|

Vacation homes and profit

|

|

June 12, 1999: 2:22 p.m. ET

Renting your beachfront condo can yield dividends, but do your homework first

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - If you're like most Americans, the idea of owning a beachfront condo or lakeside retreat is an appealing one indeed.

Ideally, you'd use the place when you wanted, rent it when you're gone and make at least enough money to cover your costs. Realistically, it doesn't always work that way.

Industry insiders say any number of factors can affect a rental property's profitability. They also say you should take some time to determine whether you and your family are suited to own vacation rental properties.

"There are so many positives to owning a second home, but if you are the type of person who is bothered if a bowl is moved from this side of the table to the other, you probably don't want to get into it," said Michael Sarka, executive director of the Vacation Rental Managers Association. "It's not like you are inviting your brother Carl and his wife to use your place for the weekend. These are strangers."

Your goals

First, experts say you should decide what you want to get out of your rental home. Are you looking at it as a profit making venture, or as a way merely to offset some of the costs of owning a second property?

In many cases, the latter is more likely, but that's not to say you can't make money.

"It can be quite profitable," said Cindy Frailing, an enrolled agent and spokeswoman for the National Association of Tax Practitioners. "It all depends on how much you own, how much rent you charge and where it's located."

She added most of her clients don't view their rental homes as a business.

"A lot of people just want to not lose money on the deal," Frailing said. "They just want to cover their expenses. They rent it when they are not using it, and if they collect enough rent it's like having a free property."

Those of her clients who do make a profit typically bring in between $2,000 and $5,000 a year on top of expenses. It hasn't made them rich, but considering the equity they are building in their second homes and the benefits of owning a vacation getaway, most people decide it's worth it, she said.

A few of the things that affect the ability to own a profitable second home include the size of the downpayment, the amount of rent you charge and the location of the property itself. (Not surprisingly, waterfront homes, whether on an ocean, lake or river, tend to rent better than those that are not.)

Geography is a factor, too. The farther north you go, the shorter the rental season gets.

The market

Sarka, of the property managers group, said the rental market is booming. And the industry, he noted, shows no signs of slowing down.

"What's happening is the Baby Boomers are getting to the age where they are buying second homes," he said. "We see a big demand for vacation homes over the next 10 or 15 years."

Sarka's group estimates there are 3,000 property management firms nationwide handling the rental side of the business for vacation home owners.

Last year, the average property company surveyed grew 11.4 percent and Sarka said this year is shaping up to be even better.

The vacation rental industry, he noted, has significantly matured in recent years, creating new high-end niches.

"These days it's the high-end units that are popular," Sarka said. "It's the same thing that happened in the hotel industry a few years back."

Terry Hough, executive vice president of O'Conor, Piper & Flynn in Ocean City, Md., said business has been particularly strong in his neck of the woods.

"Each year we say [the vacation rental market] can't get any better and it does," he said. "We start booking in November and by the end of January our prime properties for the summer are booked. Demand is very strong."

Long-term benefits

Initially, the biggest financial advantage of owning rental property is the tax breaks. Over the long term, however, the biggest benefit can be the equity you build using other people's money (renters, of course) and the appreciation gains on your property (if you bought at the right time and place).

Changes to the tax law in the late 1980s made it less rewarding to own a rental property, driving many investors out of the real estate market. But some perks remain.

The Internal Revenue Service allows you to deduct from your taxes all of your mortgage interest payments, property taxes and insurance payments -- but only if you use the property for 14 days or fewer out of the year.

If you use it for more than 14 days out of the year, be prepared for some paperwork. The tax-collector will require you to categorize your expenses between rental and personal.

"The bookkeeping can get a bit tricky," Frailing warned. "You have to count the number of days you used it and renters used it and you come up with a fraction that you use to allocate your expenses."

Sound confusing? The best plan is to have a tax professional or accountant help you crunch the numbers. You don't want to miss out on tax benefits you are entitled to.

Other write-offs include expenses on repairs and home improvement projects and depreciation claims, which allow for deductions on the normal wear and tear of business use properties.

(Click here for the IRS guidelines on depreciation claims.)

"Despite tax relief provided under certain conditions by the 1997 Taxpayer Relief Act, there are still numerous opportunities for owners to shoot themselves in the foot at tax time, especially if you intend to rent out the vacation property for part of the year," said N'ann Harp, president of Smart Consumer Services, a consumer education group in Crystal City, Va.

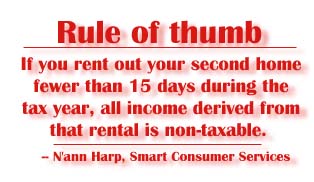

A basic rule of thumb, she said, is if you rent out your second home fewer than 15 days during the tax year, all income derived from that rental is non-taxable. For those who rent their home more often, the IRS says rental income deductions should not exceed rental income.

Harp said the IRS and the U.S. Tax Court, however, remain at odds over how to calculate those deductions when a second home rental situation applies. The matter is unresolved in all but a handful of states.

Points to consider

Harp stressed the decision to purchase a vacation rental property should not be made lightly.

"The pleasures and benefits of having a vacation house are considerable, if you do your homework, get good tax advice beforehand and are realistic about how you will pay for and plan to sell or use the second residence in the future," she said.

Before taking the plunge, Harp advised prospective homebuyers to prepare for the additional costs of owning vacation rental properties -- expenses that go way beyond mortgage payments.

For example, you should factor in the estimated cost of upkeep, repair and condo or homeowner association fees.

Be aware that oceanfront or harsh climate residences are subject to unpredictable weather damage and determine ahead of time who will keep an eye on the place while you are away, she said.

(Note: It's not uncommon for rental property owners in growing resort towns to be assessed increasingly higher community fees to pay for new schools and infrastructure improvement projects.)

Also, don't overlook the higher rates of loan interest, taxes and insurance you'll likely have to pay on your second home, Harp said.

Be sure to check in advance with the condo or homeowner association that governs your property. Find out what restrictions apply.

Suggestions for the undecided

If you're still unsure whether owning a vacation home is right for you, you may want to consider another option: timeshare ownership.

Harp said the IRS at one time tried to force timeshare owners to pay taxes on capital reserves maintained for upkeep purposes, but owners of timeshares successfully lobbied against it. That protection became part of the Taxpayer Relief Act of 1997. Contact the American Resort Development Association for more information on timeshare ownership.

You also may be interested in a well-established but little-explored option called home swapping. Companies, including Intervac, have been helping families worldwide with spending vacation time in someone else's home since the 1950s.

"Second home purchase can be a rewarding way to spend relaxing time with family and friends," Harp said. "If the costs, deductions and income tax changes brought about by owning a second home are a benefit or at least not a burden, the pleasures are even greater."

|

|

|

|

|

|

|