|

Magellan changes top 10

|

|

July 15, 1999: 1:16 p.m. ET

Flagship Fidelity fund drops AOL, Time Warner for Lucent, AT&T

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - Manager Robert Stansky of Fidelity's flagship Magellan Fund dropped America Online and Time Warner from his top 10 list of stocks in favor of Lucent Technologies and AT&T, new data show.

Stansky, whose stock-picking choices at the nation's largest mutual fund are closely watched, also increased his holdings in Home Depot and Citigroup.

"What he needs to do to stay in his job is continue to beat the S&P 500," said Donald Dion, editor of the independent newsletter Fidelity Independent Advisor.

Fidelity Investments each quarter releases a list of the 10 biggest stock holdings in each of its funds.

Magellan Fund, with $97.5 billion in assets, is up 15.68 percent year to date as of Tuesday, about 1.2 percentage points ahead of the S&P 500, according to Chicago fund-tracker Morningstar.

The top 10 stocks as of June 30 were: General Electric (GE), Microsoft (MSFT), Home Depot (HD), Citigroup (C), MCI WorldCom (WCOM), Cisco Systems (CSCO), Lucent Technologies (LU), Merck & Co. (MRK), Wal-Mart (WMT), and AT&T (T).

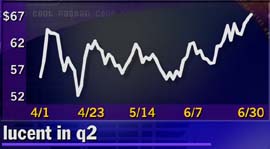

Dion said he is happy to see the addition of AT&T since the company has made such inroads into Internet-related businesses. Lucent has also been a top performer, he said.

GE and Microsoft remain in the top two spots from the first quarter, while Cisco and Wal-Mart also are unchanged.

"The big news is the fact that AOL has dropped out of the top 10 holdings in so many funds," said Eric Kobren, editor of Fidelity Insight, another independent newsletter. The other funds include Fidelity Fifty, Contrafund, Contra II, Aggressive Growth and Blue Chip Growth.

Fidelity sold about 43 percent of its AOL holdings in the first quarter, worth roughly $3.8 billion, Kobren said. The continued selling in the second quarter explains why the stock was under selling pressure and lost 25 percent of its value, he said.

But as AOL went out the door, Lucent made an appearance in the top 10 lists of Aggressive Growth, Fidelity Fifty, Blue Chip Growth, Large Cap Stock, and Trend Fund, Kobren said.

Likewise, AT&T joined the top stocks in Fidelity Fifty, Growth & Income, New Millennium and Puritan.

The disappearance of Time Warner (the parent of CNNfn.com) from Magellan's top 10 is probably because the stock has risen so much and Stansky wanted to take some profits, Dion said. It's likely the fund still owns some AOL and Time Warner stock, he said.

Philip Morris (MO) is another new top holding in Blue Chip Growth, Disciplined Equity, Dividend Growth and Large Cap Stock, Kobren said.

Another highlight of the new figures is that Fidelity Fifty's Web stakes lightened up substantially, Kobren said. Internet stocks such as AOL, Amazon.com (AMZN), At Home (ATHM), Yahoo! (YHOO) and eBay (EBAY) all dropped off the top 10 list. AT&T, Philip Morris, Cisco, Lucent, GE and Waste Management (WMI) took the place of those big Internet names.

In the health sector, Fidelity shaved Merck, Pfizer, and Schering Plough in a number of its funds, Kobren said.

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|