|

Bonds slump on CPI data

|

|

May 14, 1999: 3:50 p.m. ET

Market takes worst drubbing in nearly three years; stable dollar offsets losses

|

NEW YORK (CNNfn) - The bond market took its worst beating in almost three years Friday after a government report pointing to higher inflation shot a wake-up call to investors that the economy's strength is finally beginning to push up prices on store shelves.

Prices rose at a 0.7 percent pace in April from March, the biggest monthly increase since October 1990, fueled by a 6.1 percent jump in energy prices. Gasoline alone surged 15 percent in the month, the biggest monthly increase on record, the U.S. Labor Department reported.

On a year-to-year basis, prices jumped 2.3 percent, the first time since October 1997 that prices rose more than an annualized 2 percent.

Even excluding volatile components like energy and food, prices rose 0.4 percent in April, the index's biggest jump in more than four years. The unexpected rise in the core rate sparked a massive sell-off in bonds, pushing the 30-year benchmark's yield to its highest in almost a year.

"It's a wake-up call for the bond market," said Andrew Pyle, chief markets strategist with ABN Amro in Toronto. "The bond market was nervous to begin with that the goldilocks scenario wasn't panning out, and this report appears to confirms that."

Shortly before 3:30 p.m. ET, the 30-year Treasury bond had fallen 2-1/8 points, or $21.25 per each $1,000 bond, to 90-24/32, its biggest drop since July 5, 1996. That pushed the yield up 16 basis points to 5.91 percent, the highest since May 15, 1998. Yields on two-year notes, among the securities most sensitive to expectations about Fed policy, rose 15 basis points to 5.26 percent.

The fuss among bond investors is that the strength of the U.S. economy, combined with a 54 percent rise in oil prices since mid-February, is finally beginning to spark inflation, which erodes the fixed value of their securities. Low inflation is crucial to bond holders because it allows them to ensure their fixed investments buy as much in goods and services as possible when they come due. If prices stay low, they can buy more in the future.

Looking out for rate outlook

This morning's report suggests that the strong growth/low-inflation scenario -- the norm within the U.S. economy for almost two years -- is finally coming to an end, which eventually will prompt Federal Reserve officials to raise short-term interest rates and put the brakes on the economy, said Rob Palombi, a senior analyst with Standard & Poor's MMS.

"It was a very surprising number and very harmful for the bond market, given a number of Fed officials have been warning about rising inflation," Palombi said. "We could be at the beginning of a gradual increase in CPI, which may lead to some insurance in the form of a rate hike by the Fed."

Next Tuesday the Fed holds its Open Market Committee meeting to discuss the economy and determine whether short-term interest rates need to be adjusted to either accelerate or slow down the economy. Prior to today's report, few analysts had anticipated a change in Fed policy.

"Now I think that perception is much, much different," Palombi said. The fear is that a change in so-called bias -- which way the Fed's board of governors is leaning on interest rate policy -- will be the order of next week's meeting. That would eventually prompt the Fed to lift its target for overnight loans between commercial banks in an effort to cool economic growth and ward off inflation. The target rate is currently around 4.75 percent.

A separate report that U.S. industrial production posted its strongest gain in eight months in April also weighed on bonds, analysts said.

The Fed reported Friday that output at factories, mines and utilities rose 0.6 percent in April after rising 0.5 percent in March, providing more evidence that the U.S. economy is on rails. Analysts had expected a 0.4 percent increase. April's capacity utilization rose slightly to 80.6 percent from a revised 80.4 percent in March, indicating that the manufacturing sector is suddenly starting to sizzle after six months of relatively flat growth.

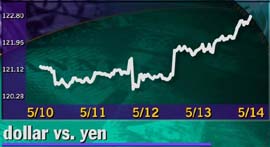

A strong dollar helped offset some of the losses in the bond market.

The dollar rose to a two-month high against the yen as investors deemed Japan isn't yet

recovering from its long recession, and the U.S. economy is expanding at a robust pace that could trigger an increase in lending rates before summer.

'A very severe situation'

Japan's Economic Planning Agency said Friday in its monthly report that the economy is "still in a very severe situation," suggesting its central bank won't move to raise lending rates anytime soon. Higher rates typically draw investors to purchase a country's dollars and securities because it boosts the return on their investment. Lower rates, by contrast, artificially depress the cost of dealing with a currency, effectively rendering it less valuable in exchange.

The yen was particularly susceptible to the planning agency's report because Japanese interest rates already are close to zero, leaving traders to wonder just how much room the Bank of Japan really has to further spark activity within its struggling economy.

The dollar rose as high as 122.45 yen, its highest since March 8, before retreating to 122.25 yen. The dollar rose against the euro, with the single currency at $1.0717 from $1.0641 yesterday.

For many investors, there's no incentive to buy bonds as long as the economy, now in its ninth year of expansion, keeps chugging along. The economy grew at a 4.5 percent annual rate in the first quarter.

Wall Street dealers and investors who stepped up to buy some of the $27 billion of five- and 10-year notes sold at this week's quarterly auctions are now sitting on losses. Since Tuesday's sale, the five-year notes have fallen more than 3/4 of a point, while the 10-year notes have declined by more than a full point since Wednesday's auction.

With investors now giving sobering second thoughts to next Tuesday's Fed meeting, few analysts expect bonds to recover before then.

Investors will look to reports on April housing starts, building permits and retail sales Tuesday as well as releases on weekly jobless claims and March's trade balance Thursday for more clues of the economy's strength. Minutes of the FOMC's March 31 policy meeting also will be released Thursday.

Still, "the Fed meeting will become the main focus for the bond market," said Mark Wanshel, a senior economist with JP Morgan in New York. "There's more expectation of something from that meeting than there was before the (CPI) numbers."

Proof of that is in the future, so to speak. The possibility of either a shift in Fed policy or even a Fed rate increase soon is building, judging by futures rates on Eurodollars.

The implied yield on the September contract for three-month Eurodollars climbed 14 basis points Friday to 5.25 percent. That's a full quarter point more than the current three-month borrowing rate of 5 percent, indicating investors are pricing in a rate hike before the contract expires in September.

--by staff writer M. Corey Goldman

|

|

|

|

|

|

|