|

Apple dishes up shiny 3Q

|

|

July 14, 1999: 6:56 p.m. ET

Computer maker posts profit of $1.20 per share on strong iMac sales

|

NEW YORK (CNNfn) - Apple Computer Inc. Wednesday reported higher-than-expected fiscal third-quarter earnings on strong demand for its popular and colorful iMac personal computers.

Apple also said it plans to buy back up to $500 million of its own stock - about 5 percent of its diluted shares outstanding, at current prices - a sign that company executives have confidence in its business strategy and see the current stock price as a bargain, analysts said.

The Cupertino, Calif.-based company recorded a profit of $203 million, or $1.20 a diluted share, almost double the net profit of $101 million, or 65 cents a share, it posted in the year-earlier period.

Excluding an $89 million one-time gain from the sale of 10 million shares of AMR Holdings Inc., Apple's fiscal third-quarter profit would have been $114 million, or 69 cents a share, still above the 64 cents a share expected by analysts polled by First Call Corp.

Revenues rose 11 percent to $1.56 billion from $1.4 billion a year earlier.

Strong sales of the multicolor iMac personal computer fueled overall unit growth by 40 percent during the latest fiscal quarter, said Apple interim Chief Executive Steve Jobs. "Apple is growing faster than the industry, driven by continued success of the iMac in our consumer and education markets," Jobs said.

A working strategy

Apple unveiled the funky iMac computer in August 1998 as part of Jobs' strategy to restore the company's financial health. His plan at the time was to offer more appealing models, pare the number of products being produced and sold, contract out manufacturing and slash costs.

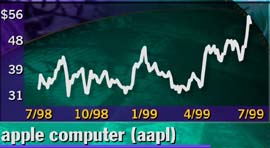

The drastic measures have dramatically boosted earnings for the company and instilled renewed investor confidence in its stock. Since April of this year Apple's stock has gained 64 percent, rising to its highest in more than six years, on optimism about the turnaround the company has staged.

Apple stock has risen 64% since April

Also helping in its latest quarter were falling prices for D-Ram chips and microprocessors, the guts of any home computer. Those falling prices helped lower Apple's production costs and widen profit margins on its sales.

Still, sales of its G3 and Powerbook products weren't as strong in the latest quarter, offsetting some of the gains, Anderson said.

Anderson expects earnings of 76 cents a share in the September quarter.

Overall, Apple ended its third quarter with an impressive balance sheet. Highlights included a cash balance of more than $3.1 billion, converting $661 million of its debt into common shares and keeping its inventory turnover down to less than a day, said Fred Anderson, Apple's chief financial officer.

Share buyback announced

Geographically, the biggest increase in demand came from Japan, where unit volume almost doubled in the latest quarter. Unit volumes in the rest of Asia and in Europe were also in double digits in the fiscal third quarter - 42 percent to 52 percent - while unit volume in North America rang in around 12 percent.

Apple is expected to unveil its new consumer portable computer at MacWorld Expo in New York next week. Analysts say the new, more powerful machine, along with the iMac, will help the company do well in the back-to-school and upcoming holiday sales seasons.

"There's going to be a lot of new products announced next week" which should bode well for sales through the remainder of the year, said Charles Wolf, an analyst with Warburg Dillon Read in New York. He currently rates Apple a "buy" and has a 12-month target price of 60, "though I may have to revise that target higher," he said.

Average prices for Apple computers fell 27 percent to $1,683 from $2,129 in the year-ago quarter. The average price was $1,813 in the March quarter.

Separately, Apple announced plans to buy back as many as 9 million shares of its own stock, a move typically made by companies who think the investors aren't pegging enough of a premium on their own shares. It's the first buyback program announced by the company since 1992.

"We're confident about Apple's future and believe this repurchase program is a good long-term investment for shareholders," Anderson said.

Apple shares rose 2-1/4 to close at 55-5/16 on the Nasdaq stock exchange.

|

|

|

|

|

|

Apple

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|