|

'Couch potato fund' soars

|

|

July 1, 1999: 6:30 a.m. ET

Manager Marc Gabelli seeks rapid growth in stable interactive companies

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - Fund manager Marc Gabelli is banking on the idea that you can get a prescription filled, check your stock portfolio or a start a home business from your living room.

The world is at your fingertips, and you don't even have to get up from the couch.

"The individual can do anything at home," said Gabelli, manager of the Gabelli Global Interactive Couch Potato Fund. "In your small home or office, you have the power to compete globally."

The fund, with $142.8 million in assets, has a coveted five out of five-star rating for risk-adjusted returns from Chicago fund-tracker Morningstar, putting it in the top 10 percent of its category. The fund is up 37.49 percent year to date as of Tuesday. It earned 28.93 percent in 1998 and 41.70 percent in 1997.

Gabelli, 31, is the son of famed Wall Street stock picker Mario Gabelli, founder of Gabelli Asset Management and chairman of Gabelli Funds. Gabelli Asset Management (GBL) went public in February.

The younger Gabelli sat down to talk about the Couch Potato Fund recently while attending a conference in New York. While he sipped ice tea at a shaded outdoor table, he made it clear he doesn't relish talking about himself. (It seems to run in the family. His father also declined to comment for this story).

At first, he comes across a little like one of the high-power Wall Street characters in Tom Wolfe's book, "Bonfire of the Vanities." He's young, with dark hair and sculpted good looks, a cell phone in his hand. Cuff links, a dark suit.

"Marc Gabelli likes fishing. You can write that down," he said.

But gradually bits of his personality slip through, showing a sharp man with a sense of humor who got his first taste of investing working for the family business as a kid. He gives the impression that his dad taught him the value of a dollar and hard work. The elder Gabelli founded the company in 1977.

"In the first year my father started his business, he made $5,000," Gabelli said. "I was working for him, stuffing envelopes after school."

Today, Gabelli Asset Management has $20 billion under management, which includes $10 billion in its fleet of 25 funds. The younger Gabelli is also on the team that manages the Global Telecommunications Fund, the Global Opportunities Fund, and the Gabelli/Westwood Mighty Mites Fund.

His bio in Morningstar data says he graduated from Boston College in 1990 with a bachelor's degree. He worked for Lehman Brothers for three years and joined Gabelli in 1993. He is a managing director at Gabelli Funds, the bio said.

"We have a simple model -- succeed with success," Gabelli said, tapping his finger on the table for emphasis. "If our funds do well, if our products do well, we'll do well as professionals."

Stable companies with rapid growth

The Couch Potato Fund invests in media and cable stocks, publishing and entertainment companies, and telecoms that are benefiting from technological advances.

The fund also invests in so-called "infrastructure" companies that provide fiber optic lines, networking software and other products that will form the backbone for the new flow of information.

"It's a great fund that invests in an area of rapid change, but it invests in change through stable and cash-generating businesses with good management," Gabelli said. "We want stable franchises that are enhanced by this rapid change of technological advancement."

For example, "content" companies that have film libraries, music or software can use the Internet to get their products distributed. The companies have strong brands that people recognize, such as Disney's mouse ears and Viacom's MTV Network.

"Technology is just the grease that gets the content distributed quickly," Gabelli said.

(For the record, another top holding is Time Warner (TWX), the parent of CNNfn.com. The fund owns a 2.89 percent stake in Time Warner).

"We're buying the brands that aggregate the most amount of eyeballs," he said.

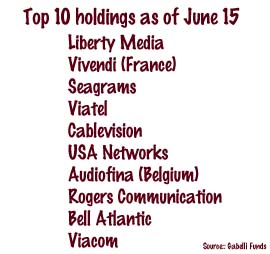

The top holding as of June 15 is cable television provider Liberty Media Group (LMG.A), a wholly-owned subsidiary of AT&T (T). It provides programming such as Discovery Channel and Black Entertainment Television. The fund owns a 9 percent stake in the stock.

He thinks valuations of cable companies will rise dramatically as the stocks deploy new services.

