|

Merrill Lynch nods to Net

|

|

June 1, 1999: 8:25 p.m. ET

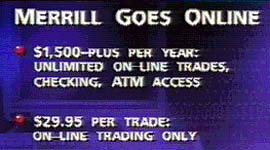

Largest U.S. broker reverses stand, to offer $29.95 online trade service

|

NEW YORK (CNNfn) - Leery of the threat posed by a growing parade of online stock brokers, Merrill Lynch and Co., the largest U.S. brokerage house, confirmed Tuesday it plans to offer online trading by year's end for as little as $29.95 per transaction.

It marks a change of direction for Merrill, which had resisted the idea of online brokerages for years. But Merrill Chairman and CEO David H. Komansky characterized the company's steps as "aggressive."

"I don't look at it as at all defensive," Komansky told the Moneyline News Hour with Lou Dobbs. He said the move had been in the thought process for some time, while conceding competitive pressures forced the issue. "Clearly we might have lost Round 1. But today starts Round 2."

He also downplayed the prospect that Merrill's brokers would be unhappy with the lower commissions that come from online trades. "I think they'll realize what's best for the client is best for them and best for the firm."

The announcement came as part of a dual-pronged financial-services package designed to help Merrill (MER) maintain clout among its wealthy clientele while fending off other, less expensive, online brokerage services attempting to eat away at its traditional client base.

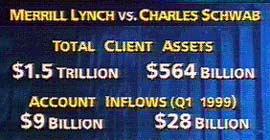

Included in that group is rival Charles Schwab Corp. (SCH), the leader in the Net-brokerage space, which already offers similar $29.95 fees to 5.1 million online accounts.

"It will just be a natural edge for some of the more sophisticated and capable investors to do that," said Robert Robbins, a market strategist at Robinson-Humphrey in Atlanta. "I think it's also fighting the competition a little, too. There have been a lot of upstarts that have grown very rapidly and the big firms are going to want to participate in that, too."

Merrill depicted itself as a leader rather than a follower.

"We are creating a comprehensive framework that we believe will be a revolutionary concept," Komansky said. "We think we're uniquely capable of offering this comprehensive range of services under one roof."

Online challenges

Merrill intends to offer its online service beginning Dec. 1, although there's some question whether the venerable company isn't already behind the curve.

"This was the obvious thing that they should have done about two years ago," said Bill Burnham, senior research analyst for e-commerce at Credit Suisse First Boston. "I think they lost a lot of ground by being indecisive between now and then. And it's a little disconcerting that they're waiting until December to actually get this up and running."

But while acknowledging the market pressures that helped lead to the decision to move onto the Web, Komansky said the strategy was deliberately designed with the clients' needs in mind.

"It's clear we are not pricing ourselves to beat the bottom of the [online] market," he said. "On the other hand, we are definitively placing ourselves up against the market that is offering [online trading] at $29.95. We can clearly make a case with all the additional things we will bring to the table, we can make that difference immeasurable."

Still, some of those online brokerages that price below Merrill's proposed service welcomed the new competition.

"I do applaud them for getting into the Internet strategy because they really have to be there to offer their full range of services, said Chris Cotsakos, president of E*Trade Group, a leading online brokerage. "Our view is to do it fully electronic, theirs is to have a hybrid. So we do it differently. I think it's not a zero-sum game. I think it's a game where everybody wins."

Full-service product also offered

In addition to its foray onto the Web, Merrill was careful in designing the new product line not to neglect its more affluent customers wanting more hands-on care, either.

Merrill also unveiled a new account Tuesday featuring no commissions and a minimum annual fee of $1,500 to customers seeking unlimited transactions in most equities, mutual funds and fixed-income products.

That service, which includes ready access to one of Merrill's many financial advisers, is slated to begin in July.

"When we look at market segments, one of the most attractive and fastest growing is affluent households," said Herbert M. Allison, Merrill's president and chief operating officer. "This is the segment that is increasingly seeking investor advice, and no one is better equipped than Merrill Lynch to meet that need."

Komansky said the firm projects many of its customers will chose to subscribe to the new online service as well as Merrill's traditional broker-assisted offerings.

Brokers get two-year protection

There was some speculation the cheaper, no-consultation online service would cause a revolt among some of Merrill's 14,800 brokers, who stand to see their annual commissions severely cut by the one-price service.

But John F. Steffens, Merrill's vice chairman and executive vice president of the U.S. Private Client Group, said the company will protect its financial consultants for a period of two years against whatever revenue they might have otherwise gained.

Merrill's decision to venture online comes less than a year after the firm's brokerage chief, in remarks widely quoted at the time, scoffed at the Internet investment model as a "serious threat to Americans' financial lives."

"There's been a lot of debate within the firm, as well there should have been" about online trading, Komansky said. "Had we been looking just to put up an online trading operation, it would have been very easy. We could have done it a long time ago. We felt it was critical that we put it together with a wide array of offerings that offered choice to our clients."

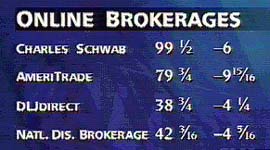

Competing online brokerages generally closed down for the day Tuesday.

Merrill's stock also dipped, closing at 75-1/4 Tuesday, down 8-3/4. Komansky attributed the drop mostly to inflationary fears and the entire financial services sector being down.

|

|

|

|

|

|

Merrill Lynch

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|