|

A critical look at life insurance

|

|

April 21, 1999: 1:24 p.m. ET

Critics say conflict of interest issues surround variable life insurance plans

|

NEW YORK (CNNfn) - Variable life insurance policies: They're marketed as one of the most ubiquitous investment tools in the financial planning industry.

Insurance agents tout them for their high-return potential and tax breaks. Financial advisors say you can borrow against them later in life to pay for your child's college education. And don't forget the death benefits that such a policy provides - benefits that act as a financial security blanket for the loved ones you leave behind.

Everything they say is true. It's what they're not telling you that critics say could hurt you.

Ric Edelman, a financial advisor, said the marketing push behind VULs, or variable universal life insurance policies, is being driven by the high-flying commissions of the agents and financial advisors who sell them.

Those who object to the commission structure say agents and advisors get paid almost nothing for pointing their clients toward mutual funds. For selling VULs, however, they can get upward of 80 percent of the first year premiums in commission from the insurance companies. (At least one company, they say, pays 120 percent).

Edelman, along with a growing group of fee-only financial advisors, says that presents a clear conflict of interest and raises questions about whether the agents are working in the best interest of their clients. It also chips away at the value of your benefit, they say, since insurance companies diverts more funds to the sellers.

"I'm not a big fan of VULs," Edelman said. "It's an aggressively sold product that is often used by financial advisors and insurance agents. There are substantial fees associated with these plans and they weigh down the performance."

VULs

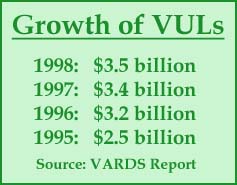

The sales pitches must be working. VULs are the fastest growing product in the insurance industry portfolio. Since 1993, new sales of the contracts have grown to $3.5 billion, up from $1.7 billion.

At the same time, they are claiming market share from other life insurance products. VUL market share rose to 17 percent in 1996 from 7 percent in 1992, while whole life insurance products shrank to 41 percent of the market from 54 percent. The market share of universal life policies dipped to 22 percent from 24 percent during the same period.

How it works

The variable life insurance contract is much the same as a fixed life insurance plan, except that premiums are invested in investment portfolios selected by you, the contract holder.

The premiums can be invested in equities or fixed income securities. They can be as conservative or aggressive as you want.

The investment performance of the portfolios directly affects the cash value of the policy. The National Association for Variable Annuities (NAVA) said the owner can also choose to have the performance affect the amount of the death benefits.

The biggest benefits of the VUL are the tax breaks. Income earned through your VUL grows tax free, and when you die, the money is distributed to its beneficiaries tax free.

You can also borrow from your policy later in life to pay for your child's college education - tax free.

Advocates for the product say it's a far better plan than putting your money into a mutual fund, since you don't have to pay earned income taxes.

Naysayers, though, including the National Association of Personal Financial Advisors, a consumer advocacy group, argue these policies are far too expensive (in fees and commissions).

"Basically, the concern of NAPFA is the extraordinary expense often associated with these insurance policies," said Gary Schatsky, a financial advisor and vice chair of NAPFA. "The problem with a lot of these high cost products is that they attempt to push hot buttons with consumers. They ask, 'do you want to pay taxes?' Obviously, you don't. But the NAPFA approach is to look at your overall financial picture and do it on an unbiased, non-partial basis."

He acknowledged VULs can be appropriate for some investors. But for most, he said, there is "often an opportunity to purchase what you need in insurance and be involved in separate investments."

If you want the tax breaks, Edelman suggested you place the money into a variable annuity, a tax-deferred retirement savings tool. You could also stick with mutual funds, which have "much lower fees and commission and superior returns (when you take out the costs of managing the plans)," he said.

Schatsky said you could also park your dollars in a 401(k) individual retirement account, which is both tax deductible and tax deferred, or a Roth IRA, which is not tax deductible but is tax deferred.

Some, too, say you might consider buying a variable annuity, more of a retirement savings tool. Those sold by Vanguard, which charges minimal fees, were among the most recommended.

One last thing to consider: Edelman noted the tax breaks proffered by VULs are not necessarily a sure thing. Congress could, he said, change the tax law at any time, as it has it has done so often in the past.

"You are gambling on tax advantages being present in 20 years when you are ready to withdraw from the contract and I'm not convinced that's going to be true," Edelman said. "I think that the consumer is generally unaware of certain material facts, particularly the tax risk and compensation issues."

Commissions

Fee-only financial advisors (those who do not work on commission) say most of their industry counterparts collect a hefty commission from the sponsoring insurance company - up to 80 percent of the value of your first year's premiums. According to estimates, that's about 25 times more than the financial advisor typically receives for selling mutual funds.

(The money is paid by the insurance company - it doesn't come out of your pocket.)

In defense of the practice, Mark Mackey, president and chief executive of the National Association for Variable Annuities, said the commissions are based on the work involved.

Commissions on sales of variable life insurance products are higher because they are a complicated investment tool to design. Each one is tailor made for the client.

"There's nothing inherently wrong with working on commission," Mackey said. " It's a very complicated financial product. You have to make a lot of determinations including what level of death benefit is appropriate and what type of benefit the client needs. You also have to decide whether the client needs a product that will enable them to take out money for loans in retirement. Variable life insurance policies can serve a lot of functions."

Moreover, he noted financial advisors and insurance agents are governed by strict regulatory guidelines, issued by the Securities and Exchange Commission.

"These policies can only be recommended if it's in the best interest, or most appropriate, for the client," Mackey said, noting the vast major of the industry adheres to these principals.

And he said, the criticism that the commission structure is often unclear to the consumers is no fault of the insurance companies. Each prospectus on VULs comes with an explanation of commission costs and fees in the back, he said.

"You are always going to have isolated cases where abuses will occur and these receive a lot of publicity," he said. "But it would be inaccurate to say that selling practice problems are widespread throughout the industry."

At least one independent financial advisor says he stands by VULs as valuable investment tools. But he noted consumers would be wise to seek out a fee-only financial advisors or someone they trust before buying into them.

"[The critics] are absolutely right," said Lance Wallach, a tax advisor and frequent industry convention speaker. "You need to go with a low-load commission product or a no-load commission product."

Even so, Wallach said his three VULs have performed well - since 1985 they've returned an average of about 18 percent (before costs are taken out).

"Instead of putting your money in a mutual fund, where you will maybe lose money and pay taxes, move it into a variable life insurance policy," he said. "There are life insurance policies where you can actually make a lot of money."

Good advice

As you can see, differences of opinion on VULs abound.

On one thing, however, most industry experts agree: You should always seek out a financial planner you trust when deciding where to invest your money. For unbiased advice on VULs, use an advisor you've worked with before, or call a group like NAPFA for suggestions. Explore all your options and read up on the risks versus rewards of these products.

"It does have its place," said Edelman, noting he's licensed to sell VULs but rarely finds it appropriate for clients. "I can envision some scenarios where it's arguably a good idea [to buy VULs], but in my opinion, the overwhelming majority doesn't belong in them."

--by staff writer Shelly K. Schwartz

|

|

|

|

|

|

|