|

What will the Fed do now?

|

|

June 16, 1999: 5:17 p.m. ET By Staff Writer M. Corey Goldman

Doubts emerge over immediate rate rise, though one still expected this year

|

NEW YORK (CNNfn) - An interest rate increase by the Federal Reserve may not be imminent as previously believed, judging by Wednesday's inflation report, but it's still going to happen, analysts and economists say.

Stocks and bonds soared Wednesday after the Labor Department reported that inflation stalled after surging a month earlier. The Dow Jones industrial average jumped more than 160 points in midday trade and the yield on the benchmark 30-year bond plunged to its lowest level in a week on the view that Fed officials now may think twice before pulling the trigger and raising interest rates to fend off faster inflation.

They may think twice, but they still eventually will act, probably before the end of the year, according to various Wall Street analysts and investors. That's because, with world economies rebounding, consumer spending going gangbusters and salaries on the rise, inflation is all but inevitable.

"They will still go. Absolutely. Definitely. There's no question about it," said Richard Berner, chief economist at Morgan Stanley Dean Witter. "They now have a little latitude to space the timing of the increases, but there's no question they will move."

A not-so-different perspective

Earlier this month there seemed to be little question at all. A surprise jump in May consumer prices along with strong wage gains and a surge in retail sales all seemed to point to the same thing -- higher official interest rates.

That probably still holds true, analysts and economists said, though the urgency for the Fed to act at the June 29-30 meeting may have fizzled somewhat.

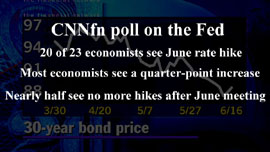

According to a poll conducted by CNNfn Wednesday, 20 of 23 economists still expect the Fed will raise rates at the end of this month, and most anticipate the move will be a quarter-point increase. Still, almost half of those surveyed by CNNfn now expect that a June interest-rate rise, if it happens, will be a one-time event for the year.

The Fed late last year slashed short-term rates three times in succession in a bid to protect the U.S. from economic turmoil overseas and keep the economy going at a steady pace.

Since then the performance of the U.S. economy has surpassed almost all expectations. Unemployment remains at a record low. Consumers are picking store shelves clean. The housing and construction markets remain strong and auto sales are speeding along at near record levels. And, after years of stagnating, wages have started to rise.

All that had been missing from the mix was faster inflation. That fly appeared in the economic ointment in May's inflation report. After the Fed's May 19 policy meeting, officials warned they were shifting their bias toward lifting rates soon.

Some economic indicators did suggest growth may not be as strong as expected. Job growth slowed dramatically in May, but workers' wages grew at a surprisingly brisk pace. Factory orders rose, but so did productivity among workers. The wood chips and bricks are flying on residential construction sites, but producers' costs remain tame.

Half full, half empty?

To be sure, it's all a matter of interpretation.

The tame May CPI report "washes out the surprising jump from April and gives the Fed some more breathing room if [Fed Chairman Alan] Greenspan so desires," said Kim Rupert, a senior economist at Standard & Poor's MMS in San Francisco. Still, "the strength in the economy is undeniable and there is a camp at the Fed which will strongly advocate a more pre-emptive stance."

Indeed, financial markets are still deeming some kind of rate increase a fait accompli.

The yield on the July fed funds futures contract -- reflecting where investors expect official rates to be in the future -- fell as low as 4.98 percent Wednesday, about a quarter-point above the Fed's current 4.75 percent target for the fed funds rate, which banks charge one another for overnight loans.

The futures rate had been in the 5.15 percent to 5.20 percent range only a week ago, indicating investors were then expecting almost a half-point rise in the fed funds rate.

"The inflation data does not take the Fed out of the picture," said Sherry Cooper, chief economist with brokerage Nesbitt Burns. "It does, however, remove the risk of the Fed having to tighten 50 basis points on June 30." Fifty basis points equals half a percentage point.

Either way, all eyes and ears will be directed toward the Fed chief Thursday when he addresses the Joint Economic Committee of U.S. Congress.

"Greenspan's remarks will be significant, either because of what he does say or what he doesn't say," Morgan Stanley's Berner said. "They will move rates higher this year but the timing of that may have changed."

|

|

|

|

|

|

|