attracting lenders and borrowers alike, although analysts say that partly reflects the very favorable introductory rates the company offers.

Airlines took their cue from their U.S. rivals and partners. German carrier Lufthansa (FLHA) originally developed its presence on the Internet to sell its own tickets. From there it has developed a virtual ticketing mall through its partial-ownership of one of the world's leading central reservation systems, Amadeus.

One of the more innovative examples of how a distribution system can be maximized comes from supermarket Waitrose, a unit of employee-owned U.K. retailer John Lewis.

Waitrose has structured its use of the Internet to link up with a number of big employers close to one of its main distribution centers. British Airways, Digital and Oracle employees all can order groceries online and have them delivered to work before the end of the day.

Business-to-business e-commerce

Yet electronic consumerism is expected to take a back-seat to the business-to-business applications of e-commerce, where companies are attracted by the potential for huge savings. Ernst & Young's Mullis estimates that companies can halve process costs by using the Internet to link with suppliers and distributors.

"Most of the investment in European e-commerce is going into the business-to-business side," said Mullis. He estimates that the most aggressive companies will spend about 1.5 percent of annual revenue on this area in the next few years.

It seems unlikely, then, that a European challenge to Amazon.com will invade cyberspace in the next three years. But things change fast in the new medium.

What is certain is that if Europe is to transform itself into an on-line marketplace worth tens of billions of dollars by the middle of the next decade, there still are plenty of stumbling blocks to overcome.

-- by staff writer Mark Odell

|

|

|

|

|

|

|