"Digitalization enhances (cable) asset value through opening up new customers to products and services," Gabelli said.

Liberty, for example, is offering "splinter services" such as Discovery Health, a part of the Discovery Channel, for people interested in health topics.

The fund controls risk by spreading its holdings across many industries, from wireless to utilities, in many countries, from the United States to Japan and Europe.

About half the holdings have been in overseas markets - although only in developed global markets to limit risk. Recently, he has moved towards a 60 percent international weighting.

"We think Japan and Europe are great bargains," Gabelli said.

The fund owns a 4 percent stake in Vivendi, a French company that has telecom, utility and cable components, among other businesses.

Another international play is Viatel (VYTL), a U.S. telecommunications company that is laying fiber optic network through Europe. Gabelli thinks the company is a good takeover candidate, trading at around 50 dollars a share but worth up to 70.

Gabelli follows the same value-investing philosophy as his father, and looks for companies that are trading at 50 percent of their actual value. He doesn't own any Internet stocks, pointing out that he believes most will not be around in five years.

That means that you won't see many of the glitzy technology stocks and high-flying Internet companies in the portfolio, despite the word "interactive" in the title of the fund, said Chris Traulsen, an analyst at Morningstar.

Gabelli did own America Online (AOL) - but it was two or three years ago, when the stock was trading for a fraction of the price, he said. The fund owned BBN, an Internet networking company, which was acquired by GTE in 1997. It also owned Netcom, another Internet networking company acquired by ICG and later sold to MindSpring.

"We were buying Internet stocks when they were reasonably priced," Gabelli said. "There's no question that the Internet will change society. But I don't think the valuations of Internet stocks are justified."

For that reason, the fund gets its Internet exposure through AT&T (T), which owns a stake in @Home Corp (ATHM). The fund still owns GTE.

"Over a five-year period, we're going to be with the winners," Gabelli said.

What the experts say

Traulsen said the fund is one of only a handful like it because of its unique combination of companies. Traulsen said the closest comparison is Fidelity Select Multimedia Fund, also in Morningstar's specialty-communications category.

"Overall, it's been a terrific fund," Traulsen said. "It's a great lower-volatility way to play the information and communications economy."

Traulsen gave Gabelli credit for good stock picking and said he's changed the portfolio dramatically since he became manager. But Traulsen said part of Gabelli's success is "being in the right place at the right time," like getting into cable stocks before they started heating up.

One problem for some investors, however, may be trying to find a place for the fund in a portfolio, Traulsen said. The fund will have some overlapping stocks with funds that invest in print media, television, and the entertainment conglomerates, for example. The fund's unusual name might also be a reason why assets aren't higher for such a top-performing fund.

That said, the fund has its loyal followers.

Frank Triolo, a financial planner with Triolo and Associates of New London, Wis., said he often recommends the Couch Potato Fund to clients. He likes the fund because it is not loaded down with technology stocks as are other funds he recommends. And he gets exposure to sectors such as cable and entertainment that he doesn't have in other funds.

"It's one of the top mid-sized growth funds, and I like that," Triolo said. "What I like about (Gabelli funds) is they look for growth stocks but look for value at the same time."

Looking ahead

Gabelli, meanwhile, is focusing on hunting for value.

"I don't know where the market is going, but it looks rich, and it has for some time," Gabelli said. "We're trying to buy a dollar of assets for 50 cents. And we want that 50 cents to reach a dollar within three years."

And as much as he doesn't like to talk about himself, he also doesn't care to talk about the company's IPO. Gabelli (GBL) stock is trading near or below its 17-1/2 IPO price on Feb. 11.

"No comment," Gabelli said, when first asked about the IPO.

Then he changed his mind, speculating that the stock had been hurt by the downturn in small caps and financial services stocks. "I'll tell you this: It's the cheapest asset management stock out there. We think it's disproportionately valued."

But Gabelli did reveal one other tidbit about himself.

As far as the fishing goes, he prefers salt water.

-- CNNfn.com profiles a noteworthy fund manager every month.

|

|

|

Gabelli Funds

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|