|

Private equity: a crystal ball?

|

|

July 22, 1999: 6:27 a.m. ET

Venture capitalists, LBO shops can help the average investor spot trends early

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - Let's face it, we all wish we could predict stock market swings.

But realistically speaking, most of us would settle for the ability to spot emerging market trends before they hit the headlines -- something, anything that would help us make more educated investment decisions.

Enter private equity.

It's no crystal ball, but experts say this asset class -- normally reserved for institutional investors and high net worth individuals -- often acts as a leading indictor for what lies ahead on Wall Street.

And they say by monitoring the industry's latest investment picks, you may gain valuable insight into which sectors will be hot in the months and years to come.

"Even for the investor who doesn't want to get into private equity, it's always good to look at private markets because they are the ones spotting trends earliest," said Brian Hirsch, an associate with ABN AMRO Private Equity. "They invest in the next generation of technology. Everyone should look at private equity."

Venture capitalists are key

To be fair, the so-called barometer effect mostly just applies to venture capitalists (VC) -- only one component of the broader market called private equity.

Leveraged buyout (LBO) shops are also considered private equity investors. But Nick Peters, president and chief executive of Prometheus Partners, a leveraged buyout firm in Atlanta, said LBOs are less useful as trend indicators since they tend to invest in companies that are more mature, already profitable and generally part of existing market trends.

VC firms and funds enter the picture much earlier on, sometimes funding companies based on nothing more than a business plan.

"I would say [LBO shops] are still ahead of Wall Street (in identifying tomorrow's sector trends) but the VCs are way ahead of the curve," Peters said, noting venture capitalists assume more risk as a result. "They tend to have pretty good vision about the future though. Some call [private equity investors] private stock pickers."

Hirsch, of ABN AMRO, said that's partly true.

"The [venture capitalists] sense what's going on," he said. "When you hear an analyst talking about an interesting young company, if you look closely you'll notice there are already 10 or 15 private investors already on board."

Private money

Over the years, venture capitalists have been instrumental in fostering the growth of start-ups, companies that might otherwise have lacked the resources to build their business.

VC funding, in fact, helped get hundreds of major corporations off the ground, including Microsoft (MSFT), Apple (AAPL), Federal Express, Compaq (CPQ), Intel (INTC) and Sun Microsystems (SUNW).

Jeanne Metzger, a spokeswoman for the National Venture Capital Association, said the industry is credited with helping to create the technological revolution we take for granted today.

"They've been five or 10 years ahead of all the industries we've seen come down the line, from Internet to biotech to health care services," she said. "We expect a lot of the companies they are investing in now to take hold in the next few years."

Ahead of the curve

Had you been following the lead of venture capitalists earlier this decade, you might be looking at an early retirement today.

Kleiner Perkins Caufield & Byers of Menlo Park, Calif., for example, one of the nation's most closely watched venture capital firms, is largely credited with helping America Online (AOL) stay afloat in its early years.

The firm reportedly purchased 250,000 shares of AOL (then called Quantum Computer Services) in 1987 for $2 a share. The company changed its name to America Online in 1991, went public in 1992 and today its stock is trading at better than 115 a share.

(Here's a list of Kleiner Perkins' latest investment targets.)

Accel Partners, of Palo Alto, Calif., tells a similar story.

The VC firm was the first to invest in UUNet, an Internet service provider now owned by MCI WorldCom (WCOM). Accel Partners invested $3.9 million in UUNet between Oct. 1993 and September 1994. UUNet went public less than a year later in May of 1995, and now claims a large share of the ISP market.

Accel Partners was also the first to invest in RealNetworks (RNWK), an Internet media streaming company. And four other Internet companies in which Accel invested a total of $26 million several years ago have only recently gone public: Mpath Interactive (MPTH); North Point Communications; (NPNT) Portal Software (PRSF); and Redback Networks. (RBAK).

Jim Breyer, managing partner of Accel Partners, said the average investor can learn a lot by simply watching private equity investors from the sidelines.

"I think the discipline that occurs in VC investing is one that is very applicable today to the average investor in public Internet companies," he said. "The reality of today's public markets is that in many ways they resemble traditional VC markets. Companies are going public much earlier than ever before."

What's hot?

Broadly speaking, venture capitalists today are focused on companies involved in Internet infrastructure, bandwidth capacity, software development and telecommunications.

