|

Doing the Fed's dirty work

|

|

May 6, 1999: 3:55 p.m. ET

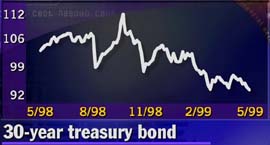

Rising yields in the bond market are already slowing down the economy

|

NEW YORK (CNNfn) - Once again the bond market is doing the Fed's dirty work.

In the past three months, the yield on the benchmark, 30-year Treasury bond has risen more than 107 basis points to 5.78 percent, a nine-month high -- all because bond traders think the inflation train is due to pull into the station at any minute. Back in October, the 30-year Treasury's yield fell to 4.71 percent, the lowest since the mid-'70s.

The cause, analysts say, is concern about accelerating inflation. Economic growth currently rests in the 4.5-percent range. Unemployment is at its lowest in decades. Retail sales are surging as consumers flush from wages, tax reductions and stock market gains spend their hard-earned cash. All that has bond investors worried that prices for goods and services will rise and erode the fixed value of their holdings.

The effect of that concern, those same analysts contend, is essentially an indirect interest-rate rise. As bond yields go up, the cost of borrowing to banks and other institutions becomes more expensive, eating into companies' profits, boosting the cost of loans and mortgages at banks and generally slowing the economy -- without Federal Reserve Chairman Alan Greenspan or his colleagues lifting a finger.

"The bond market is essentially raising interest rates for him," said Dick Berner, a senior economist at Morgan Stanley Dean Witter in New York. "There's no question that bond holders are seeing the whites of inflation, and anticipating some kind of move by the Fed. They're taking pre-emptive action before it happens."

No work required

The Fed last altered its target for overnight loans between banks Nov. 17, lowering the benchmark rate by 1/4 of a percentage point to 4-3/4 percent. It was the third in a series of rate reductions designed to unlock the credit crunch occurring with the bond market and restore calm to jittery financial markets.

Economic growth has surged since then. Last week the Commerce Department reported that the U.S. economy grew at a whopping 4.5-percent pace in the first three months of the year, well above forecasts.

The stock market also has enjoyed heady times in the past six months, a reflection of low interest rates cajoling consumers into spending and allowing companies to borrow money at cheaper rates.

Now, it seems, the party may be over.

"The bond market has been pricing in a premium against potential inflation," said Rob Palombi, a senior analyst with Standard & Poor's MMS in Toronto. "They've been looking at the numbers for some time and assuming that U.S. growth has consistently been strong enough to trigger inflation, and that is not a good thing for bonds."

"There's also concern the Fed will move toward a tightening bias, perhaps as soon as this month," Palombi added. Higher rates make bonds pegged at lower rates a less attractive investment to other potential buyers.

Greenspan confirmed that Thursday. Speaking at a Fed conference on banking in Chicago, the world's most influential central banker expressed concern that record low unemployment will cause a rise in wages and an increase in prices.

"An increase in inflation doggedly forecast to follow the ever lower unemployment rate -- now the lowest in three decades -- has not occurred," Greenspan said. However, "at some point, labor market conditions can become so tight that the rise in nominal wages will start increasingly outpacing the gains in labor productivity, and prices inevitably will then eventually begin to accelerate," he said.

True enough, say market pundits. But while consistently strong economic growth may have enough momentum to begin pushing prices higher in the next few months, it may not necessarily mean an increase in official interest rates from the Federal Reserve.

Credible Fed policy

"The key question is whether the Fed has credibility in regard to keeping inflation down, and the answer is yes," Berner said. "So long as they get their message across to the market in a clear way -- that it has to be a two-way street to slow the economy without killing it -- then I don't think there will be any surprises."

Indeed, the only surprise for the bond market and the Fed may come from Friday's employment report, due out at 8:30 a.m. Eastern time. Economists expect unemployment remained unchanged at a 30-year low of 4.2 percent in April, suggesting the economy is still on rails. If the rate drops even further, that could fuel even more concern about potential inflation, causing bond yields to rise further.

Even so, few economists believe the Fed's Open Market Committee will alter interest rates when it meets later this month.

"What the Fed may do right now is prepare the market for a switch to a tightening policy from a neutral policy, and that may happen as soon as this month," Palombi said. "There's always been the expectation that the economy would slow and ease labor market conditions, but that doesn't seem to be happening."

--by staff writer Corey Goldman

|

|

|

|

|

|

Federal Reserve Board

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|