|

Picking an online broker

|

|

July 26, 1999: 6:18 a.m. ET

There are more than 100 to sort through, so where do you start?

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) -. It's $7.95 a trade. $14.95 a trade. $20 a trade. Ducks, bulls, bears and countless same-sounding brands. Suretrade, Ameritrade, E*Trade, you-name-it-dot-trade. Set up your Internet account here. Hurry hurry hurry!

But where do you start when it comes to opening an online account? There's no shortage of choice -- more than 100 online brokerages are vying for your attention.

And it's no secret why. Online trading rocketed 47 percent in the first three months of 1999 alone, according to CS First Boston.

For the second quarter, growth was a still-rapid 15 percent, a rate that has held for close to three years. Internet investors now execute more than 570,000 online trades every day.

Picking a brokerage can be time consuming. Most investors can't weed through 100 different services. But it isn't rocket science. You just have to ask yourself a few questions and then find the right fit.

Services must meet your needs

"Looking in the mirror is the most important thing," says Dan Burke, senior brokerage analyst with Gomez Advisors. Evaluate how experienced you are, and decide what your goals are, he suggests. "Am I looking to plan for retirement, or am I looking for a quick buck?"

Be honest about your investing skills, Nancy Smith, director of the Securities and Exchange Commission's Office of Investor Education and Assistance, advises.

"If you aren't, that's where you lose a lot of money," Smith says. Taking the wheel of your own investments is attractive, but learn to drive first. "You're putting yourself in the driver's seat, and are you prepared?"

Online brokerages aren't regulated differently from traditional establishments and there's no watchdog organization. But the SEC has an investor-assistance Web page with a special section on online investing. It points out the pitfalls consumers have run into.

That experience is better than learning the hard way, Smith says.

"Sometimes that education can be very expensive." Several weeks back, the SEC had an investor call who lost a quarter of a million dollars online. It can be "unforgiving technology," she says.

Outside advice is outstanding

The next step is research. Check out financial-media sources that review online brokerages. Barron's, Money (owned by CNNfn.com parent Time Warner) and SmartMoney all rank online brokerages. Smith suggests finding a source that suits your style.

In December and January, Forrester Research ranked online-brokerage customer satisfaction. Fidelity finished on top, followed by Datek Online, Suretrade.com, DLJ Direct and E*Trade.

Gomez Advisors rates overall performance in its "Internet Broker Scorecard," free online, and breaks out the best brokerages for four different kinds of investor -- hyperactive traders, serious investors, life-goal planners and one-stop shoppers.

Going straight to the source is useful. Suretrade.com promotes itself as No. 1 on Gomez' ranking for overall cost, but actually it's No. 2. Brown & Co. offers $5 trades for experienced investors, with a $15,000 minimum to open an account.

Many brokerages such as National Discount Brokers, DLJ Direct, Datek Online and Suretrade.com don't require a minimum opening balance. Others such as E*Trade and Waterhouse have low opening balances of $1,000. All margin accounts require $2,000.

"But I don't think it's much of an issue," Burke says, because you can't trade until you put money in the account. And don't expect much in the way of extras from the bottom of the rung account, The general rule is you get what you pay for.

Gomez Advisors also rates brokerages by areas such as ease of use, services and cost. And it has a primer on picking an online broker, "Broker Selection 101."

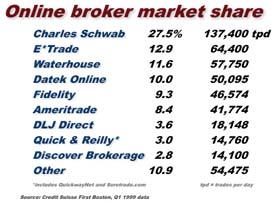

CS First Boston and US Bancorp Piper Jaffray both track industry trends and market share. The top 15 or so dominate 80 percent of the market, so to save time it makes sense to limit a search to those.

Performance makes perfect

Forrester analyst Ken Clemmer finds what consumers say more interesting than media rankings. He says there are three main factors to consider when picking an online broker.

Execution, including price and speed, is most important to active traders. They want features like Nasdaq Level 2 quotes, which market makers get, and the cheapest trades.

Datek Online and Quick & Reilly's Suretrade.com have an edge there. For moderately active or infrequent investors, speed is similar and price isn't a big factor. A $20 saving in commissions disappears rapidly with wrong decisions, experts point out.

The second consideration is advice, both quality and breadth. That's important to people who trade less actively, Clemmer says. All brokerages have research, much of it "aggregated" from third parties.

But DLJ Direct and Discover Brokerage Direct, for instance, have proprietary research: DLJ from Donaldson Lufkin & Jenrette and Discover from Morgan Stanley Dean Witter. Charles Schwab and Fidelity offer large families of mutual funds. E*Trade has a broad scope and Robertson Stephens research, too.

To get that proprietary research, though, most charge a fee, $95 a year at E*Trade, for instance. For free access to their research, DLJ and Discover require a high balance, $100,000.

Ease of access is third, Clemmer says. People uncomfortable with a pure virtual relationship might like the physical presence of Fidelity, Schwab and Waterhouse. Digital-happy investors might just weigh phone access and the quality of advice. Brokerages range from "24-7" to trading-hours-only phone service. Very active investors open three or four backup accounts.

Check out the demos on the sites, Clemmer says, and ask about performance on financial message boards. That gives you first-hand advice, though it's something "you can take with a grain of salt," he says.

Differences are getting harder to find

Because it's easy to copy ideas online, the brokerage sites are very similar.

"Real-time quotes - just a year ago you were paying for," George Barto, an analyst at Gartner Group's Dataquest, says. "Now everyone's offering them."

For most investors, Burke says, the priority list for online brokers is: customer service, research, then price.

Most sites trade U.S. equities and mutual funds. But there are differences if you want to trade bonds or more-complicated options strategies such as straddles or butterfly spreads.

For options, look to E*Trade, Ameritrade, Wyse, Accutrade and Sunlogic, Burke suggests.

For online bonds, check out Citicorp Investments, Discover Brokerage Direct, DLJ Direct, E*Trade, Fidelity, Quick & Reilly's QuickwayNet and Suretrade.com, and Schwab.

For mutual funds, Burke highlights Discover Brokerage Direct, Schwab, E*Trade, DLJ Direct and Fidelity.

He says active investors might want to check if their accounts will be updated in real time or posted the next day.

Many sites promote access to initial public offerings. The SEC's Smith warns against that marketing hype.

"Not all IPOs are created equally," she says. "You can lose a lot of money on these IPOs as well." And check the fulfillment rate, the percentage of people who want new offerings who get them, she says.

Moving an account online normally takes one to three weeks for a basic stock, cash and no-load mutual fund account, Burke says. But mutual funds can make things stickier. There isn't normally an advantage transferring from a regular broker to their online equivalent -- DLJ to DLJ Direct, for instance -- because they're operated separately, he says. The exception is a wrap account with a full-service broker that lets you trade online for a fee.

The SEC reports a sizable number of problems in transferring accounts, with delays before trading and so on. Before you become one of the 15,000 new online accounts each day, read the customer-account agreement, the SEC recommends.

"Are they communicating with me in plain English?," Smith asks. Many complaints can be avoided by consumers knowing what they are getting into. Some brokers can liquidate your account without a margin call, for instance.

"Read the fine print, and understand the fine print," she says. "Don't fall for, 'It's just boilerplate.' Because when problems arise, guess what. The boilerplate applies."

|

|

|

|

|

|

|