Biotechnology firms and health care services, the fair weather darlings of Wall Street, have fallen out of favor among the VC community, said NVCA president John Martinson, a managing partner with Edison Venture Fund.

Those two sectors are "currently starved for capital," he said.

Returns

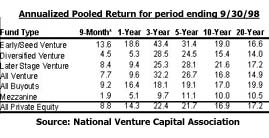

Industry data shows that private equity has turned in one of the highest rates of return of any asset class. In the past 20 years, the total return on all private equity investments averaged 17.2 percent.

(Click here for a larger view of the chart)

But that doesn't mean venture capitalists haven't seen failure. Indeed, 30 percent or more of all VC investments fail miserably, another 40 percent or so shuffle along, and - if they're lucky - about 30 percent are wildly successful.

It's risky. That's why private equity remains the domain of wealthy individuals and institutional investors -- pension funds, endowments, banks, insurance companies.

Even then, most use private equity to diversify their portfolios while keeping their investments to a minimum. The NVCA reports that most portfolios allocate just 2 percent to 3 percent to alternative assets, including venture capital and LBOs.

With that in mind, experts say you should maintain a distance between your investments and the equity picks of venture capitalists who have the expertise to take greater risks. They also say you should avoid buying into IPOs simply because they are venture-backed. Instead, look for the broad trends.

Ask yourself which sectors and which types of companies are the VCs placing their bets.

A well-balanced mutual fund that mirrors those investments might be one option -- one that helps you diversify your risk.

Resources

To begin your research, Metzger of the NVCA said you might want to look on the individual Web sites of venture capital firms. Most provide a list and description of the companies they invested in.

You can also go to the NVCA's Web site, which offers a list of its members.

(Click here for the NVCA's list of members)

Lastly, Metzger said new magazines tracking the VC markets are springing up all the time as the industry gains momentum. You can use them keep tabs on the market. Among them: Red Herring and TechCapital.

Peters, of Prometheus Partners, however, acknowledged it can be tough to find out what the private investors are up to.

"We are buying private companies and we are fairly closed mouth about what we are doing," he said. "The only way you can garner information from some of these LBO firms is to pay attention when they make acquisitions in the industry."

How to implement

As you embark on your quest to track the VC market, Martinson of the NVCA said there's one thing you should watch out for.

"I would say in some cases, by the time you spot a trend it may be too late," he said. "If you see that we've invested in three or four similar companies, a fourth may be imprudent in that there are already too many well financed competitors."

But Martinson noted that groups of similar investments are "often a signal to what industries are emerging."

One way to apply the information learned from VCs to your portfolio might be to invest in venture-backed initial public offerings -- particularly those that still include VCs on their boards of directors.

Martinson said that's particularly true if you're focused on Internet-related stocks.

Following broader market trends, venture-backed IPOs last year fell far behind the firestorm of coming out parties in 1997 -- only 78 venture-backed companies went public in 1998, NVCA reports.

On a brighter note, however, the average offering size increased 39 percent from the previous year to $49.2 million, indicating more money is flowing into the private equity market.

Additionally, NVCA said several venture-backed IPOs showed "tremendous aftermarket performance," including eBay (EBAY), which rose 1,240 percent in share price from its IPO date to year-end, and Inktomi, which rose 619 percent in share price from IPO date to year-end.

"If the average investor does his or her homework along all of these dimensions, there are significant chances of outperforming the market over a long period of time," Breyer said. "We are really in the first or second inning of the Internet build-out. Companies that we invested in early on, like UUNet and RealNetworks, are very representative of the future opportunities that may exist in companies that are just now tapping the public markets."

When weighing their investment opportunities, Breyer said the average investor today should do as the VCs do. Look for management expertise, he said, and the size of the company's market opportunity.

Also, pay attention to the brand defensibility, or the ability of the company to keep its competitive edge. And lastly, Breyer said, "investors should be highly focused on the consumer experience, particularly for the e-commerce companies going public."

He noted nothing is certain in stock market investing -- especially in the high-risk, high-reward arena of Internet equities.

"There will be thousands of Internet winners, there will also be thousands of significant Internet losers," Breyer said. "Therefore, the average public investor today needs to do far more homework than ever before."

|

|

|

|

|

|

|