|

Qwest ups US West bid

|

|

June 23, 1999: 4:45 p.m. ET

Long-distance company sweetens rejected bid with a $69 per share offer

|

NEW YORK (CNNfn) - Long-distance carrier Qwest Communications International raised its unsolicited takeover bids for US West Inc. and Frontier Corp. Wednesday, hoping to persuade each to spurn existing merger pacts with Global Crossing Ltd.

Combined, Denver-based Qwest now is offering roughly $46.5 billion for the two companies, based on Wednesday's opening prices, above its original offer of approximately $45.4 billion and the $42.5 billion offered by Global Crossing.

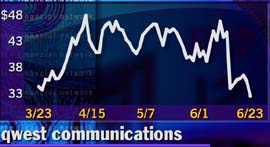

Qwest, the nation's fourth largest long-distance firm, also placed a "collar" on its stock price, thereby ensuring the deals' higher value by offering to supplement any drop in its share price with additional cash. Both US West, a regional Baby Bell, and Frontier recently declined to consider Qwest's original bids, in part because the company's stock price dropped sharply after the offers, diluting the deals' overall values.

Analysts believe with the collar now included, the revised offer likely will spark a fierce bidding war between Qwest and Global Crossing and two former top AT&T Corp. colleagues: Global Crossing's Robert Annuziata and Qwest's Joseph P. Nacchio.

"The collar is an interesting addition," said Philip Wohl, a telecommunications analyst at S&P Equity Group in New York. "Global Crossing can't match that. It levels the playing field for Qwest."

Qwest insisted the provision made its proposal the stronger choice.

"Clearly, we believe if you stack up Qwest and Global Crossing, we believe you have to go a country mile to believe these companies' [offers] are the same," said Nacchio, Qwest's chairman and chief executive officer, in a conference call with reporters. "Clearly, we have addressed every [concern] they have signaled."

US West holds tight ... for now

However, analysts believe Qwest has still failed to address what may be the primary concern of US West shareholders, if not its management: Dividend payments.

US West paid shareholders a healthy $2.14 per share dividend each of the last four years. The fast-growing Qwest, meanwhile, currently does not pay a dividend.

"There are very different perspectives at play here," said Hank Riehl, an analyst at American Fronteer, a broker/dealer based in Denver. "Nacchio views this deal as an insider that knows the direction of the industry and views US West as a strategic asset. But the typical owner of US West views [the company] as the payer of a dividend.

"You have a mismatch of cultures that is trying to communicate in the town of babble that is the [financial] market."

Nacchio said he might consider some sort of dividend payout if US West shareholders demand it.

US West spokesman David Banks said Wednesday the company's board had received the proposals and would "review them in due course." A Frontier spokeswoman said her company likewise would "take the time necessary to determine the best course of action for Frontier and its shareholders."

Meanwhile, Global Crossing Inc (GBLX) told Reuters Wednesday it has to assess the value of the latest Qwest bids and isn't planning any action at this time. With Qwest's initial proposal, Global Crossing never offered to raise its bid.

Qwest, an upstart long-distance carrier eager to expand its geographical base, raised its bid for US West to $34.7 billion, or $69 per share. The firm's original offer was valued at $61.37 per share based on Tuesday's closing price, but the new deal represents a 12 percent premium over Global Crossing's bid, Qwest said.

Qwest also offered nearly $12 billion, or $20 per share cash and $48 per share in stock, for each Frontier share, an increase from the original offer of $61.70 per share in cash and stock, based on Tuesday's closing price. Qwest said the deal was an 8 percent premium over Global Crossing's offer.

Cash is king

In both offers, Qwest attempted to ensure the high value of the deal price by placing a collar on the price of its stock between $30.50 and $43.50. Should the Qwest's stock price drop below $30.50, the company has agreed to offset the decline with additional cash or shares. Likewise, if the stock price rises above $43.50, Qwest will exchange only a fixed rate of shares.

Nacchio said his firm had roughly $2 billion remaining from Bell South's $3.5 billion investment for a 10 percent stake in the company. Qwest also secured about $4 billion in credit last week and has other lines of credit it can tap if the need arises, Nacchio said.

Conversely, Global Crossing's offers to both companies are fixed-exchange bids, much like Qwest's initial offers. By providing more protection against a further decrease in his company's stock value, Nacchio said his offer is now clearly superior.

Analysts agreed the revised bid is at least strong enough to possibly now merit consideration by the boards of US West and Frontier.

"Qwest has the advantage of its offer being easier to understand," said Tom Burnett; founder and managing director of Merger Insight, a New York-based institutional research company. "I think that once again caution and patience are the watch words here. We're not sure where we are heading."

Qwest's revised offers come less than 48 hours after the Denver-based US West (USW) declined to consider Qwest's original merger offer, noting the company's weakened share price, which fell 22 percent after the proposal was announced on fears the deal would hurt corporate earnings. Likewise, Frontier's (FRO) board previously refused to consider Qwest's offer.

Nacchio noted the revised offer protects Qwest shareholders by sweetening the deal with cash and not stock, meaning the company won't have to issue any more shares than originally anticipated. But Qwest (QWST) shareholders still reacted negatively to the revised offer, sending the company's stock down 2-3/4, or nearly 8 percent, to 32-9/16 in trading Wednesday.

Qwest shareholders again showed no stomach for a possible US West/Frontier union Wednesday.

Nacchio said the stock was under pressure because of "deal economics."

"I think it will come back up," Nacchio said. "I think when you're in the middle of one of these, it creates volatility in the stock. Our stock will recover once there is clarity ... and be driven more by the fundamental of our business."

Does US West really add value?

Analysts too questioned the value of sparking a bidding war for a mostly rural telecommunications company.

The stock price decrease "isn't pretty, but it had to be expected," Wohl said. "I'm just wondering why they are going through so much trouble to acquire mediocre assets."

But Nacchio said his company is pursuing US West because the company's 14-state telephone network would help break the "bottleneck" confronting Qwest's bid to reach residential consumers through a nationwide fiber optic network.

Residential "consumers can't get the benefits that large customers have," Nacchio said. "We believe that by taking a company like US West we will rapidly and significantly break that logjam."

US West shares closed the day up 15/16 to 57-15/16, while Frontier climbed 1-7/8 to 59-7/8 and Global Crossing slipped 1-9/16 to 45-7/8.

|

|

|

|

|

|

|