|

Awaiting the Fed's verdict

|

|

June 29, 1999: 9:30 a.m. ET

Economists, public see rate boost this week -- but will that be the end?

|

NEW YORK (CNNfn) - Economists say the Federal Reserve's two-day meeting beginning Tuesday is likely to result in an interest rate increase of a quarter percentage point. But, they ask, will the Fed be content with that move alone?

As soon as the Federal Open Market Committee wraps up its meeting Wednesday, "we're going to start worrying about what Act II is," said Vince Farrell, chief investment officer at Spears, Benzak, Salomon & Farrell. "Will Mr. (Federal Reserve Chairman Alan) Greenspan have to raise rates again? We'll kind of go back into the whole soup all over again."

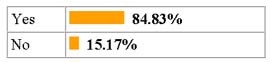

A poll of CNNfn.com readers also has found that an overwhelming majority think the Fed will raise rates by a quarter point. And like Wall Street economists, they are uncertain if the increases will stop there.

CNNfn.com Readers Poll

Most experts predict the Fed will raise interest rates this week. Do you agree?

Farrell points out that the last time the central bank moved on interest rates was last September. That's when it slashed rates three successive times to stabilize the economy in the wake of the Russian financial crisis and the collapse of the Long-Term Capital Management hedge fund, which Wall Street had to bail out at a cost of $3.5 billion.

Now, "Does Mr. Greenspan in the recesses of his mind think 'I've got to take back all 75 basis points'?" Farrell said. "That's what we're going to start worrying about at 2:20 on Wednesday afternoon after we get the 2:15 announcement."

Vince Farrell: Will Fed stop

at a quarter point?

Earlier this month, the famously cryptic Fed chairman put Wall Street on notice that a rate increase was imminent. But don't expect any further guidance from Greenspan, Farrell says.

"At best, you'll get the bias toward tightening staying in place," he said.

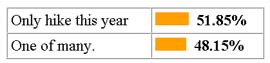

If the Fed does raise rates, do you think this will be the only rate hike approved this year or one of many?

Richard Yamarone, economist at Argus Research, says that he thinks the Fed will not act beyond this week's expected rate hike. He said Greenspan's move is not about fighting inflation, but about maintaining credibility.

"Greenspan will take it away on Wednesday like everyone's saying here, but he's only taking it away momentarily," Yamarone said. "He's taking one and he's done."

But Bruce Steinberg, chief economist at Merrill Lynch, said economic data due for release later this summer will determine whether the Fed will raise rates again .

"I think one might do the trick, but it depends very much on the kind of data the Fed sees between the June meeting and the August meeting," he said.

William Dudley, an economist at Goldman Sachs, said the Labor Department's jobs report due to be released Friday will be a key gauge of the state of economic growth. He predicted that Federal Reserve policymakers will keep their tightening bias in place.

Meanwhile, Bear Stearns economist John Ryding said he thinks the Fed should switch to a neutral bias.

"There's no inflation," he said. "I don't know what inflation the Fed is trying to fight here."

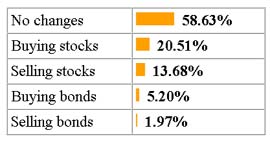

As for how the interest rate talk has influenced investors, the CNNfn.com poll found that a majority of participants plan to make no changes to their portfolio due to rate fears.

Nearly 59 percent said that they would take no action, while 21 percent said they would buy stocks and 14 percent said they would sell stock holdings.

Given your feelings about interest rates, what changes are you making in your portfolio?

|

|

|

|

|

|

|