|

Nets roll on, big techs lag

|

|

April 13, 1999: 6:38 p.m. ET

Financial services lead Internet issues; Intel nearly flat ahead of earnings report

|

NEW YORK (CNNfn) - The Internet sector plodded forward Tuesday, with Web financial service firms in the driver's seat.

Banks and brokerages with an Internet presence - or plans to establish one - were beneficiaries of consumers' increasing desire to carry out financial transactions online.

Surging onto the scene was Florida Banks (FLBK), rallying 22-13/16, or 270 percent, to 31-1/4, after the Jacksonville-based bank said it will offer real-time, Net-based banking.

Also getting into the action was software maker Sanchez Computer Associates (SCAI), up 48 to 79-7/8, or 151 percent, after the company presented its new online banking software at a trade show in Atlanta.

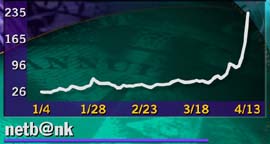

Investors continued to gobble up shares of NetB@nk (NTBK), which surged 76-17/32 to 235-1/32, after gaining 39 Monday in the wake of upbeat comments by executives about account growth at the Internet bank.

Meanwhile, leading online broker Charles Schwab (SCH) gained 15-3/8 to 150-3/8 on optimism the brokerage firm will report solid financial results on Wednesday after both Merrill Lynch and PaineWebber Group Tuesday reported first-quarter profits that beat Wall Street forecasts. Schwab also said it plans to hire 1,000 people as the broker handles explosive growth at its online service.

Schwab's premier web-based rivals also rallied. Ameritrade (AMTD) rose 31 to 173-1/4 and E*Trade Group (EGRP) blasted up 29-1/2 to 125-1/2, or 31 percent.

Elsewhere in cyberspace, web community operator Xoom.com (XMCM) tacked on 17-1/4 to 94-1/8, or 22 percent, rising for a second day even though it said talks with one potential buyer did not pan out.

Big techs still sluggish

The biggest names in tech didn't muster any solid gains Tuesday, as investors awaited the first-quarter earnings release of chip bellwether Intel (INTC).

After the bell, Intel reported earnings of 57 cents per share, but said it expected its second-quarter revenue to be flat or slightly down due to "seasonal factors.

Analysts polled by research firm First Call Corp. expected the chip giant to report profits of 55 cents a share.

Shares of Intel fell 3/4 to 60-1/2 Tuesday and then slipped to 59 in after-hours trade.

Investors have grown wary of the strength of computer-related companies after the leader in PC's - Compaq Computer (CPQ) - warned last Friday its earnings would be about half as much as analysts' expected. Compaq edged down 3/16 to 23-7/8.

Meanwhile, Dow issue Hewlett Packard (HWP) rose 2-7/16 to 70-13/16 after Chief Executive Lewis Platt said Tuesday that HP's personal-computer business remains healthy.

Rival Dell Computer (DELL) fell 1-3/8 to 40-7/16, while Dow stock IBM (IBM) shed 3-5/16 to 180-1/8.

Software titan Microsoft (MSFT) fell 2-7/8 to 90-1/8. Chairman and Chief Executive Bill Gates reiterated that any possible settlement of the government's antitrust suit against Microsoft should respect the integrity of its Windows operating system.

One relative bright spot in the tech sector: Qwest Communications International (QWST), up 5-1/4 to 96-1/8.

Morgan Stanley Dean Witter raised its price target to $110 on shares of the telecom player. Meanwhile Qwest unveiled a joint venture with a Dutch firm, KPN, to build a fiber-optic cable network.

Also getting a boost from Morgan Stanley Dean Witter was the fellow telecom player Williams Companies (WMB), up 2-1/4 to 48 after the brokerage set a $55 price target on the stock.

And looking ahead...

With Intel's report out of the way, ahead for Wednesday's plate of upcoming earnings news will be the latest sign of how well the computer business is faring.

Apple Computer (AAPL) is expected to report second-quarter earnings. According to First Call, analysts expect the computer maker to report 57 cents a share.

And top Intel rival Advance Micro Devices (AMD), which specializes in low-cost chips, is expected to report a first-quarter loss of 71 cents a share. The company said last month it would face a loss due to the sector's woes.

|

|

|

|

|

|

|