|

AT&T bids for MediaOne

|

|

April 22, 1999: 9:05 p.m. ET

Ma Bell, in second big step into cable, would pay $58B, thwart Comcast bid

|

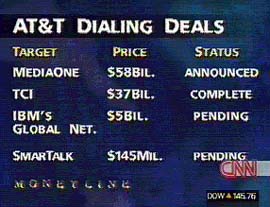

NEW YORK (CNNfn) - AT&T Corp. Thursday launched a surprise $58 billion bid for MediaOne Group Inc. -- seeking to thwart a rival bid by Comcast Corp. and cement its role as the leader of communications in the Digital Age.

The offer marks the latest in a series of blockbuster moves by AT&T Chairman Michael Armstrong to bypass local telephone companies.

If the deal goes through, AT&T (T) -- already the nation's top long-distance phone carrier -- also would become the leading provider of cable service -- a key conduit for high-speed delivery of data, video, Internet and voice service to millions of American homes.

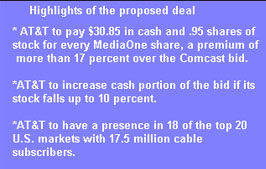

Under terms of the unsolicited bid, which would include cash and stock, AT&T would pay $87.375 per share for Englewood, Colo.-based MediaOne (UMG), representing a 17 percent premium over Comcast's $49 billion offer.

"This is so strategic to us. They very nicely complement where we are today," Armstrong told "Moneyline News Hour with Lou Dobbs."

"Americans have been waiting for someone to run another wire to their homes to give them a choice in local phone service and deliver the advanced services they expect in a competitive market," Armstrong said in a statement.

Analysts said the proposed deal is a bold step for AT&T.

"It's a huge, huge deal. It's all about bandwidth, it's all about Internet access, (and) MediaOne certainly is the front-runner in realizing bandwidth is important,'' said Arthur Hogan, chief market analyst at Jefferies & Co.

The offer is AT&T's second unsolicited takeover deal in recent years, following its acquisition of computer company NCR Corp., which it has since spun off.

Antitrust law professor William Kovacic of George Washington University said AT&T is likely to stress the changing competitive landscape when it talks to regulators.

"They would say: 'Don't focus on the fact that all this cable ownership is being concentrated, Focus on the fact that the bigger our earnings get, the better we'll be able to provide local telephone service,'" he said.

With the addition of MediaOne, which had revenues of nearly $3 billion last year, AT&T would be roughly the same size today, in terms of sales, as in 1984 when the government ordered the company to break up its local phone service into seven regional "Baby Bells."

AT&T/MediaOne would also become the nation's fourth largest company in terms of market capitalization, at $229 billion.

MediaOne shares soar on new bid

In after-hours trading, shares of MediaOne rocketed to 80-1/4 from 69-9/16 at the close Thursday. AT&T fell 3-1/2 to 57, as Comcast rose to 72-3/4 from 67-5/8.

The proposed deal underscores a wave of global consolidation in telecommunications as traditional telephone companies prepare to send data over high-speed cable lines.

On Wednesday, Telecom Italia agreed to a $82 billion merger with Germany's Deutsche Telekom in the biggest cross-border corporate combination in history.

MediaOne is the United States' No. 3 cable operator, with nearly 5 million subscribers. It was formerly a unit of the Western regional phone giant U S West Inc (USW).

AT&T Broadband and Internet Services, which was formed after the company's buyout of cable giant Tele-Communications Inc. last year, is the nation's No. 2 cable operator.

AT&T disclosed its bid in a letter to MediaOne Chairman and Chief Executive Charles Lillis. MediaOne spokesman Steven Lang said the proposal is under review.

Armstrong said he has long coveted MediaOne, but had to wait for the TCI deal to clear before he could make his move.

"I was always interested in MediaOne, but I was consumed with the approval of TCI," he said on "Moneyline." "That was our first priority; we didn't want to influence the approvals of TCI."

With the addition of MediaOne's 5 million households, AT&T would reach 17.5 million homes with its cable service -- vaulting it ahead of Time Warner Inc., the nation's largest cable provider. Time Warner is the parent of CNNfn.

Time Warner wouldn't be left out, however. MediaOne holds a 25 percent stake in Time Warner Entertainment. AT&T recently signed a deal with Time Warner to use its cable lines to offer local phone service in 33 states.

Terms of the deal

By offering a combination of cash and stock, AT&T said the proposed bid would protect MediaOne shareholders if AT&T shares fall, while not putting a cap on the upside potential if AT&T shares soar.

MediaOne in March agreed to be acquired by Comcast in a deal currently valued at $44 billion, based on Comcast's closing stock price Thursday.

Comcast is the majority owner of QVC and E! Entertainment cable channels, and owns the Philadelphia Flyers hockey team and Philadelphia 76ers basketball team.

Comcast could not be immediately reached for comment.

AT&T said it expects to experience savings between $175 million and $200 million as part of the deal through the combination of its TCI-related holdings with those of MediaOne.

But the deal doesn't come without costs: AT&T said it expects dilution to its earnings per share of about 30 cents in the first full year of combined operations. AT&T said that over time it would divest about $18 billion to $20 billion of MediaOne assets.

AT&T would also assume $4.5 billion in MediaOne debt, would offer a cash element lacking in Comcast's bid and would give a seat on the AT&T board to MediaOne.

Armstrong said AT&T is confident it can close the deal quickly, noting the company has already lined up commitments from Chase Manhattan Bank and Goldman Sachs Credit Partners L.P. for a $10 billion credit facility.

"As lead arrangers, they have also advised us that they are highly confident of their ability to raise financing for the balance of the cash portion of our offer," Armstrong said.

In addition to requiring approval from both boards and their shareholders, the deal would almost certainly face regulatory scrutiny. But Armstrong said he was confident about that.

"Our legal advisers are confident of our ability to obtain all necessary approvals in a timely manner," he said.

-- by staff writer Jamey Keaten with additional information from wire reports.

|

|

|

|

|

|

|