|

CNNfn market movers

|

|

June 17, 1999: 2:38 p.m. ET

Investors seek a lift from drug and technology company shares

|

NEW YORK (CNNfn) - Anxious investors, weary from long hours spent guessing what Federal Reserve Chairman Alan Greenspan might reveal in congressional testimony, turned to drug and technology shares for relief Thursday.

Volatile technology shares took charge of advancing issues after Greenspan's remarks were released, led by Internet portal CMG Information Services (CMGI), which rose 10-1/8 to 103-1/4 after BancBoston Robertson Stephens upgraded its rating on the company to a "buy."

BancBoston's decision to re-initiate coverage of Internet provider Excite@Home (ATHM) with a "buy" had investors feeling right at home. In early afternoon trading, the company's shares jumped 4-7/8 to 52-1/4.

Shares of networking firm Cisco Systems (CSCO) surged 1-7/16 to 117-11/16 after the company announced it was buying TransMedia Communications Inc. for $407 million in stock.

And software company Allaire Corp. (ALLR) bounced 4-3/8 to 48-1/8 after Credit Suisse First Boston raised its 1999 earnings estimate on the company to a loss of 39 cents per share.

Among the day's biggest gainers by midday included Neurogen Corp. (NRGN), a biotechnology company that rose 2-11/16 to 15-1/4 after sealing a deal with Pfizer Inc. (PFE) to license its rapid drug discovery system.

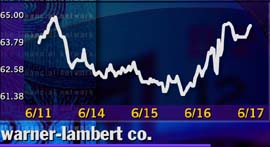

Drug company Warner-Lambert Co. (WLA) found relief for what ailed its stock for the second straight day after announcing a decision Wednesday to extend the co-promotion of its popular cholesterol-lowering drug Liptor with Pfizer.

Even news that the U.S. Food and Drug Administration was telling doctors they should limit their prescriptions of Rezulin, a diabetes pill produced by Warner-Lambert's Parke Davis division that was linked to a rare but fatal liver toxicity, didn't deter investors, who sent the company's stock up 1-13/16 to 64-1/16 on the Pfizer deal.

But drug and medical supply distributor Bergen Brunswig Corp. (BBC) found nowhere to hide after warning its newly acquired PharMerica unit could be hit hard by changes in Medicare. The company's stock shed 4-5/16 to 14-9/16 in early afternoon trading.

In other news, investors liked the tune coming from K-Tel International Inc. (KTEL) after the music distributor signed several Internet distribution deals for its online store. K-Tel's stock was up 1-3/16 to 7-1/8.

And retailer Best Buy Corp. (BBY) found no shortage of customers for its stock after announcing it expected to double sales in the next five years to $20 billion, sending its shares up 4 to 60-1/2.

|

|

|

|

|

|

|